Is Advanced Braking Technology's (ASX:ABV) Share Price Gain Of 257% Well Earned?

Advanced Braking Technology Limited (ASX:ABV) shareholders might understandably be very concerned that the share price has dropped 31% in the last quarter. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Like an eagle, the share price soared 257% in that time. So it may be that the share price is simply cooling off after a strong rise. More important, going forward, is how the business itself is going.

Check out our latest analysis for Advanced Braking Technology

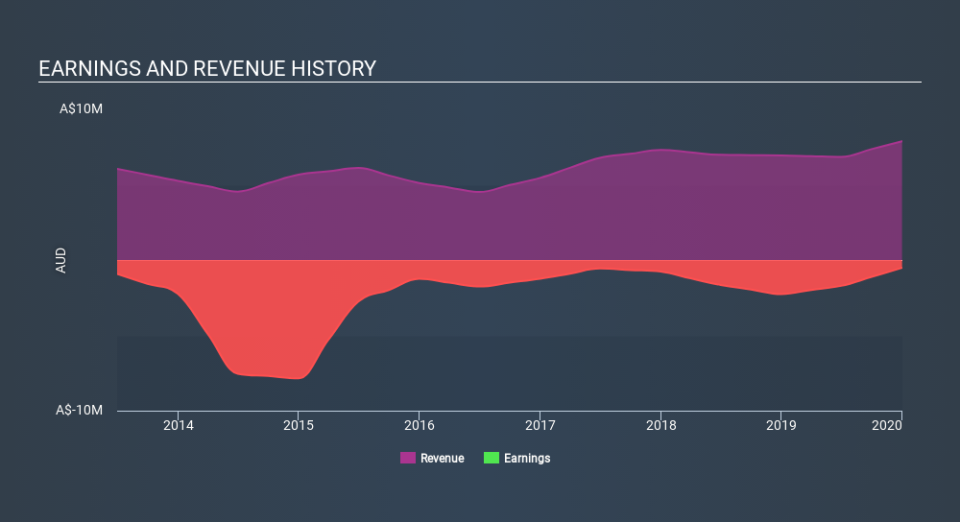

Given that Advanced Braking Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Advanced Braking Technology grew its revenue by 13% last year. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 257%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Advanced Braking Technology's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Advanced Braking Technology shareholders have received a total shareholder return of 257% over one year. Notably the five-year annualised TSR loss of 16% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Advanced Braking Technology (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance