Adtalem (ATGE) Rallies 43% in the Past Year: More Room to Run?

Adtalem Global Education Inc. ATGE has been gaining from strong demands for its programs and offerings, and strategic initiatives to boost enrollment. Also, the OnCourse learning, and introduction of evening and weekend classes bode well.

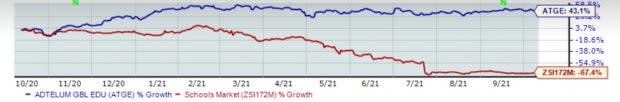

Shares of Adtalem have gained 43.1% in the past year against the Zacks Schools industry’s 67.4% fall. The outperformance can primarily be attributable to a solid earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in nine of the trailing 13 quarters. Notably, earnings estimates for fiscal 2022 have moved up 28.4% over the past 60 days.

This positive trend signifies analysts’ bullish sentiments and justifies the company’s Zacks Rank #1 (Strong Buy), indicating robust fundamentals and the expectation of outperformance in the near term.

Major Growth Drivers

Healthcare Institution Boosting Sales: Since 2013, Adtalem’s health care and international institutions have witnessed significant upside in revenues and profitability. Notably, health care institution Chamberlain’s new and total student enrollment was solid in the fourth quarter of fiscal 2021, improving a respective 3.6% and 4.6% in the May session from a year ago. Also, during fiscal 2021, revenues for the medical and veterinary schools increased 4.7% compared with the prior year. This growth was mainly attributable to new enrollment. The company is optimistic about the medical and healthcare segment demand trend from both students and employees.

Meanwhile, Adtalem has completed the acquisition of Walden University — a healthcare education unit of Laureate Education, Inc. With the addition of Walden University, Adtalem has 26 campuses in 15 states and four countries, 6,100 dedicated faculty members, and more than 90,000 students, of which 34% will be African American enrollees. Encouragingly, this acquisition would help Adtalem generate more than $300 million of free cash flow annually.

Furthermore, Altadem anticipates opening a few more campuses in the country to meet the growing new enrollments. During fiscal 2021, Chamberlain revenues increased 10.2% to $563.8 compared to the prior year. The upside was mainly attributed to a rise in total student enrollment during each fiscal year 2021 enrollment session along with a hike in non-tuition fee price.

Innovation and Collaboration Aid Growth: Adtalem has consistently balanced strategic investments and delivered the best returns to its shareholders. First, the company will focus on collaborating with corporations, hospitals, government agencies, and professional organizations to design education programs to teach new skills to employees. Meanwhile, the company emphasizes short-term programs that are directly aimed at meeting student’s preferences and employers’ needs. During fourth-quarter fiscal 2021, the company inked a partnership with Emory Healthcare in Atlanta. Emory is working to address the enormous nurse staffing challenges across the country.

OnCourse Learning Bodes Well: OnCourse learning has been a significant growth driver for Altadem’s Financial Services segment. During fiscal 2021, segment revenues increased 10.7% year over year to $205.5 million on higher ACAMS, OnCourse Learning and Becker revenues. OnCourse Learning’s persistent focus on execution in a favorable mortgage market and strength in the education business drove revenues for the quarter. Becker’s revenue growth stemmed from continued growth in ongoing education program offerings and increased CPA exam preparation revenues. Meanwhile, Adtalem has increased its focus on virtual technology capabilities to combat the impact of the pandemic-led crisis.

Cost-Saving Efforts: Adtalem undertook various cost-saving initiatives like workforce reduction, centralized operations and curbing discretionary spending through supply management. The cost of educational services decreased due to lower bad debt expenses. The company is following a strict cost-control routine, emphasizing controlling and escalating costs at some of its institutions. The company is optimistic about achieving at least $60 million in annual run-rate cost synergies in the future. Also, the company is positive about its portfolio management approach and effective cost management efforts to drive sustainability in revenues and earnings growth over the long term.

Superior ROE: Adtalem’s superior return on equity (ROE) also indicates its growth potential. The company’s ROE currently stands at 11.7%. This compares favorably with the negative ROE of 5.2% for the industry it belongs to. It indicates efficiency in using its shareholders’ funds and Adtalem’s ability to generate profit with minimum capital usage.

Image Source: Zacks Investment Research

3 Other Consumer Discretionary Stock to Bet on

A few other top-ranked stocks in the Zacks Consumer Discretionary sector include Stride, Inc. LRN, La-Z-Boy Incorporated LZB and Lincoln Educational Services Corporation LINC. Stride sports a Zacks Rank #1, while La-Z-Boy and Lincoln Educational Services carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Stride has a three- to five-year earnings per share growth rate of 20%.

La-Z-Boy has a trailing four-quarter earnings surprise of 20.2%, on average.

Lincoln Educational Services’ earnings for 2021 are expected to rise 136.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LaZBoy Incorporated (LZB) : Free Stock Analysis Report

Lincoln Educational Services Corporation (LINC) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance