Affirm (AFRM) Shares Fall 7.3% After Apple Pay Later Launch

Affirm Holdings, Inc.’s AFRM shares fell 7.3% yesterday after Apple Inc. AAPL launched its long-anticipated Apple Pay Later services in the United States. This buy now, pay later (“BNPL”) service is expected to affect fintech firms like Affirm.

Investors of Affirm reacted negatively to the news as Apple’s entry into the market is likely to shed transactions from Affirm’s kitty. As Apple device users can seamlessly utilize the newly introduced service bypassing additional terminals for payments, demand for Affirm’s products is expected to take a hit.

Apple Pay Later is expected to enable customers to split transactions into four payments, which will be laid out over six weeks. The tech juggernaut joined hands with financial transaction services mammoth Mastercard Incorporated MA to leverage the latter’s massive network. The usage of the Mastercard Installments program will allow merchants working with Apple Pay to seamlessly implement Apple Pay Later, without any integration.

Analysts expect the new service from Apple to capture a sizeable chunk of the market share, that too at a rapid pace, due to the sheer size of Apple device users. This might lead to BNPL companies further diversifying their revenue sources, both geographically and product wise.

Affirm keeps adding new partners to diversify its base. In a recent deal, it struck a partnership with global fitness brand VersaClimber to provide consumers with its BNPL services. Affirm has a network of more than 240,000 retail partners, which is expected to grow in the coming days.

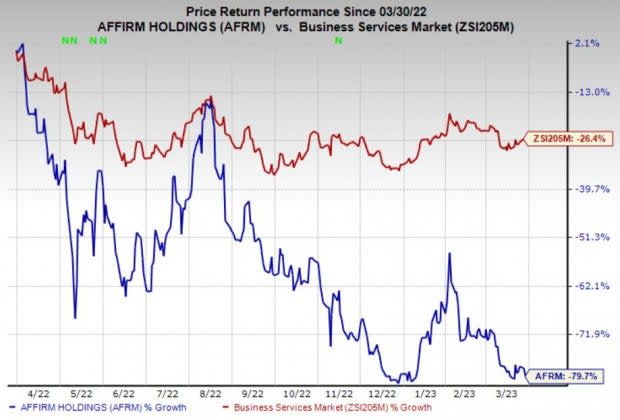

Price Performance

Over the past year, shares of Affirm have declined 79.7% compared with the 26.4% fall of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & A Key Pick

Affirm currently has a Zacks Rank #3 (Hold). A better-ranked stock in the broader Business Services space is International Money Express, Inc. IMXI, sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Headquartered in Miami, International Money Express offers money remittance services. The Zacks Consensus Estimate for IMXI’s 2023 earnings indicates a 24.3% year-over-year increase.

IMXI beat earnings estimates in all the past four quarters, with an average of 17.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

INTERNATIONAL MONEY EXPRESS, INC. (IMXI) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance