Airline Stock Roundup: AAL's Revised Q1 Forecast, JBLU's Expansion Update & More

In the past week, American Airlines’ AAL management gave an updated outlook for first-quarter 2023. AAL’s results are likely to be hurt by higher costs. Latin American carriers, Gol Linhas GOL and Azul AZUL also grabbed headlines, courtesy of their respective March traffic numbers. Upbeat air travel demand aided the traffic reports.

European carrier, Ryanair Holdings’ RYAAY March traffic numbers were also aided by the rise in air travel demand. Meanwhile, an expansion-related update was availablefrom JetBlue Airways JBLU in the past week.

Read the last Airline Roundup here.

Recap of the Latest Top Stories

1 Driven by soaring demand on healthy bookings, AAL’s management expects first-quarter 2023 TRASM to be 25.5% higher than the first-quarter 2022 actuals. This is at the mid-point of the 24-27% uptick expected previously. AAL, currently sporting a Zacks Rank #1 (Strong Buy), expects system capacity for the March-end quarter to increase 9.2% from the figure reported in first-quarter 2022, which again is at the mid-point of the 8-10% uptick expected previously.

Fuel cost per gallon in first-quarter 2023 is now expected to be in the $3.27-$3.32 range (earlier guidance: $3.33-$3.38). Fuel gallon consumption is now expected to be $970 million in first-quarter 2023, higher than $955 million expected previously. The company continues to expect total non-operating expenses of $415 million for the March-end quarter. CASM, excluding fuel and special items, is now expected to decrease 1.5% in the first quarter of 2023 from the figure reported in first-quarter 2022 (earlier guidance: flat to down 3%). The adjusted operating margin in the March-end quarter is anticipated to be 3.5% (earlier guidance: 2.5-4.5%). AAL now expects the March-end quarter's earnings per share (excluding net special items) to be in the 1-5 cents range (earlier guidance called for breakeven earnings). The mid-point of the revised guidance is in line with the Zacks Consensus Estimate of 3 cents. You can see the complete list of today’s Zacks #1 Rank tocks here

2. The number of passengers ferried on RYAAY flights in March was an impressive 12.6 million. This compared favorably with the year-ago figure of 11.2 million. Load factor (% of seats filled by passengers) was 93% in March 2023 compared with 87% a year ago. Ryanair expects its traffic in fiscal 2023 to be 168 million, indicating 13% growth from pre-COVID traffic numbers.

3. Driven by the improvement in air travel demand, Gol Linhas reported healthy traffic data for March. The number of passengers ferried on Gol flights in March registered a 22.3% year-over-year increase. The consolidated load factor was 82.3% in March 2023 compared with 29.5% a year ago. Load factor increased as consolidated traffic growth of 17.2% in the month was more than the capacity expansion (also on a consolidated basis) of 13.3%. Domestic departures, which accounted for more than 95% of total departures during the month, have grown 17.4% on a year-over-year basis. On the domestic front, the number of seats increased 17.1% in March.

4. At Azul, consolidated revenue passenger kilometers, a measure of air traffic, showed an increase of 8.1% for March 2023 compared with the year-ago reported figure. The company’s various codeshare agreements have helped increase international air traffic by 89.7% compared with the year-ago figure. A 9.4% increase in capacity has resulted in the load factor being at 77.8% for the reported period.

5. JetBlue, in coordination with Massachusetts Port Authority, announced two new routes from Worcester Regional Airport in Massachusetts to attract additional traffic. One of these is a seasonal service from Worcester, MA, to Southwest Florida International Airport in Fort Myers, FL. Flights (non-stop) on this route will be operational from Jan 4, 2024. The other route will be operating from Worcester, MA to Orlando Sanford International Airport. Flights to Orlando, which stopped during the pandemic, will resume operation from Jun 15.

Performance

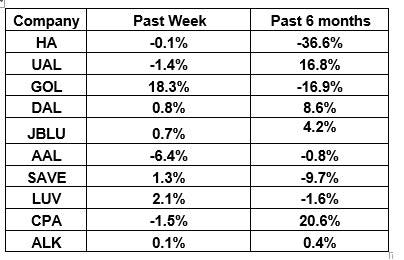

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks have traded in the green over the last five trading days. The NYSE ARCA Airline Index has increased 3.6% to $58.47, led by a double-digit gain at Gol Linhas. Over the course of the past six months, the NYSE ARCA Airline Index has gained 12.2%.

What's Next in the Airline Space?

Stay tuned for first-quarter 2023 earnings reports of various airlines.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Gol Linhas Aereas Inteligentes S.A. (GOL) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

AZUL (AZUL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance