AECOM (ACM) Wins Major Contract in $4.5B CapEx Central Project

AECOM ACM, a leading infrastructure consulting firm, has secured a pivotal role in Texas' infrastructure development. Tasked by the Texas Department of Transportation (TxDOT), AECOM will oversee project inspection services for the construction of vital drainage tunnels as part of the $4.5 billion Capital Express (CapEx) Central project in Austin.

The project encompasses the construction of two large-diameter drainage tunnels and a pump station along the crucial I-35 corridor, aimed at mitigating flooding and enhancing safety. Leveraging its extensive global experience in tunnel projects, AECOM is poised to deliver innovative solutions that will underpin the success of the CapEx Central project.

With an eight-mile stretch of I-35 accommodating nearly 200,000 vehicles daily, the significance of this endeavor cannot be overstated. AECOM's expertise will ensure the seamless integration of drainage infrastructure, safeguarding against disruptions to traffic and above-ground structures.

Beyond immediate benefits, AECOM's involvement aligns with its commitment to global resilience strategies. By integrating international best practices, the company aims to fortify Texas' roadways against future challenges, fostering long-term sustainability and reliability.

Upon completion, the CapEx Central project promises to revolutionize transportation in Central Texas. Enhanced safety measures, reduced congestion, and improved accessibility for all road users, including pedestrians and cyclists, are among the anticipated outcomes. Moreover, the project will see the reconstruction of vital cross-street bridges and the implementation of additional mobility enhancements within the project area.

In essence, AECOM's partnership with TxDOT represents a significant milestone in Texas' infrastructure evolution. Through innovative solutions and a global perspective, AECOM is poised to shape a safer, more resilient future for the Lone Star State's transportation network.

Backlog Growth Signals Positive Outlook

AECOM has been witnessing robust prospects in each of its segments. Currently, it has a good visibility of a strong backlog and pipelines for the upcoming quarters. Owing to the improving global scenario, which is fostering infrastructural demand around the globe, there has been an increase in demand for ACM’s services. This improving trend is reflected in the company’s backlog levels.

As of the fiscal second-quarter end, the total backlog was $23.74 billion compared with $22.98 billion reported in the prior-year period. The current backlog level includes 54.8% contracted backlog growth. The design business backlog grew 6.3% to $22.29 billion. The metric was driven by a near-record win rate and continued strong end-market trends.

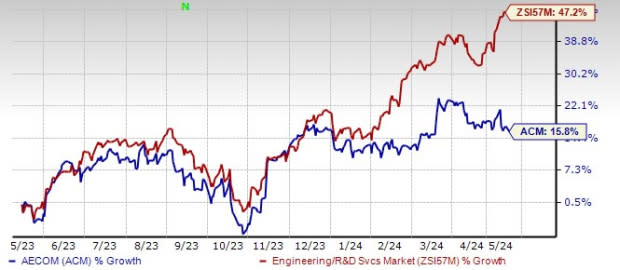

Image Source: Zacks Investment Research

Shares of this current Zacks Rank #3 (Hold) company gained 15.8% in the past year compared with the Zacks Engineering - R and D Services industry’s 47.2% growth. Although shares of the company have underperformed its industry, the ongoing contract wins are likely to boost its prospects in the forthcoming quarters.

Key Picks

Some better-ranked stocks in the same space are:

M-tron Industries, Inc. MPTI currently sports a Zacks Rank #1 (Strong Buy). It has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 26.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates a rise of 10.3% and 58.6%, respectively, from the prior-year levels.

Howmet Aerospace Inc. HWM presently carries a Zacks Rank #2 (Buy). HWM has a trailing four-quarter earnings surprise of 8.5%, on average.

The Zacks Consensus Estimate for HWM’s 2024 sales and EPS indicates a rise of 10.6% and 29.9%, respectively, from the prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2. GTES has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance