Should You Be Adding Advance NanoTek (ASX:ANO) To Your Watchlist Today?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Advance NanoTek (ASX:ANO), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Advance NanoTek

Advance NanoTek's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Advance NanoTek's EPS went from AU$0.019 to AU$0.073 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

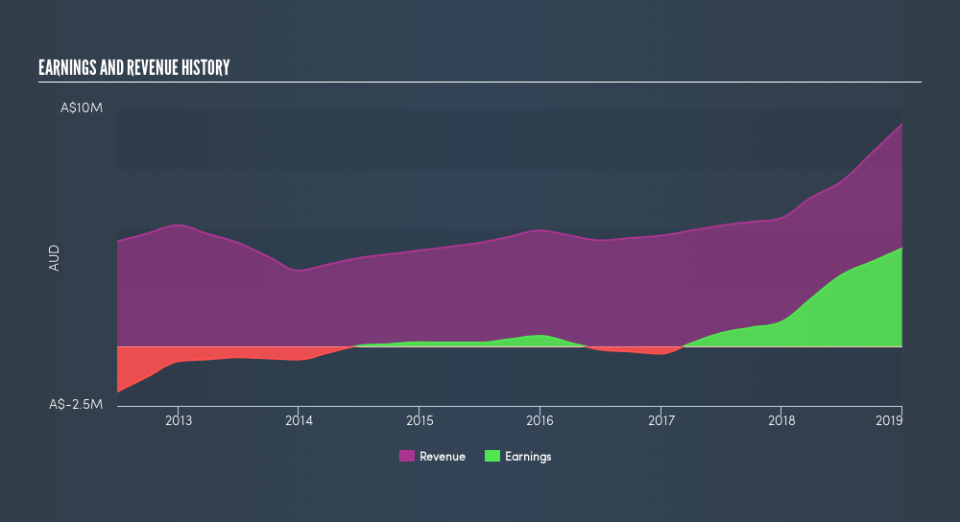

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Advance NanoTek is growing revenues, and EBIT margins improved by 4.2 percentage points to 28%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Advance NanoTek is no giant, with a market capitalization of AU$369m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Advance NanoTek Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Advance NanoTek were both selling and buying shares; but happily, as a group they spent AU$268k more on stock, than they netted from selling it. On balance, that's a good sign. We also note that it was the Non-Executive Chairman, Lev Mizikovsky, who made the biggest single acquisition, paying AU$207k for shares at about AU$1.73 each.

On top of the insider buying, we can also see that Advance NanoTek insiders own a large chunk of the company. Indeed, with a collective holding of 63%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about AU$230m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Geoff Acton, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Advance NanoTek with market caps between AU$144m and AU$575m is about AU$756k.

The Advance NanoTek CEO received total compensation of just AU$125k in the year to June 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Advance NanoTek To Your Watchlist?

Advance NanoTek's earnings per share growth has been so hot recently that thinking about it is making me blush. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Advance NanoTek is at an inflection point, given the EPS growth. If so, then it the potential for further gains probably merit a spot on your watchlist. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Advance NanoTek's ROE with industry peers (and the market at large).

As a growth investor I do like to see insider buying. But Advance NanoTek isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance