AI Is Coming for European Bank Jobs With Italy Taking a Hit

(Bloomberg) -- European banks are beginning to cut staff by deploying artificial intelligence tools, with BPER Banca SpA becoming one of the first to put hard numbers on the impact.

Most Read from Bloomberg

The Cablebus Transformed Commutes in Mexico City’s Populous Outskirts

Chicago’s $1 Billion Budget Hole Exacerbated by School Turmoil

Urban Heat Stress Is Another Disparity in the World’s Most Unequal Nation

Should Evictions Be Banned After Hurricanes and Climate Disasters?

The Italian lender on Thursday unveiled plans to reduce its workforce by about 2,000 over the coming years as advances in AI boost output. The bank will rely on “AI/GenAI-enabled process optimization and automation” to cut headcount by 10% through 2027 to about 18,500.

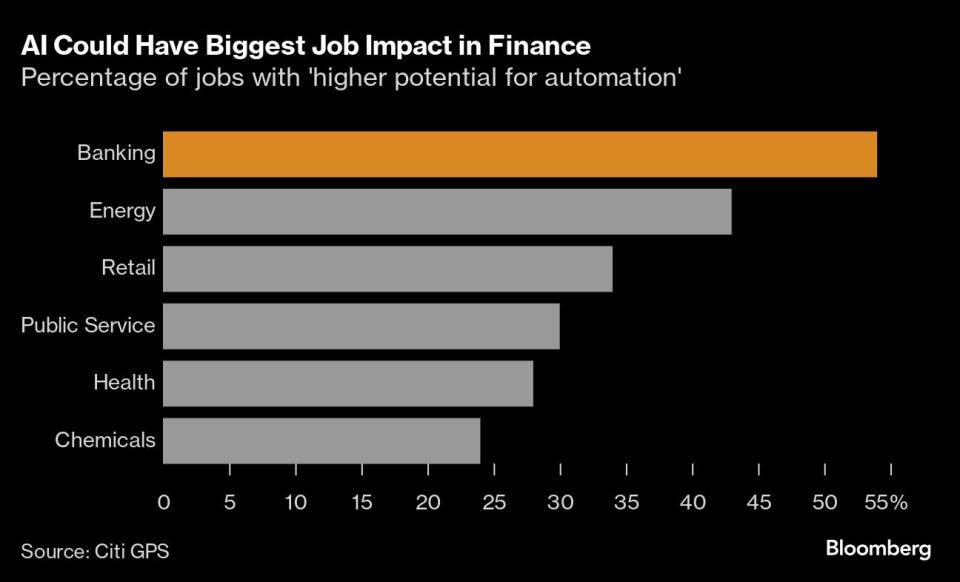

A growing number of lenders is betting on traditional and generative artificial intelligence to improve efficiency and reduce costs. Citigroup Inc. has said that the technology is likely to displace more jobs across the banking industry than in any other sector, helping to increase profitability in the sector globally by $170 billion over the next few years.

In Europe, UBS Group AG has developed an artificial intelligence tool to help it offer clients potential M&A deals, able to analyze a database of over 300,000 companies in less than half a minute. Deutsche Bank AG is using artificial intelligence to scan wealthy-client portfolios. And ING Groep NV is screening for potential defaulters.

Elsewhere, JPMorgan Chase & Co. is scooping up talent and Chief Executive Officer Jamie Dimon has said he believes the technology will allow employers to shrink the workweek to just 3.5 days.

But while many European banks have said that AI will ultimately allow them to lower costs by performing tasks previously carried out by salaried humans, few have put a concrete amount on the expected savings. BPER’s plan to cut headcount by 10% is among the first announcements of that nature.

The Italian lender’s staff reduction is to take place “through voluntary exits already agreed upon and natural turnover,” it said Thursday. Other measures such as shifting sales from branches to digital channels will also play a role in shedding roles, it said.

The workforce change caused by AI across banking also raises a fresh hiring challenge as AI deployment requires a skillset not necessarily found in existing staff. Dutch lender ING recently hired James Robinson, with a PhD in machine learning, to develop FX trading technology.

Spain’s CaixaBank is planning to create a team of hundreds of artificial intelligence and IT experts as it prepares to highlight the booming technology as a pillar of a new strategy it’s scheduled to present next month, Bloomberg reported last week.

For BPER, the projected reduction in its overall workforce will be partially offset by hiring. While the Italian bank anticipates about 3,100 overall departures through 2027, it’s aiming to recruit 1,100 fresh employees during the same period. Those will be added in “strategic areas” including IT, it said.

(Updates with background about hiring plans in final two paragraphs.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance