Airbus And Two More Stocks On Euronext Paris That Could Be Trading Below Their Estimated Value

Recent political uncertainties and market fluctuations in France have left investors cautious, yet such environments can also present opportunities for discerning stock pickers. In this context, identifying stocks like Airbus that appear undervalued relative to their fundamentals could be particularly compelling.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kaufman & Broad (ENXTPA:KOF) | €28.20 | €52.84 | 46.6% |

Lectra (ENXTPA:LSS) | €27.30 | €43.07 | 36.6% |

Wavestone (ENXTPA:WAVE) | €56.40 | €88.60 | 36.3% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | €19.50 | €34.25 | 43.1% |

Antin Infrastructure Partners SAS (ENXTPA:ANTIN) | €10.94 | €15.46 | 29.2% |

Vivendi (ENXTPA:VIV) | €9.752 | €15.52 | 37.2% |

MEMSCAP (ENXTPA:MEMS) | €5.87 | €8.61 | 31.9% |

Tikehau Capital (ENXTPA:TKO) | €21.50 | €32.18 | 33.2% |

Thales (ENXTPA:HO) | €153.05 | €258.12 | 40.7% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €4.00 | €6.69 | 40.2% |

We'll examine a selection from our screener results

Airbus

Overview: Airbus SE operates globally, focusing on the design, manufacture, and delivery of aerospace products, services, and solutions with a market capitalization of approximately €117.08 billion.

Operations: Airbus's revenue is primarily generated through its segments, with €48.82 billion from commercial aircraft, €11.60 billion from defense and space operations, and €7.20 billion from helicopter activities.

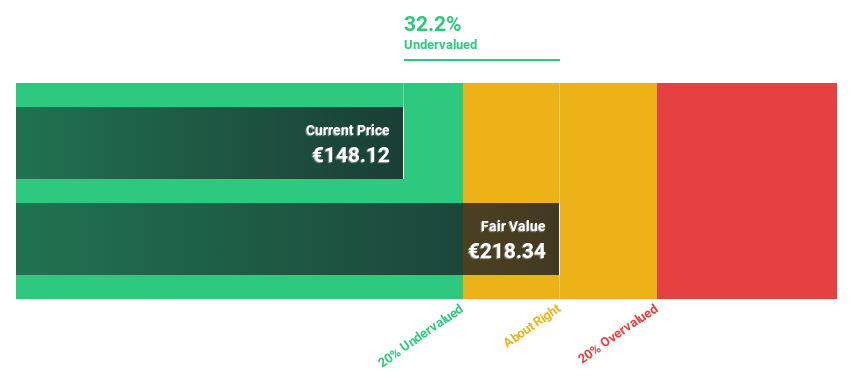

Estimated Discount To Fair Value: 32.2%

Airbus SE, currently priced at €148.12, is trading significantly below its estimated fair value of €218.34, indicating a potential undervaluation based on discounted cash flow analysis. Despite this, its earnings are expected to grow by 17.75% annually, outpacing the French market's forecasted growth rate of 11%. Additionally, Airbus' revenue growth is projected at 10.3% per year, also above the market average of 5.8%. These factors suggest that Airbus may be an attractive opportunity for investors looking for stocks trading below their intrinsic value while still offering solid growth prospects in both earnings and revenue streams.

The analysis detailed in our Airbus growth report hints at robust future financial performance.

Click to explore a detailed breakdown of our findings in Airbus' balance sheet health report.

Antin Infrastructure Partners SAS

Overview: Antin Infrastructure Partners SAS is a private equity firm focused on infrastructure investments, with a market capitalization of approximately €1.96 billion.

Operations: The company generates its revenue primarily from asset management, totaling approximately €282.87 million.

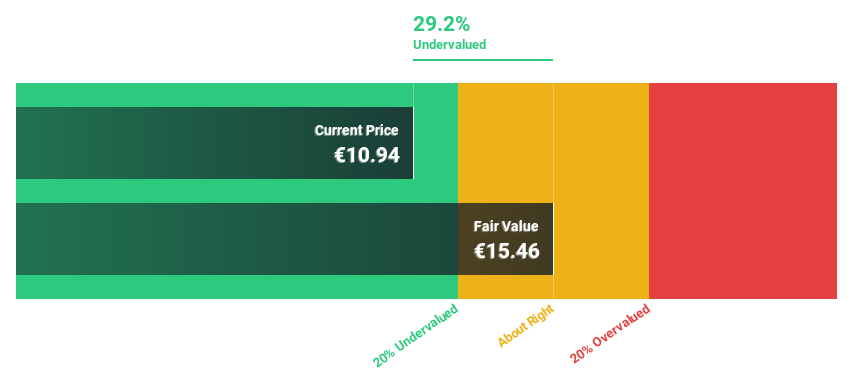

Estimated Discount To Fair Value: 29.2%

Antin Infrastructure Partners SAS, with a dividend yield of 5.85%, faces challenges in covering payouts through earnings or cash flows, indicating potential sustainability issues. Despite this, the company's revenue is expected to grow by 12.7% annually, surpassing the French market's 5.8%. Additionally, Antin's earnings are forecasted to increase significantly at 25.9% per year—more than double the market projection of 11%. These growth metrics suggest potential undervaluation based on future cash flow prospects despite some financial strains.

Thales

Overview: Thales S.A. operates globally, offering a range of solutions across defence, aerospace, digital identity and security, and transport sectors with a market capitalization of approximately €31.63 billion.

Operations: The company's revenue is divided into €10.18 billion from Defence & Security (excluding Digital Identity & Security), €5.34 billion from Aerospace, and €3.42 billion from Digital Identity & Security segments.

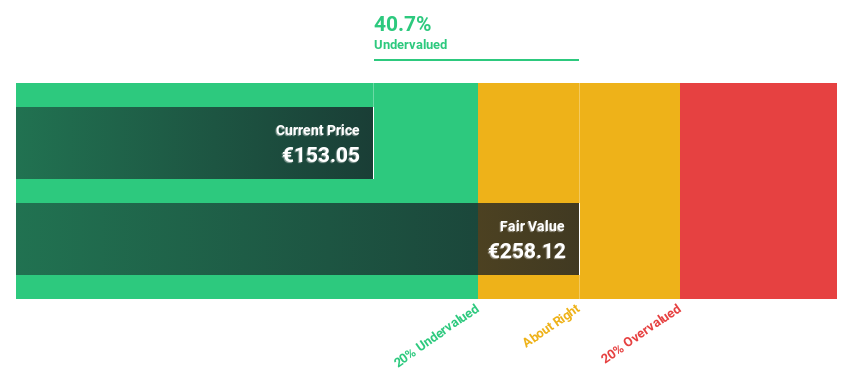

Estimated Discount To Fair Value: 40.7%

Thales, a French multinational, shows promise in cash flow-based valuation despite some financial challenges. Recently, Thales has engaged in strategic alliances to enhance its air traffic management solutions with satellite-based services, targeting operational readiness by 2027. Although the company's debt levels are high and dividend track record unstable, it forecasts an annual profit growth of 15.1% and revenue growth of 6.2%, both outpacing the French market projections of 11% and 5.8%, respectively. However, large one-off items have impacted its financial results, which could be a concern for potential investors looking at long-term stability.

According our earnings growth report, there's an indication that Thales might be ready to expand.

Click here to discover the nuances of Thales with our detailed financial health report.

Where To Now?

Navigate through the entire inventory of 14 Undervalued Euronext Paris Stocks Based On Cash Flows here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AIRENXTPA:ANTINENXTPA:HO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance