Should You Be Adding Artisan Partners Asset Management (NYSE:APAM) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Artisan Partners Asset Management (NYSE:APAM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Artisan Partners Asset Management with the means to add long-term value to shareholders.

View our latest analysis for Artisan Partners Asset Management

How Fast Is Artisan Partners Asset Management Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Artisan Partners Asset Management has grown EPS by 19% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

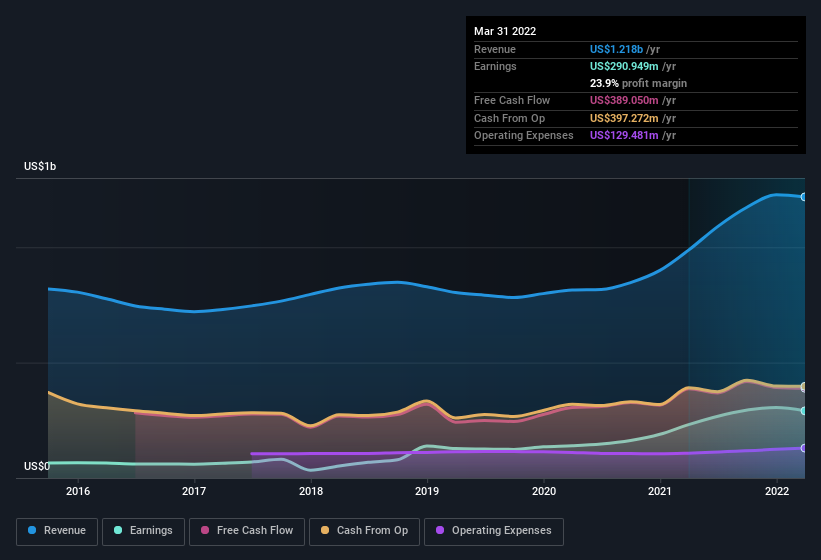

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Artisan Partners Asset Management remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 23% to US$1.2b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Artisan Partners Asset Management's future profits.

Are Artisan Partners Asset Management Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Artisan Partners Asset Management is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. Indeed, Independent Director Tench Coxe has accumulated shares over the last year, paying a total of US$10.0m at an average price of about US$45.39. It doesn't get much better than that, in terms of large investments from insiders.

On top of the insider buying, it's good to see that Artisan Partners Asset Management insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$111m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does Artisan Partners Asset Management Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Artisan Partners Asset Management's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. These things considered, this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Artisan Partners Asset Management (at least 1 which is significant) , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Artisan Partners Asset Management, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance