AES Sets Up US Solar Buyer Consortium to Promote Solar Industry

The AES Corporation AES recently collaborated with leading solar companies in the United States to set up the U.S. Solar Buyer Consortium to boost the growth of the American solar industry and propel the pace of the domestic production of solar components amid the supply-chain vulnerabilities of the region.

Other solar energy developers who are the key members of this Consortium are Clearway Energy Group, Cypress Creek Renewables and D.E. Shaw Renewable Investments.

Goal of the Consortium

U.S. President Biden recently invoked the Defense Production Act to aid the domestic production of clean energy technologies, including solar panel parts, and reduce the dependence of the nation on the imports of solar components and parts.

In this context, the recent consortium aligns with the government’s initiative and highlights the procurement of more than $6 billion of solar panels. Also, the group seeks to add manufacturers who can supply up to 7 gigawatts (GW) of solar modules per year from the beginning of 2024.

Such initiatives are likely to boost investments in the U.S. solar market and provide immense opportunities for the solar components manufacturing companies of the region to capitalize on the growing demand and bolster their growth trajectory.

AES Corp’s Contribution to the Goal

AES Corp. is currently leading the utility industry's transition to clean energy by investing in sustainable growth and innovative solutions. The company has a strong pipeline of solar projects, which boast a strong demand for various solar components that will be needed to develop the projects.

To this end, it is imperative to mention that AES Corp. has 3.4 GW of new projects coming online from 2022 to 2025 out of a total backlog of 10.3 GW across all geographies and technologies. Moreover, in 2021, AES signed contracts for 5 GW of power purchase agreements for renewable energy, including 1.4 GW for U.S. solar projects.

With such a strong backlog of solar projects, the company is well-poised to fulfill its commitment to contributing to restoring the growth of the U.S. solar manufacturing sector.

Stocks to Benefit

With the entire Utility sector rapidly transitioning to a green environment, utility providers that are adopting solar power as their preferred energy resource and thus expected to gain as the aforementioned consortium sees daylight include:

Duke Energy’s DUK subsidiary, Duke Energy Renewables, owns and operates approximately 500 megawatts (MW) of photovoltaic solar power projects at more than 50 solar plants across the country, delivering customized solar solutions to utilities, municipalities, electric cooperatives and large business customers. The company plans to add about 4,525 MW of solar power during the next 20 years.

Duke Energy’s long-term earnings growth rate is pegged at 6.1%. The Zacks Consensus Estimate for DUK’s 2022 sales suggests a growth rate of 6.6% from the prior-year reported figure.

Eversource EnergyES currently has 70 MW of solar power facilities operating in Massachusetts and its five-year forecast includes expenditures of $500 million to build an additional 280 MW of solar generation capacity.

Eversource Energy boasts a long-term earnings growth rate of 6.2%. The Zacks Consensus Estimate for ES’ 2022 sales indicates a growth rate of 10% from the prior-year reported figure.

WEC Energy WEC is investing heavily in the cost-effective zero-carbon generation like solar and wind. It has plans to build 2,400 MW of solar, wind and battery storage in the 2022-2026 period to further strengthen its renewable portfolio.

WEC Energy’s long-term earnings growth rate is pegged at 6.1%. WEC shares have rallied 3.3% in the past year.

Price Movement

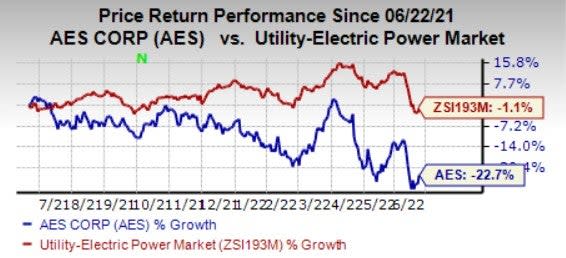

In a year, shares of AES Corp have declined 22.7% compared with the industry’s fall of 1.1%.

Image Source: Zacks Investment Research

Zacks Rank

AES Corp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance