Should You Be Adding GUD Holdings (ASX:GUD) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like GUD Holdings (ASX:GUD). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for GUD Holdings

GUD Holdings's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. GUD Holdings has grown its trailing twelve month EPS from AU$0.63 to AU$0.66, in the last year. That amounts to a small improvement of 5.0%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note GUD Holdings's EBIT margins were flat over the last year, revenue grew by a solid 4.7% to AU$441m. That's a real positive.

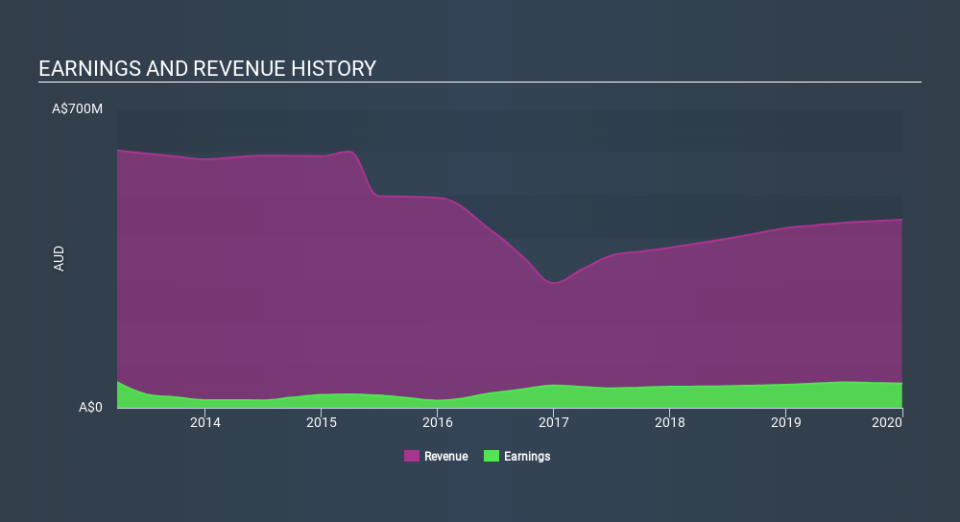

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of GUD Holdings's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are GUD Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see GUD Holdings insiders walking the walk, by spending AU$343k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the CEO, MD & Director, Graeme Whickman, who made the biggest single acquisition, paying AU$226k for shares at about AU$9.05 each.

It's me that GUD Holdings insiders are buying the stock, but that's not the only reason to think leader are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between AU$596m and AU$2.4b, like GUD Holdings, the median CEO pay is around AU$1.4m.

The GUD Holdings CEO received AU$1m in compensation for the year ending June 2019. That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is GUD Holdings Worth Keeping An Eye On?

As I already mentioned, GUD Holdings is a growing business, which is what I like to see. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. If that doesn't automatically earn it a spot on your watchlist then I'd posit it warrants a closer look at the very least. If you think GUD Holdings might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

The good news is that GUD Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance