Airbus And Two Additional Stocks Estimated To Be Undervalued On Euronext Paris

Amidst a turbulent week for European markets, where political uncertainty and economic indicators painted a mixed picture, investors are keenly observing potential opportunities. In this context, identifying undervalued stocks such as Airbus on the Euronext Paris could be particularly intriguing for those looking to capitalize on discrepancies between current market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Vente-Unique.com (ENXTPA:ALVU) | €15.50 | €29.79 | 48% |

Kaufman & Broad (ENXTPA:KOF) | €27.85 | €53.12 | 47.6% |

Lectra (ENXTPA:LSS) | €28.40 | €43.17 | 34.2% |

Wavestone (ENXTPA:WAVE) | €55.00 | €88.84 | 38.1% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | €19.46 | €34.19 | 43.1% |

Guerbet (ENXTPA:GBT) | €36.10 | €71.57 | 49.6% |

Vivendi (ENXTPA:VIV) | €9.92 | €15.58 | 36.3% |

MEMSCAP (ENXTPA:MEMS) | €5.49 | €8.55 | 35.8% |

Thales (ENXTPA:HO) | €157.65 | €254.68 | 38.1% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.94 | €6.69 | 41.1% |

Let's take a closer look at a couple of our picks from the screened companies

Airbus

Overview: Airbus SE operates globally, specializing in the design, manufacture, and delivery of aerospace products, services, and solutions with a market capitalization of approximately €117.59 billion.

Operations: The company's revenue is primarily generated from three segments: commercial aircraft, which brings in €48.82 billion, helicopters at €7.20 billion, and defense and space activities accounting for €11.60 billion.

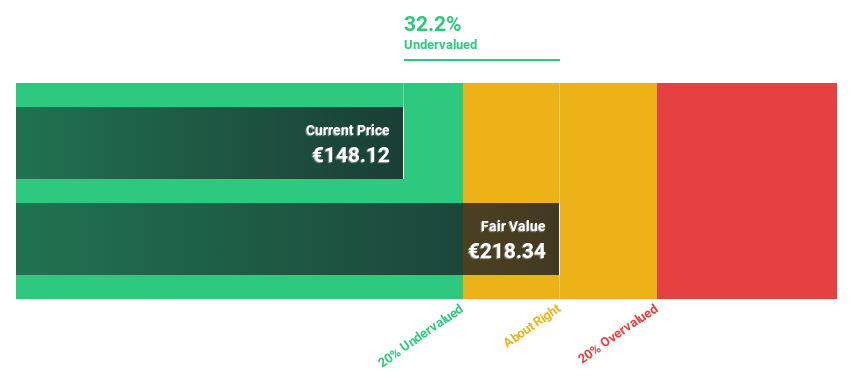

Estimated Discount To Fair Value: 31.8%

Airbus SE, trading at €148.76, significantly below the estimated fair value of €218.04, appears undervalued based on discounted cash flows and current market assessments. Recent financials show a strong uptick in sales to €12.83 billion and net income to €595 million in Q1 2024, reflecting a robust year-over-year growth. Strategic alliances and technological advancements, like the feasibility study for hydrogen infrastructure in Canadian airports and collaborations for high-speed communications systems, underscore its innovative edge and potential for future growth despite slower revenue growth projections (10.3% annually) compared to higher market expectations.

Guerbet

Overview: Guerbet SA specializes in the development and marketing of contrast media products, delivery systems, medical devices, and related solutions with a market capitalization of approximately €454.06 million.

Operations: The company generates €795.65 million in revenue from the research, development, production, and sale of contrast media for medical imaging.

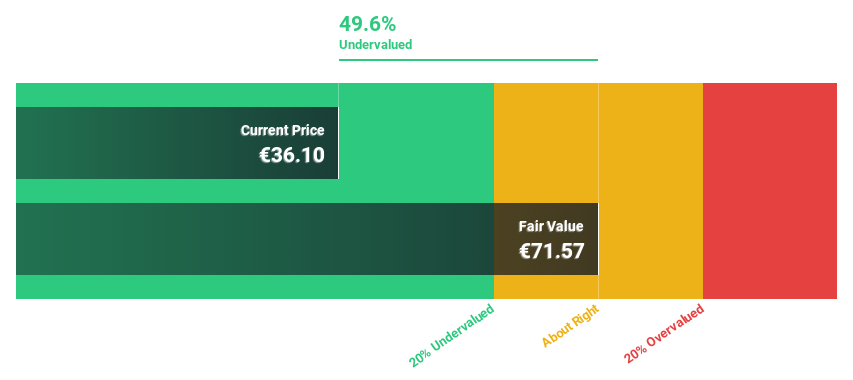

Estimated Discount To Fair Value: 49.6%

Guerbet, priced at €36.1, is markedly below its fair value of €71.57, suggesting undervaluation based on cash flow analysis. Recent strategic moves, including a partnership with NUCLIDIUM and leadership changes, could bolster its market position. Despite a slow forecasted revenue growth rate of 7% annually, Guerbet has turned profitable this year with significant earnings growth expected at 23.65% annually. However, its debt is poorly covered by operating cash flow, indicating potential financial strain.

The analysis detailed in our Guerbet growth report hints at robust future financial performance.

Unlock comprehensive insights into our analysis of Guerbet stock in this financial health report.

Tikehau Capital

Overview: Tikehau Capital is a private equity and venture capital firm that offers a variety of financing products such as senior secured loans, equity, senior debt, unitranche, mezzanine, and preferred shares, with a market capitalization of approximately €3.83 billion.

Operations: The company generates revenue through two main segments: Investment Activities, which brought in €179.19 million, and Asset Management Activities, contributing €322.32 million.

Estimated Discount To Fair Value: 31.6%

Tikehau Capital, trading at €22.15, appears undervalued by over 31% against a fair value estimate of €32.41, based on discounted cash flow analysis. Recent corporate actions include a dividend increase to €0.75 per share and an extension of its buyback plan, reflecting positive management sentiment. Despite challenges like a lower net profit margin this year at 35.2% compared to last year's 53.2%, Tikehau is poised for substantial earnings growth, forecasted significantly above the market average with expected annual growth rates around 31%. However, the sustainability of its dividend is questionable due to insufficient cash flow coverage.

Where To Now?

Investigate our full lineup of 16 Undervalued Euronext Paris Stocks Based On Cash Flows right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AIR ENXTPA:GBT and ENXTPA:TKO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance