Is Adelaide Brighton Limited’s (ASX:ABC) CEO Paid Enough To Stay Motivated?

In 2014 Martin Brydon was appointed CEO of Adelaide Brighton Limited (ASX:ABC). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we’ll look at a snap shot of the business growth. Third, we’ll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Adelaide Brighton

How Does Martin Brydon’s Compensation Compare With Similar Sized Companies?

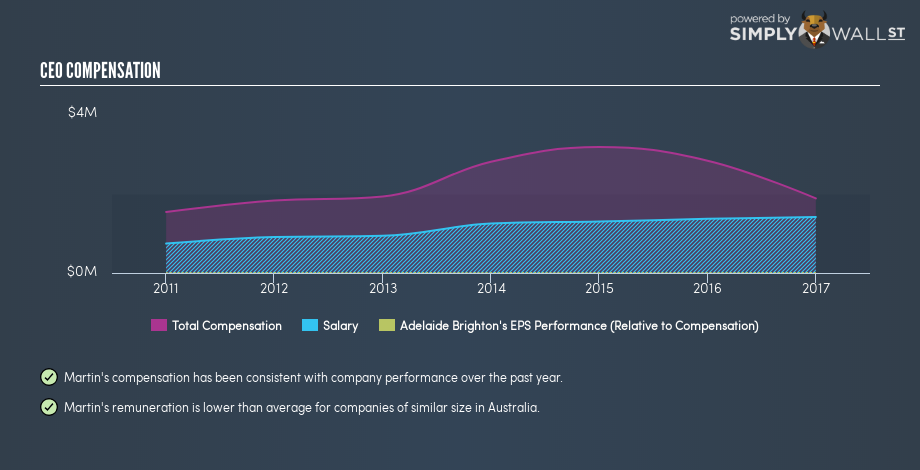

At the time of writing our data says that Adelaide Brighton Limited has a market cap of AU$3.7b, and is paying total annual CEO compensation of AU$2m. That’s less than last year. We examined companies with market caps from AU$2.8b to AU$8.8b, and discovered that the median CEO compensation of that group was AU$4m.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. While this is a good thing, you’ll need to understand the business better before you can form an opinion.

The graphic below shows how CEO compensation at Adelaide Brighton has changed from year to year.

Is Adelaide Brighton Limited Growing?

Adelaide Brighton Limited has reduced its earnings per share by an average of 4.4% a year, over the last three years. It achieved revenue growth of 15% over the last year.

Sadly for shareholders, earnings per share are actually down, over three years. There’s no doubt that the silver lining is that revenue is up. But it isn’t sufficiently fast growth wto overlook the fact that earnings per share has gone backwards over three years. It’s hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration.

Shareholders might be interested in this free visualization of analyst forecasts. .

Has Adelaide Brighton Limited Been A Good Investment?

I think that the total shareholder return of 54%, over three years, would leave most Adelaide Brighton Limited shareholders smiling. So they may not be at all concerned if the CEO is paid more than is normal for companies around the same size.

In Summary…

Adelaide Brighton Limited is currently paying its CEO below what is normal for companies of its size.

It’s well worth noting that while Martin Brydon is paid less than most company leaders (at similar sized companies), there isn’t much EPS growth. Having said that, returns to shareholders have been great. Although we could see higher EPS growth, we’d argue the remuneration is not an issue, based on these observations. So you may want to check if insiders are buying Adelaide Brighton Limited shares with their own money (free access).

Of course, the past can be informative so you might be interested in considering this analytical visualization showing the company history of earnings and revenue.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance