AIG Tops Q1 Earnings on Underwriting Gains, Ups Dividend

American International Group, Inc. AIG reported first-quarter 2023 adjusted operating earnings of $1.63 per share, which comfortably beat the Zacks Consensus Estimate of $1.43 and our estimate of $1.36. Also, the bottom line jumped 9.4% year over year in the first quarter.

Operating revenues of $12.4 billion increased from $11 billion a year ago and beat both the consensus estimate and our estimate of $11.3 billion.

The strong first-quarter results were supported by massive underwriting gains and growing net investment income, partially offset by reduced alternative investment income and higher expenses. Solid North America Commercial Lines growth aided AIG’s first-quarter results.

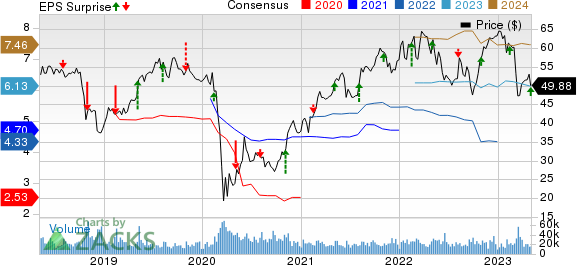

American International Group, Inc. Price, Consensus and EPS Surprise

American International Group, Inc. price-consensus-eps-surprise-chart | American International Group, Inc. Quote

Quarterly Operational Update

Total net investment income increased 9.1% year over year to $3,533 million due to increased yields generated from fixed maturity securities and loan portfolios, partially offset by a decline in alternative investment income. The figure beat the consensus mark by 15.9%.

American International’s total benefits, losses and expenses of $11,215 million increased 21.5% year over year, primarily due to higher policyholder benefits and losses incurred. The figure was much higher than our estimate.

Adjusted return on common equity increased 20 basis points (bps) year over year to 8.7% in the first quarter.

Segmental Performances

General Insurance

The segment reported net premiums written of $6,965 million, which increased 5% year over year and grew 10% on a constant-dollar basis. The metric was higher than our estimate of $6,703.5 million. Business generation and higher retention levels supported AIG’s North America Commercial Lines business. Rising renewal premium rates aided the Commercial Lines operations. Also, reduced quota share cession in North America Personal Lines benefited the company’s Personal Insurance performance.

Underwriting income of $502 million jumped 13% year over year in the first quarter. The same comprised catastrophe losses (CATs) of $264 million, primarily due to two New Zealand storms, comparing favorably with CATs of $288 million in the year-ago quarter.

The segment’s combined ratio improved 100 bps year over year to 91.9% in the quarter under review.

Life and Retirement

American International closed the IPO of Corebridge Financial, the holding company of its Life and Retirement unit, in September 2022. Following the move, AIG has 77.7% of Corebridge and combines its results of operations in its Condensed Consolidated Financial Statements.

Premiums and fees of the segment increased 84% to $2,899 million in the first quarter. Meanwhile, premiums and deposits of $10,448 million jumped 44% from a year ago. Adjusted revenues of the segment amounted to $5,371 million, up from $3,941 million in the prior-year quarter due to higher net investment income and premiums. The figure beat the Zacks Consensus Estimate by 30.9%. However, the segment’s adjusted pre-tax income of $886 million fell 5% in the first quarter.

Financial Position (as of Mar 31, 2023)

American International exited the first quarter with a cash balance of $1,923 million, which decreased from $2,043 million at 2022-end. Total assets of $536.6 billion increased from $522.2 billion at 2022-end.

Short and long-term debt of $22.1 billion rose from $21.3 billion at the prior-year end.

Total equity rose to $46.3 billion from $43.5 billion at the prior-year end. Total debt and preferred stock to total capital was at 32.8% at the first-quarter end.

Adjusted book value per share was $75.87, up from $72.62 a year ago.

Share Repurchase & Dividend Update

American International rewarded its shareholders with $603 million in repurchases and dividends worth $241 million.

Concurrent with announcing the first-quarter results, the board of directors approved a new quarterly cash dividend of 36 cents per common share, up 12.5% sequentially.

Zacks Rank and Key Picks

AIG currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader finance space are Allianz SE ALIZY, Conifer Holdings, Inc. CNFR and Owl Rock Capital Corporation ORCC, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Allianz’s 2023 earnings predicts 48% year-over-year growth. Over the past 60 days, ALIZY has witnessed one upward estimate revision against none in the opposite direction.

The consensus mark for Conifer’s 2023 earnings indicates a 103.3% year-over-year improvement. The consensus estimate for CNFR’s bottom line has witnessed one upward revision in the past 60 days against none in the opposite direction.

The Zacks Consensus Estimate for Owl Rock Capital’s 2023 earnings suggests 24.8% year-over-year growth. Also, the consensus mark for ORCC’s revenues in 2023 suggests a 19.6% year-over-year rise.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Owl Rock Capital Corporation (ORCC) : Free Stock Analysis Report

Conifer Holdings, Inc. (CNFR) : Free Stock Analysis Report

Allianz SE (ALIZY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance