Adobe (ADBE) Boosts Experience Cloud With New Innovations

Adobe ADBE is leaving no stone unturned to innovate its Experience Cloud offerings by powering them with generative AI technology.

This is evident from the latest generative AI innovations in Adobe Sensei GenAI, which the company announced at Adobe Summit EMEA 2023.

Notably, Sensei GenAI services, based on multiple large language models (LLMs) and part of Adobe Experience Cloud, are now capable of aiding a co-pilot for marketers and other customer experience teams to boost productivity.

Further, the latest move enables Sensei GenAI to help enterprises create on-brand experiences.

Moreover, the innovative Sensei GenAI services will now be integrated across Experience Cloud applications like Customer Journey Analytics, Experience Manager, Journey Optimizer and Marketo Engage.

With this integration, Adobe strives to aid businesses in accelerating productivity and personalizing customer experiences.

We believe Adobe is likely to witness strong momentum among customers on the back of its new Sensei GenAI services.

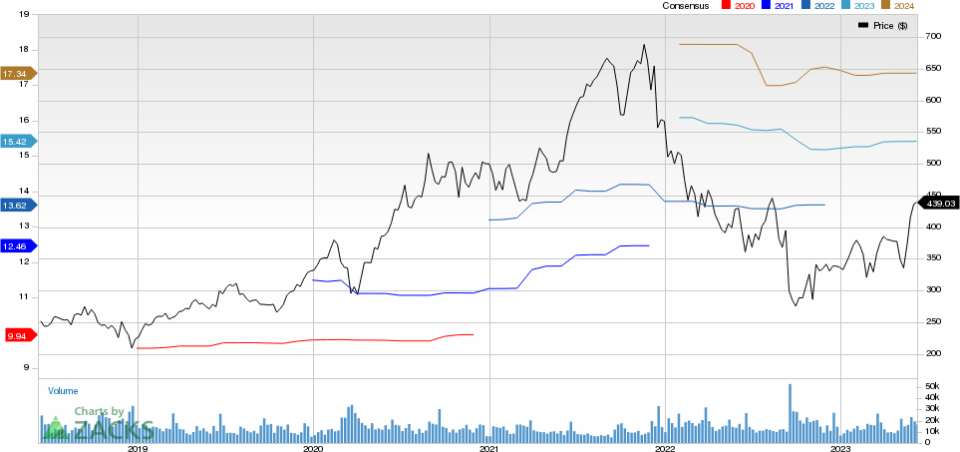

Adobe Inc. Price and Consensus

Adobe Inc. price-consensus-chart | Adobe Inc. Quote

Generative AI Prospects

The latest move boosts Adobe’s generative AI efforts. It is, in turn, likely to strengthen its presence in the booming generative AI space.

According to a report from The Brainy Insights, the market for generative AI is expected to reach $188.62 billion by 2032, seeing a CAGR of 36.1% between 2022 and 2032.

Per a Grand View Research report, the market is likely to hit $109.4 billion by 2030, witnessing a CAGR of 34.6% between 2022 and 2030.

We believe Adobe’s growing prospects in this promising market are expected to aid it in winning investors’ confidence in the near term.

Coming to the price performance, ADBE has gained 30.4% on a year-to-date basis.

Digital Experience Segment in Focus

We note that the latest move has added strength to Adobe Experience Cloud offerings.

This is also likely to aid the performance of the Digital Experience segment, which has become an integral part of the company.

In first-quarter fiscal 2023, the segment generated revenues of $1.18 billion, up 11% on a year-over-year basis. Experience Cloud’s subscription revenues were $1.04 billion, which rose 12% from the year-ago quarter.

For second-quarter fiscal 2023, Adobe expects Digital Experience segment revenues between $1.21 billion and $1.23 billion. Also, subscription revenues of Digital Experience are anticipated to be within $1.06-$1.08 billion.

Zacks Rank & Stocks to Consider

Currently, Adobe carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Palo Alto Networks PANW, NVIDIA NVDA and AMETEK AME. While Palo Alto Networks and NVIDIA sport a Zacks Rank #1 (Strong Buy), AME carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Palo Alto Networks shares have gained 61.9% in the year-to-date period. The long-term earnings growth rate for PANW is currently projected at 31.5%.

NVIDIA shares have rallied 166.1% in the year-to-date period. Its long-term earnings growth rate is presently projected at 23.02%.

AMETEK shares have increased 7% in the year-to-date period. The long-term earnings growth rate for AME is currently projected at 8.95%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance