Airline Stock Roundup: LUV, JBLU & HA Post Loss for Q1, UAL in Focus

In the past week, key players in the industry like Southwest Airlines LUV, JetBlue Airways JBLU, SkyWest SKYW and Hawaiian Holdings HA reported their respective first-quarter 2022 earnings results. With omicron-related woes hurting results, mostly in the early part of the quarter, the above carriers, apart from SkyWest, posted a loss.

However, apart from Hawaiian Holdings, the June-quarter results of which are likely to be hurt by the delay of the full restoration of its Japan network, the likes of LUV expect profitability owing to upbeat air-travel demand.

With the Q1 earnings season underway, a plethora of airline releases was also discussed in the previous week’s write-up.

On the non-earnings front, United Airlines’ UAL management stated that to meet the anticipated demand swell, UAL aims to boost its trans-Atlantic capacity significantly.

Recap of the Latest Top Stories

1.Southwest Airlines, currently carrying a Zacks Rank #3 (Hold), incurred a loss (excluding 15 cents from non-recurring items) of 32 cents in the first quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of 34 cents. However, the amount of loss narrowed 81.4% year over year. LUV’s first-quarter performance was hurt by Omicron-induced woes in January and February.

For April, LUV expects managed business revenues to decrease approximately 30% from the comparable period’s level in 2019. Southwest Airlines expects a sequential improvement in May and June managed business revenues from their respective 2019 levels.

Anticipating continued improvement in bookings, the carrier expects to reap profits in the remaining three quarters of 2022 as well as for the full year. Management predicts operating revenues to increase 8-12% in the second quarter from the comparable period’s level in 2019. Economic fuel costs per gallon are forecast to be $3.05-$3.15 in the second quarter. Due to increase in labor and airport costs as well as lower productivity levels, LUV expects unit costs, excluding fuel, oil and profit-sharing expenses, and special items, to increase 14-18% in the ongoing quarter from the comparable period’s level in 2019. Interest expenses are expected to be $90 million in the second quarter.

For 2022, Southwest Airlines expects capacity to decline approximately 4% from the 2019 level. Economic fuel costs per gallon are estimated to be $2.75-$2.85. Cost per available seat miles (CASM), excluding fuel, oil and profit-sharing expenses, and special items, are anticipated to increase 12-16% in 2022 from the 2019 level. Interest expenses are expected to be $360 million in 2022. LUV expects to end the year with total aircraft count of 814. Effective tax rate is expected to be 24-26% in the year. Capital spending is still anticipated to be about $5 billion in 2022.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2. JetBlue Airways incurred a first-quarter 2022 loss (excluding 1 cent from non-recurring items) of 80 cents per share, comparing favorably with the Zacks Consensus Estimate of a loss of 85 cents.

JBLU management expects second-quarter 2022 capacity to be flat or increase up to 3% from second-quarter 2019 actuals. CASM excluding fuel and special items is predicted to rise 15-17% from second-quarter 2019 actuals. Total revenues are forecast to increase in the 11-16% range from second-quarter 2019 actuals. The revenue projection includes up to a four-point impact from the operational disruption in April. Average fuel cost per gallon in the June quarter is estimated to be $3.79. Capital expenditures in the June quarter are anticipated to be roughly $300 million.

3. Hawaiian Holdings’ first-quarter 2022 loss (excluding 15 cents from non-recurring items) of $2.54 per share was wider than the Zacks Consensus Estimate of a loss of $2.51. HA reported a loss of $3.85 in the year-ago quarter. Moreover, quarterly revenues of $477.2 million surged more than 100% year over year but missed the Zacks Consensus Estimate of $482.1 million. Capacity for the June quarter to decline in the band of 11.5-14.5% from second-quarter 2019 actuals owing to the delay of the full restoration of its Japan network. Total revenues are anticipated to plunge 8-12% from second-quarter 2019 levels.

4. United Airlines intends to introduce more flights between the United States and Europe. UAL will augment capacity by 25% this summer from 2019 levels. Following this, UAL will serve more transatlantic destinations than any other U.S. carrier combined. Moreover, it will be the largest airline across the Atlantic for the first time in history. As part of the expansion drive, UAL aims to add nonstop flights to five distinctive leisure destinations, currently unattended by any other North American airline. UAL also aims to launch five nonstop flights to some of Europe's most popular business and tourist destinations.

5. SkyWest reported first-quarter 2022 earnings of 35 cents per share, surpassing the Zacks Consensus Estimate of 3 cents. In the year-ago quarter, SKYW reported earnings of 71 cents. The 50.7% year-over-year decline in earnings was due to the 50.6% rise in total costs. Revenues of $735.2 million outperformed the Zacks Consensus Estimate of $667.3 million. The top line jumped 37.53% year over year, courtesy of a 13% increase in block hours (a measure of aircraft utilization) on completed flights. COVID-19- related revenue concessions given to SkyWest’s major airline partners in the first quarter of 2021 also resulted in year-over-year top line growth.

Revenues from flying agreements (contributing 96.3% to the top line) surged 38.5% from the year-ago quarter’s figure. Expenses pertaining to salary, wages and benefits increased 36.5% in the quarter. With oil price increasing, aircraft fuel expenses escalated 30.7% year over year. The airline, which carried 53.9% more passengers year over year, reported a 12.6% increase in block hours. Passenger load factor (percentage of seats filled by passengers) increased 20.9 percentage points to 77.6% in the March quarter, owing to the uptick in air-travel demand.

SkyWest exited the first quarter with cash and marketable securities of $856 million, marginally down from $860 million at the end of 2021. Long-term debt (net of current maturities) was $2.79 billion compared with $2.71 billion at December 2021-end.

Performance

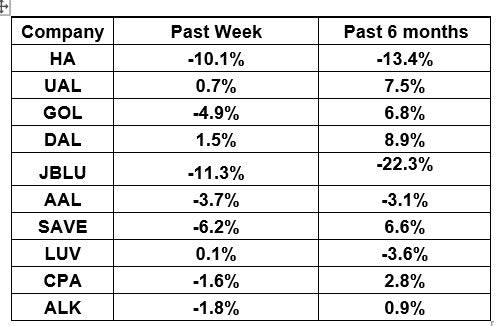

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks have traded in the red over the past week. The NYSE ARCA Airline Index has decreased 4.3% to $77.94. Over the past six months, the NYSE ARCA Airline Index has declined 11.5%.

What's Next in the Airline Space?

With some more airlines slated to report their first-quarter 2022 financials shortly, investors interested in the industry will keep a close eye on how they perform.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance