The Acrux (ASX:ACR) Share Price Is Down 77% So Some Shareholders Are Rather Upset

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Acrux Limited (ASX:ACR) during the five years that saw its share price drop a whopping 77%. The good news is that the stock is up 11% in the last week.

View our latest analysis for Acrux

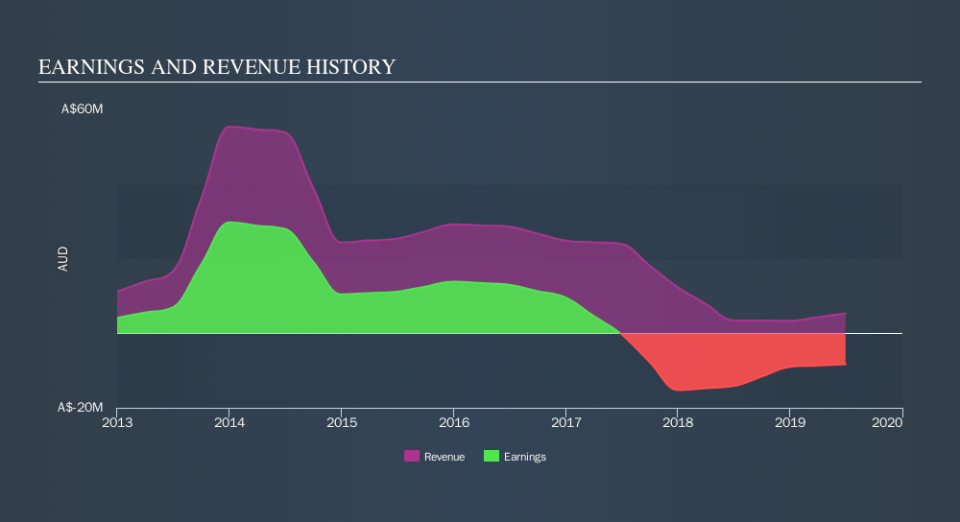

Acrux isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Acrux reduced its trailing twelve month revenue by 36% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 26% per year in that period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Acrux's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Acrux's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Acrux's TSR of was a loss of 75% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Acrux provided a TSR of 16% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 24% endured over half a decade. So this might be a sign the business has turned its fortunes around. If you would like to research Acrux in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance