Abbott (ABT) Q2 Earnings Top, Coronavirus Test Sales Solid

Abbott Laboratories ABT reported second-quarter 2020 adjusted earnings from continuing operations of 57 cents per share, exceeding the Zacks Consensus Estimate by 32.6%. However, the adjusted figure declined 30.5% from the prior-year quarter.

The quarter’s adjustments include certain non-recurring intangible amortization expense and other expense primarily associated with acquisitions and restructuring actions among others.

Reported earnings from continuing operations came in at 30 cents, reflecting 46.4% decline year on year.

Second-quarter worldwide sales of $7.33 billion were down 8.2% year over year on a reported basis. However, the top line surpassed the Zacks Consensus Estimate by 7.2%. The quarter’s reported revenues include $615 million of COVID-19 diagnostic testing-related sales.

On an organic basis (adjusting for the impact of foreign exchange), sales declined 5.4% year over year in the reported quarter.

Quarter in Detail

Abbott operates through four segments — Established Pharmaceuticals Division (EPD), Medical Devices, Nutrition, and Diagnostics.

In the second quarter, EPD sales declined 8.6%, on a reported basis (down 0.7% on an organic basis) to $1.01 billion. Organic sales in key emerging markets dropped 0.4%, year over year. Sales growth in certain countries, including double-digit growth in China, was more than offset by pandemic-led lower demand for products across several emerging market countries, including Russia, Brazil and Colombia.

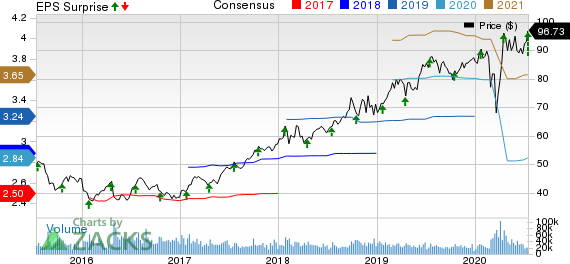

Abbott Laboratories Price, Consensus and EPS Surprise

Abbott Laboratories price-consensus-eps-surprise-chart | Abbott Laboratories Quote

Medical Devices business sales decreased 21.2% on a reported basis to $2.42 billion. On an organic basis, sales declined 19.9%. Barring Diabetes Care, all other sub segments reported lower revenues in the quarter. According to the company, cardiovascular and neuromodulation procedure volumes declined due to COVID-19.

However, in Diabetes Care, the company registered 31.9% organic growth, banking on solid worldwide adoption of FreeStyle Libre. This device alone registered global sales growth of 39.9% on an organic basis.

Nutrition sales were up 0.4% year over year, on a reported basis (up 3.1% on an organic basis), to $1.88 billion. Pediatric Nutrition sales declined 0.3% on an organic basis. Adult Nutrition sales climbed 7.4% organically. According to the company, Adult Nutrition sales benefited from improved U.S. and international sales performance of Ensure, Abbott's market-leading complete and balanced nutrition brand. In Pediatric Nutrition, however, U.S. growth of Pedialyte and growth in Southeast Asia were offset by challenging conditions in Greater China.

Diagnostics sales were up 4.7%, year over year, on a reported basis (up 7.1% on an organic basis) to $1.99 billion. Core Laboratory Diagnostics sales declined 13.1% on an organic basis. While there was lower routine diagnostics testing due to COVID-19, this was partially offset by sales of Abbott's COVID-19 laboratory-based tests for the detection of the IgG antibody. Molecular Diagnostics surged 241.4% on an organic basis on solid demand for Abbott's laboratory-based molecular tests for COVID-19 on its m2000 and Alinity m platforms. Rapid Diagnostics sales too improved 11% on an organic basis in the June-end quarter. However, Point of Care Diagnostics sales declined 17.6% on an organic basis.

2020 Guidance

The company issued a fresh guidance for 2020 after suspending the previous one on the first-quarter earnings call.

The company now projects adjusted earnings per share from continuing operations to be at least $3.25 for 2020. The current Zacks Consensus Estimate is pegged at $2.84

Our Take

Abbott posted better-than-expected earnings and revenue number for the second quarter. However, adjusted earnings and organic sales declined year over year. Despite $615 million of COVID-19 diagnostic testing-related sales, this year-over-year decline was primarily due to the pandemic-led fall in procedure volumes in other businesses.

On a positive note, Abbott has been riding high on a healthy growth graph within its Diabetes Care business. The company has also been in the limelight for developments in its flagship, sensor-based continuous glucose monitoring system, FreeStyle Libre System. Within Adult Nutrition too, the company gained from growing demand under the pandemic-led situation.

Further, Molecular Diagnostics sales were extremely strong in the second quarter. Growth was driven by strong demand for its tests on m2000 and Alinity m platforms. Rapid Diagnostics too witnessed strong demand for Abbott's point-of-care COVID-19 molecular test on its ID NOW platform.

Zacks Rank & Key Picks

Currently, Abbott carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are ViewRay, Inc. VRAY, Opko Health OPK and ResMed Inc. RMD. All the three stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for ViewRay’s second-quarter 2020 bottom line is pegged at a loss of 16 cents per share, indicating 50% narrower loss from the year-ago reported quarter figure.

The Zacks Consensus Estimate for Opko Health’s second-quarter 2020 bottom line stands at a loss of 7 cents per share, suggesting 30% improvement from the year-ago period. The same for revenues is pegged at $234.6 million, calling for a 3.6% increase from the year-earlier reported figure.

The Zacks Consensus Estimate for ResMed’s fourth-quarter fiscal 2020 revenues is $710.9 million, calling for a 0.9% increase from the year-earlier reported figure. The same for adjusted earnings per share stands at 99 cents, indicating 4.2% rise from the year-ago reported figure.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

OPKO Health, Inc. (OPK) : Free Stock Analysis Report

ViewRay, Inc. (VRAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance