ACI Worldwide Inc. (ACIW) Q1 Earnings: Exceeds Revenue Expectations and Narrows Losses

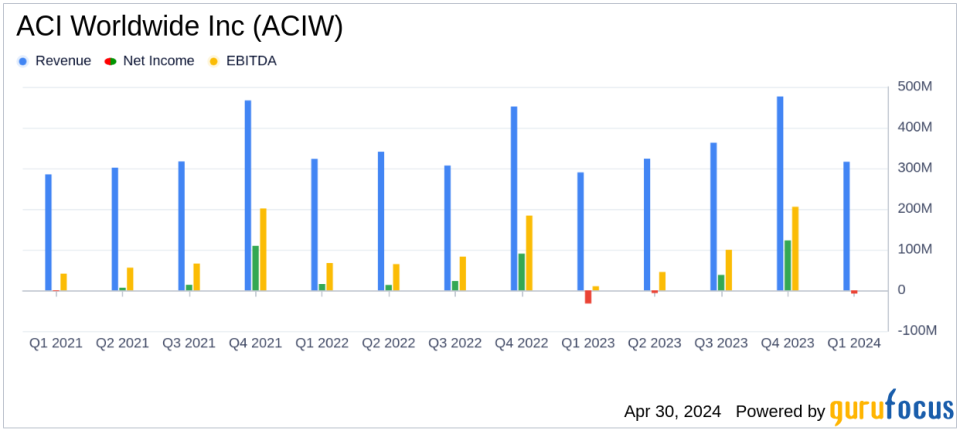

Revenue: Reported at $316 million, up 9% from Q1 2023, surpassing the estimate of $306.26 million.

Net Income: Improved to a loss of $8 million from a loss of $32 million in Q1 2023, exceeding the estimated loss of $19.98 million.

Adjusted EBITDA: Increased significantly by 93% to $48 million from the previous year.

Operating Cash Flow: Grew by 208% to $123 million, indicating strong cash generation capabilities.

Share Repurchase: 2 million shares repurchased for $63 million, demonstrating confidence in the company's value.

Guidance: Raised the upper end of full-year 2024 revenue and adjusted EBITDA forecasts, reflecting positive business outlook.

Bank Segment Performance: Revenue up 20% with significant growth in Fraud Management and Real-Time Payment products.

On April 30, 2024, ACI Worldwide Inc (NASDAQ:ACIW) released its 8-K filing, announcing its financial results for the quarter ended March 31, 2024. The company reported a revenue of $316 million, marking a 9% increase from Q1 2023 and surpassing the analyst's estimate of $306.26 million. The net loss improved significantly to $8 million from a loss of $32 million in Q1 2023, although it was a larger loss than the estimated $19.98 million. Adjusted EBITDA saw a remarkable rise of 93%, and cash flow from operating activities surged by 208%.

ACI Worldwide Inc, a global leader in mission-critical, real-time payments software, operates primarily in the United States and EMEA regions. The company develops, markets, and installs a comprehensive portfolio of software products that facilitate electronic payments and banking. Its solutions cater to retail banking clients, billers like utilities and healthcare providers, as well as community banks and credit unions.

Financial Performance Highlights

The first quarter of 2024 demonstrated robust growth across various segments. The Bank segment revenue increased by 20%, driven by significant growth in Fraud Management and Real-Time Payment products, which grew by 23% and 28%, respectively. The Merchant segment revenue grew by 3%, and the Biller segment revenue increased by 5%. These improvements reflect ACI Worldwide's strong market position and its ability to adapt to the evolving needs of the digital payments landscape.

ACI Worldwide ended the quarter with $183 million in cash and a net debt leverage ratio of 2.0x, having repurchased 2 million shares for approximately $63 million. The company's proactive capital management strategies underscore its commitment to delivering shareholder value.

Strategic Moves and Future Outlook

President and CEO Thomas Warsop expressed satisfaction with the quarter's outcomes, stating,

Q1 results exceeded our expectations, and we are increasing the high end of our full year targets."

This optimism is reflected in the revised full-year guidance, with revenue now expected to be between $1.547 billion and $1.581 billion, and adjusted EBITDA projected between $418 million and $433 million.

The company's strategic focus on enhancing its product offerings in the Real-Time Payments and Fraud Management solutions has positioned it well to capitalize on significant market opportunities. The ongoing investments in innovation and technology, coupled with a strong pipeline, are expected to drive continued growth and operational efficiency.

Investor and Analyst Perspectives

Today, management will host a conference call to discuss these results further, providing an opportunity for investors and analysts to gain deeper insights into the company's strategies and financial health. The strong Q1 performance, coupled with positive guidance for 2024, suggests that ACI Worldwide is on a solid path to achieving its strategic objectives and enhancing its competitive stance in the global payments industry.

For detailed financial figures and future updates, stakeholders are encouraged to refer to the official ACI investor relations page.

Explore the complete 8-K earnings release (here) from ACI Worldwide Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance