Acuity Brands (AYI) Partners Microsoft to Boost Technology

Acuity Brands, Inc. AYI has been seeing growth due to its prime focus on product innovation, business collaborations and geographic expansion. Also, the company has undertaken various initiatives to avoid 100 million metric tons of carbon emissions till 2030. To that note, recently, it had partnered with Microsoft to advance its smart lighting, lighting controls, and building automation solutions.

With the collaboration of Microsoft’s Cloud for Sustainability and Microsoft Azure IoT with Acuity Brands’ customer solutions, AYI will be able to allow end customers to reduce carbon emissions while saving money. Also, this will help to forecast and calculate the environmental and financial impacts that these new lighting and building management technologies deliver.

Neil Ashe, chairman, president and chief executive officer of Acuity Brands, said, “We estimate that building operations contribute 28% of global carbon emissions. By developing, deploying, and operating building systems with a focus on sustainability, we can materially reduce energy usage from facilities.”

Further, Microsoft and Acuity Brands will explore new technology solutions to evolve the way spaces can be evaluated, managed and optimized in the future.

Technology Enhancement & Sustainable Building Solutions to Drive Growth

In response to the rapidly changing market trends, Acuity Brands is consistently expanding its portfolio of innovative lighting control solutions and energy-efficient luminaries, along with its geographical presence and market reach. Its industry-leading lighting and lighting controls technologies, like the nLight digital lighting controls platform, the Compact Pro High Bay by Lithonia Lighting, among others, are currently deployed across 15-billion square feet of commercial real estate. Also, its smart building and energy management portfolio comprises of the ECLYPSE line of edge controllers by Distech Controls, which are used to automate building functions and energy management services such as the Atrius Building Manager.

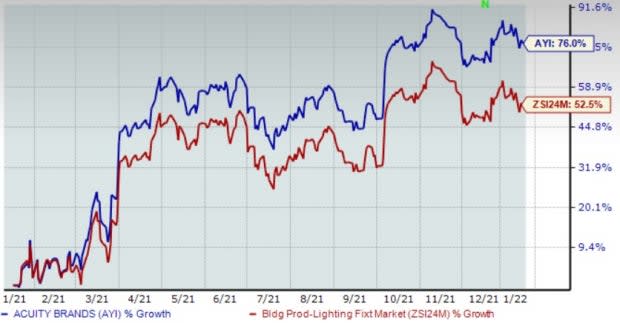

Image Source: Zacks Investment Research

Acuity Brands’ focus on innovation through product vitality and increasing service levels for the benefit of customers has delivered strong results. The company’s vitality efforts include improvements to existing products and the introduction of new ones. In first-quarter fiscal 2022, it introduced STACK PACK and STACK Switch products. These are the next generation of center-element LED lay-in lights for commercial indoor spaces. Also, the company unveiled CLAIRITY Link, a part of nLight lighting controls platform that offers remote connectivity capability. This apart, it launched Distech ECLYPSE APEX within the quarter. Distech ECLYPSE APEX is the most advanced version of our controller for HVAC and building automation.

Shares of this Zacks Rank #2 (Buy) company have gained 76% in a year compared with the industry’s 52.5% growth. The diversified portfolio and bolt-on acquisitions of Acuity Brands will benefit the company in the future despite industry woes. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks to Consider From the Construction Sector

D.R. Horton DHI currently carries a Zacks Rank #2 (Buy). This Texas-based prime homebuilder continues to gain from industry-leading market share, a solid acquisition strategy, a well-stocked supply of land, lots and homes, along with affordable product offerings across multiple brands.

D.R. Horton’s earnings are expected to rise 27.7% year over year in fiscal 2022.

Lennar Corporation LEN currently holds a Zacks Rank #2. This Miami, FL-based homebuilder continues to gain from effective cost control and focus on making its homebuilding platform more efficient, which in turn is resulting in higher operating leverage.

Lennar’s earnings are expected to rise 9.3% year over year in fiscal 2022.

Meritage Homes Corporation MTH currently carries a Zacks Rank #2. Its successful execution of strategic initiatives to boost profitability and focus on entry-level LiVE.NOW homes bodes well.

Meritage Homes’ earnings are expected to rise 23.4% year over year in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance