Accuray (ARAY) Hits 52-Week High: What's Aiding the Stock?

Shares of Accuray Incorporated ARAY scaled a new 52-week high of $3.86 on May 23, before closing the session marginally lower at $3.68.

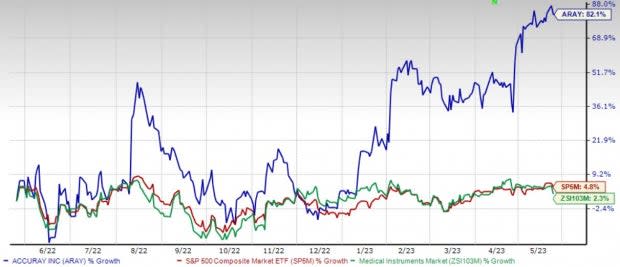

In the past year, this Zacks Rank #3 (Hold) stock has gained 82.2% compared with the 2.4% rise of the industry and the S&P 500 composite’s growth of 4.9%.

Accuray’s expected growth rate of 200% for fiscal 2024 compares with the industry’s growth projection of 24.4%. The company’s Price/Sales ratio of 0.8 compares favorably with the industry’s 3.9.

Accuray is witnessing an upward trend in its stock price, prompted by its solid product portfolio. The optimism led by solid third-quarter fiscal 2023 performance and strategic partnerships are expected to contribute further. However, concerns regarding stiff competition and overdependence on technologies persist.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Solid Product Portfolio: Accuray’s solid product portfolio raises investors’ optimism. On the first-quarter fiscal 2023 earnings call in November 2022, the company confirmed its launch of VitalHold, which resulted from its partnership with C-RAD, at the ASTRO show in San Antonio, TX.

On the same call, Accuray confirmed that it had also demonstrated its newest innovation, ARTemis, the online adaptive capability in partnership with RaySearch, at the ASTRO show.

Strategic Partnerships: Investors are optimistic about Accuray’s slew of partnerships over the past few months. On the third-quarter fiscal 2023 earnings call in April, Accuray’s management confirmed that the company’s partnership with GE Healthcare continues to advance on multiple commercial fronts.

On the second-quarter fiscal 2023 earnings call in February, the company confirmed that it had advanced key strategic partnerships, most recently with C-RAD, introducing the VitalHold breast package that will allow Accuray to offer the most comprehensive breast package in the market.

Strong Q3 Results: Accuray’s robust third-quarter fiscal 2023 results buoy optimism. The company recorded solid overall top-line and bottom-line performances in the quarter. Robust Product and Services revenues and geographical performances were also witnessed. Accuray also registered continued strong demand for its Clear RT and Synchrony on Radixact and the CyberKnife S7.

Downsides

Overdependence on Technologies: Achieving consumer and third-party payor acceptance of the CyberKnife and TomoTherapy platforms as preferred methods of tumor treatment is crucial to Accuray’s continued success. Physicians will not begin to use or increase the use of the CyberKnife or TomoTherapy platforms unless they determine, based on experience, clinical data and other factors, that the two platforms are safe and effective alternatives to traditional treatment methods.

Stiff Competition: The medical device industry and the non-invasive cancer treatment field, in particular, are subject to intense and increasing competition and rapidly evolving technologies. To compete successfully, Accuray will need to continue to demonstrate the advantages of its products and technologies over well-established alternative procedures, and other counterparts and convince physicians and other healthcare decision makers of the advantages of the same.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Merit Medical Systems, Inc. MMSI and Boston Scientific Corporation BSX.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 5.1% for fiscal 2024. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average being 27.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 5.8% compared with the industry’s 2.4% rise in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 36.5% compared with the industry’s 5.9% rise over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 28.5% against the industry’s 31.4% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance