Actuant's (EPAC) Q1 Earnings and Revenues Beat Estimates

Actuant Corporation EPAC, on Dec 19, released first-quarter fiscal 2020 (ended Nov 30, 2019) results wherein both its earnings and revenues surpassed the Zacks Consensus Estimate.

It is worth mentioning here that Actuant adopted a new business name, Enerpac Tool Group, on Sep 23, 2019. Its stock started trading on the NYSE under the ticker symbol ‘EPAC’ from Oct 7.

In the quarter, Actuant’s adjusted earnings of 12 cents per share exceeded the Zacks Consensus Estimate of 9 cents by 33.33%. On a year-over-year basis, the bottom-line figure increased 9.1% supported by higher operating profits, reduced interest expenses and favorable tax rates.

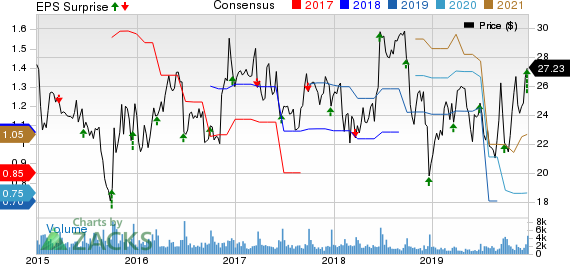

Actuant Corporation Price, Consensus and EPS Surprise

Actuant Corporation price-consensus-eps-surprise-chart | Actuant Corporation Quote

Forex Woes Hurt Revenues

Actuant generated revenues of $146.7 million in the fiscal first quarter, reflecting a 7.5% decline from the year-ago figure. However, the top line surpassed the Zacks Consensus Estimate of $137 million.

Organic sales in the quarter were flat. While unfavorable movements in foreign currencies hurt net sales by 1%, divestitures had an adverse impact of 6% on net sales.

The company’s sales are represented under two heads. A brief discussion on them is provided below:

Industrial Tools & Services (92.4% of first-quarter fiscal 2020 net sales): Revenues totaled $135.6 million, reflecting 8.8% decline from the year-ago figure. The segment’s core sales also decreased 1% due to adverse impacts of global uncertainties. Additionally, forex woes had a 1% adverse impact on sales.

Other (7.6%): Revenues totaled $11.1 million, up roughly 12.1% from the year-ago figure. The improvement was driven by growth in medical sales.

Margin Details

In the reported quarter, Actuant’s cost of sales decreased 11.5% year over year to about $78 million. It represented 53.2% of the quarter’s net sales compared with 55.6% in the year-ago quarter. Gross margin expanded 250 basis points (bps) to 46.8%. Selling, administrative and engineering expenses decreased 2.4% to $51.8 million. As a percentage of net sales, selling, administrative and engineering expenses represented 35.3% compared with 33.5% a year ago.

Adjusted EBITDA amounted to $19.4 million, relatively flat year over year. Adjusted EBITDA margin was 13.3% compared with 12.3% in the year-ago quarter. While adjusted operating income increased 0.6% to roughly $15 million, adjusted operating margin increased 80 bps to 10.2%. Net financing costs declined 8.2% to $6.7 million.

Balance Sheet and Cash Flow

Exiting the fiscal first quarter, Actuant’s cash and cash equivalents totaled $206.8 million, down 2.1% from $211.2 million at the end of the last reported quarter. Long-term debt balance decreased 36.8% sequentially to $286.2 million. Notably, the company repaid debts of $175 million in the quarter under review. Actuant’s net debt to adjusted EBITDA was 0.8x at the fiscal first-quarter end compared with 2.1x at the end of year-ago quarter.

In the quarter, the company’s cash used by operating activities came in at $22.9 million, down from $29.1 million in the year-ago quarter. Capital spending totaled $4.6 million, down 40.3%.

Outlook

For fiscal 2020, the company anticipates adjusted earnings to be 68-81 cents per share.

Sales are projected to be $575-$600 million.

Adjusted EBITDA will be within $94-$104 million compared with $96 million recorded in fiscal 2019. Free cash is expected to be $50-$75 million.

For second-quarter fiscal 2020, adjusted earnings are anticipated to be 8-12 cents per share and sales are likely to be $133-$140 million. Adjusted EBITDA will be in the $16.5-$19.5 million range.

Zacks Rank & Key Picks

Actuantcurrently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the same space are Kaman Corporation KAMN, Barnes Group, Inc. B and DXP Enterprises, Inc. DXPE. While Kaman currently sports a Zacks Rank #1 (Strong Buy), Barnes Group and DXP Enterprises carry a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kaman delivered average positive earnings surprise of 7.72% in the trailing four quarters.

Barnes Group delivered average positive earnings surprise of 4.21% in the trailing four quarters.

DXP Enterprises pulled off average positive earnings surprise of 17.67% in the trailing four quarters.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Kaman Corporation (KAMN) : Free Stock Analysis Report

Actuant Corporation (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance