Aerojet Rocketdyne (AJRD) Q4 Earnings Down Y/Y, Sales Up

Aerojet Rocketdyne Holdings, Inc. AJRD reported fourth-quarter 2019 adjusted earnings of 27 cents per share, which declined 18.2% from 33 cents in the year-ago quarter.

The Zacks Consensus Estimate for earnings was pegged at 46 cents per share.

Including one-time adjustments, the company reported GAAP earnings of 30 cents per share, reflecting a rise of 3.4% from 29 cents in the prior-year quarter. This upside can be attributed to improved year-over-year sales in the quarter under review.

For 2019, the company reported earnings of $1.56 per share, which came in 19.2% lower than the prior-year figure of $1.93.

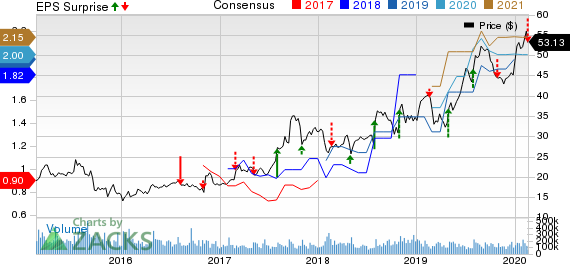

Aerojet Rocketdyne Holdings, Inc. Price, Consensus and EPS Surprise

Aerojet Rocketdyne Holdings, Inc. price-consensus-eps-surprise-chart | Aerojet Rocketdyne Holdings, Inc. Quote

Operational Performance

Aerojet Rocketdyne’s fourth-quarter sales of $523 million increased 19.4% from the year-ago quarter figure of $437.9 million. The top line also surpassed the Zacks Consensus Estimate of $504 million by 3.8%.

For 2019, the company recorded sales of $1.98 billion, which beat the Zacks Consensus Estimate of $1.96 billion by 1%. The full-year top line improved 4.5% from $1.90 billion recorded in the year-ago period.

Total backlog at the end of 2019 was $5.4 billion compared with $4.1 billion as of Dec 31, 2018. Of this, funded backlog amounted to $2.1 billion compared with $1.9 billion at 2018-end. The upside in backlog was driven by large multi-year awards on the Standard Missile and THAAD programs.

Total operating expenses grew 23.8% year over year to $474.3 million in the fourth quarter. Operating income of $48.7 million declined 11% from $54.7 million a year ago.

Segmental Performance

Aerospace & Defense: Revenues at this segment improved 19.8% year over year to $520.9 million. This can be primarily attributed to an increase in defense programs including the Patriot Advanced Capability-3, Guided Multiple Launch Rocket System and hypersonic booster programs. Also, an increase in space programs driven by growth in the RS-25 program contributed to this segment’s sales growth.

Real Estate: The segment generated revenues of $2.1 million compared with the year-ago quarter’s $3 million.

Financial Update

Aerojet Rocketdyne exited 2019 with cash and cash equivalents of $932.6 million, up from $735.3 million as of Dec 31, 2018.

Long-term debt amounted to $352.3 million as of Dec 31, 2019, same as of Dec 31, 2018.

Net cash provided by operating activities amounted to $261.2 million as of Dec 31, 2019, compared with $252.7 million in the year-ago period.

Free cash flow at the end of 2019 was $218.3 million compared with $209.5 million at the end of 2018.

Zacks Rank

Aerojet Rocketdyne currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Release

Huntington Ingalls Industries HII fourth-quarter 2019 earnings of $4.36 per share surpassed the Zacks Consensus Estimate of $4.24 by 2.83%. However, the reported figure declined 11.7% from $4.94 reported a year ago.

Teledyne Technologies TDY reported fourth-quarter 2019 adjusted earnings of $2.90 per share, which surpassed the Zacks Consensus Estimate of $2.76 by 5.1%. The bottom-line figure came above the guided range of $2.71-$2.76.

Lockheed Martin LMT reported fourth-quarter 2019 earnings of $5.29 per share, which surpassed the Zacks Consensus Estimate of $4.99 by 6%. The bottom line also improved 20.5% from $4.39 in the year-ago quarter.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Aerojet Rocketdyne Holdings, Inc. (AJRD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance