Adairs Limited (ASX:ADH) Surges 28% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Adairs Limited (ASX:ADH) shares have been powering on, with a gain of 28% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

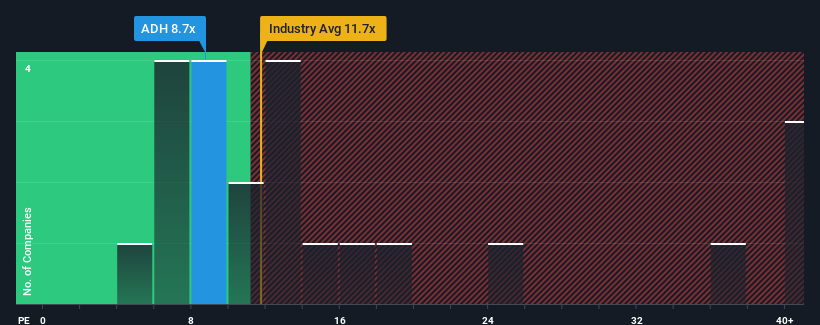

In spite of the firm bounce in price, given about half the companies in Australia have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Adairs as a highly attractive investment with its 8.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Adairs as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Adairs

Want the full picture on analyst estimates for the company? Then our free report on Adairs will help you uncover what's on the horizon.

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Adairs' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 7.6% per annum as estimated by the eight analysts watching the company. That's shaping up to be materially lower than the 18% each year growth forecast for the broader market.

With this information, we can see why Adairs is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Even after such a strong price move, Adairs' P/E still trails the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Adairs' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Adairs with six simple checks on some of these key factors.

If you're unsure about the strength of Adairs' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance