Should You Be Adding OFX Group (ASX:OFX) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like OFX Group (ASX:OFX). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for OFX Group

How Quickly Is OFX Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that OFX Group has managed to grow EPS by 30% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that OFX Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While OFX Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

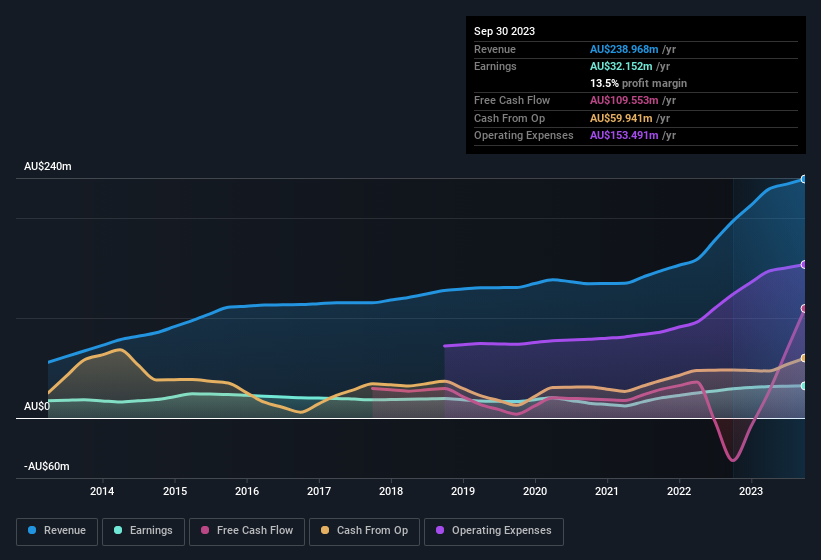

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for OFX Group's future EPS 100% free.

Are OFX Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that OFX Group insiders spent AU$83k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Non-Executive Independent Director Douglas Snedden for AU$72k worth of shares, at about AU$1.44 per share.

The good news, alongside the insider buying, for OFX Group bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$34m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 9.1% of the company, demonstrating a degree of high-level alignment with shareholders.

Does OFX Group Deserve A Spot On Your Watchlist?

You can't deny that OFX Group has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Now, you could try to make up your mind on OFX Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of OFX Group, you'll probably love this curated collection of companies in AU that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance