Air Canada (TSE:AC) Shareholders Have Enjoyed An Impressive 161% Share Price Gain

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Air Canada (TSE:AC) which saw its share price drive 161% higher over five years. On top of that, the share price is up 24% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 11% in 90 days).

See our latest analysis for Air Canada

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Air Canada's earnings per share are down 47% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

The revenue reduction of 0.7% per year is not a positive. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

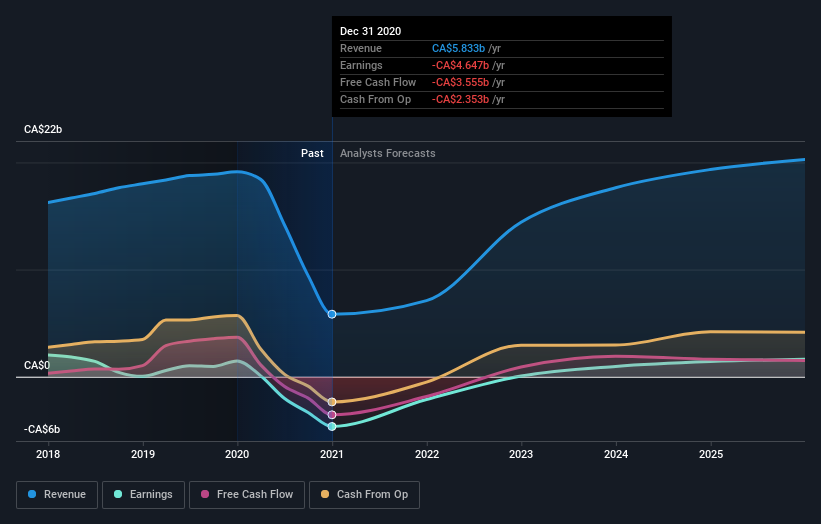

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Air Canada shareholders are up 23% for the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 21% per year over five year. It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Air Canada better, we need to consider many other factors. For example, we've discovered 2 warning signs for Air Canada (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance