AES Corp (AES) Q3 Earnings Beat Estimates, Revenues Down Y/Y

AES Corporation’s AES third-quarter 2019 adjusted earnings of 48 cents per share surpassed the Zacks Consensus Estimate of 40 cents by 20%. Moreover, earnings grew 37.1% from the year-ago quarter’s 35 cents per share.

Barring one-time adjustments, the company delivered GAAP earnings of 32 cents per share in the reported quarter compared with 15 cents in the prior-year period.

Highlights of the Release

AES Corp generated total revenues of $2,625 million in the third quarter, down 7.5% year over year. The top line also lagged the Zacks Consensus Estimate of $2,966 million by 11.5%.

Total cost of sales was $1,924 million in the third quarter, down 11.2% year over year. General and administrative expenses were $41 million, 4.7% lower than the year-ago quarter’s $43 million.

Operating income stood at $701 million, up 4.5% from $671 million in the year-ago period.

Interest expenses summed $250 million, down 2% from $255 million in the year-earlier period.

Highlights of the Quarter

AES Corp signed 921 MW of new PPAs during the third quarter of 2019, for a total of 1.9 GW year to date. The company formed a 10-year strategic alliance with Google to develop and implement solutions to enable broad adoption of clean energy. It also received approval from the government of Vietnam to develop the 2.2 GW Son My 2 CCGT.

Financial Condition

AES Corp reported cash and cash equivalents of $1,145 million as of Sep 30, 2019, compared with $1,166 million as of Dec 31, 2018.

Non-recourse debt totaled $14,323 million as of Sep 30, 2019, up from $13,986 million as of Dec 31, 2018.

In the third quarter of 2019, cash from operating activities was $761 million compared with the year-ago quarter’s $767 million.

Total capital expenditures during the third quarter amounted to $558 million, which decreased from $598 million incurred in the year-ago quarter.

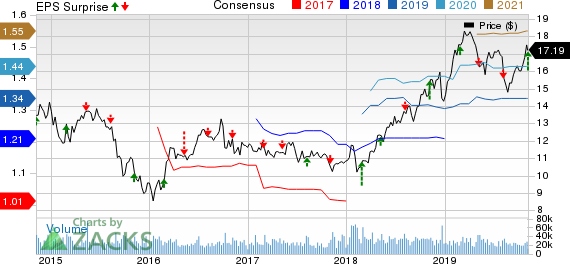

The AES Corporation Price, Consensus and EPS Surprise

The AES Corporation price-consensus-eps-surprise-chart | The AES Corporation Quote

Guidance

For 2019, AES Corp reaffirmed its adjusted EPS guidance of $1.30-$1.38. It also reaffirmed its average annual growth rate target of 7-9% through 2022.

The Zacks Consensus Estimate for earnings is currently pegged at $1.34 per share, which is the mid-point of the company’s guided range.

AES Corp also reaffirmed its 2019 Parent Free Cash Flow expectation of $700-$750 million.

Zacks Rank

AES Corp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

NextEra Energy NEE reported third-quarter 2019 adjusted earnings of $2.39 per share, beating the Zacks Consensus Estimate of $2.27 by 5.3%. Moreover, earnings rose 10.1% on a year-over-year basis.

Entergy Corporation ETR reported third-quarter 2019 adjusted earnings of $2.52 per share, which surpassed the Zacks Consensus Estimate of $2.31 by 9.1%. Moreover, the reported figure rose 7.2% from $2.35 per share in the year-ago quarter.

American Electric Power AEP reported third-quarter 2019 adjusted earnings per share of $1.46, surpassing the Zacks Consensus Estimate of $1.30 by 12.3%. Moreover, the bottom line also increased 15.9% from $1.26 per share in the year-ago quarter.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

The AES Corporation (AES) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance