AECOM's (ACM) JV Wins USACE Deal, Aids Environment Business

In line with its Sustainable Legacies strategy, AECOM’s ACM joint venture (JV) has won a U.S. Army Corps of Engineers (USACE) contract.

Building on its prior experience of executing extensive preliminary per- and polyfluoroalkyl substances (PFAS) investigations at Army National Guard (ARNG) facilities, ACM will provide remedial investigations, feasibility studies, removal actions and associated work.

Using the latest analytics and treatment technologies, the ACM’s JV will help USACE define the nature and extent of regulated PFAS, take quick action where necessary and design and implement long-term treatment solutions.

AECOM’s global Environment business’ chief executive, Frank Sweet, said, “The ARNG and all of the Department of Defense continue to take proactive measures against PFAS in the environment and we’re proud to support them as a leader in PFAS remediation. Our suite of PFAS services, spanning characterization, evaluation, mitigation and destruction and our ever-growing team of global experts enable us to provide clients with powerful PFAS capabilities, which we expect to be especially valuable as countries around the world take further action to address and limit PFAS.”

Solid Project Execution & Strategic Initiatives Aid the Business

AECOM is a leading solutions provider supporting professional, technical and management solutions for diverse industries across end markets like transportation, facilities, government and environmental, energy and water businesses. A major part of the U.S. government’s broad infrastructural plan is focused on transit and water markets, where AECOM enjoys a dominant position. The company is witnessing a robust pipeline of pursuits across the business.

AECOM has been trying to transform the company into a pure-play professional services firm to improve profitability and de-risk the business profile. To that end, it is exiting more than 30 countries globally to prioritize investments in markets with higher prospects and competitive advantages. After divesting the Management services and Power construction businesses, the company intends to exit at-risk construction and non-core oil and gas markets.

Management is focused on leveraging scale and technical leadership by simplifying the operating model to drive greater collaboration across the business and push digital innovation. Further, improved profitability enables accelerated investments in organic growth and expanded digital capabilities through Digital AECOM, the company’s digital brand that includes a portfolio of products to better serve clients on their digital transformations. This will be a key contributor toward achieving the 17% longer-term margin target.

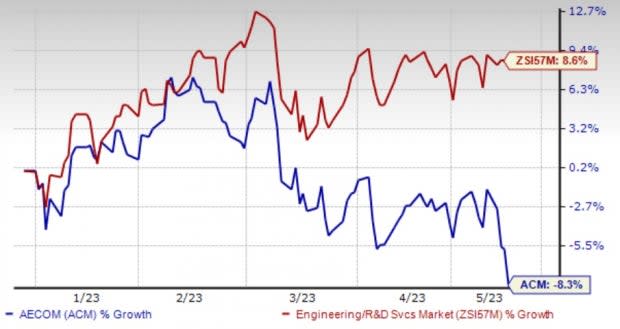

Image Source: Zacks Investment Research

In the year-to-date period, shares of the company have declined 8.3% against the Zacks Engineering - R and D Services industry’s 8.6% rise. Nonetheless, earnings estimates for fiscal 2023 have moved two cents north in the past seven days, reflecting analysts’ optimism in the company’s growth potential.

Zacks Rank & Key Picks

AECOM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Quanta Services Inc. PWR reported better-than-expected results for first-quarter 2023, wherein adjusted earnings and revenues surpassed the Zacks Consensus Estimate.

The company continues to experience high demand for its infrastructure solutions that support energy transition initiatives and increase reliability, safety and efficiency. Notably, project activities associated with renewable generation have been going strong and is expected to continue throughout the year.

KBR, Inc. KBR reported strong results in first-quarter 2023, where earnings and revenues surpassed the Zacks Consensus Estimate and increased on a year-over-year basis.

KBR’s top and bottom lines gained on strong underlying growth and margin expansion as well as excellent bookings in the reported quarter.

Fluor Corporation FLR reported mixed results for first-quarter 2023. Earnings missed the Zacks Consensus Estimate but increased from the previous year. Revenues surpassed the consensus mark and grew from the year-ago level.

FLR’s underlying performance continues to be impacted by a few remaining legacy projects.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance