900,000 drivers could have insurance claims rejected

Thousands of Australian drivers are putting their lives – and finances – at risk by failing to respond to the Takata airbag recall.

The faulty airbags are the subject of a compulsory recall due to evidence that the airbags could injure drivers.

Last year a Sydney man died after a minor collision which triggered the airbag to activate, flinging a piece of metal at his neck, the NSW Coroner’s Court heard.

It’s one story in a slew of many, with the Takata airbag recall the largest recall in Australian automotive history, with 2.8 million airbags already replaced. The recall is also occurring internationally.

However, a staggering 912,000 motorists are yet to respond to the recall, and it could cost them their insurance, said comparison service Mozo.com.au spokesperson Tom Godfrey.

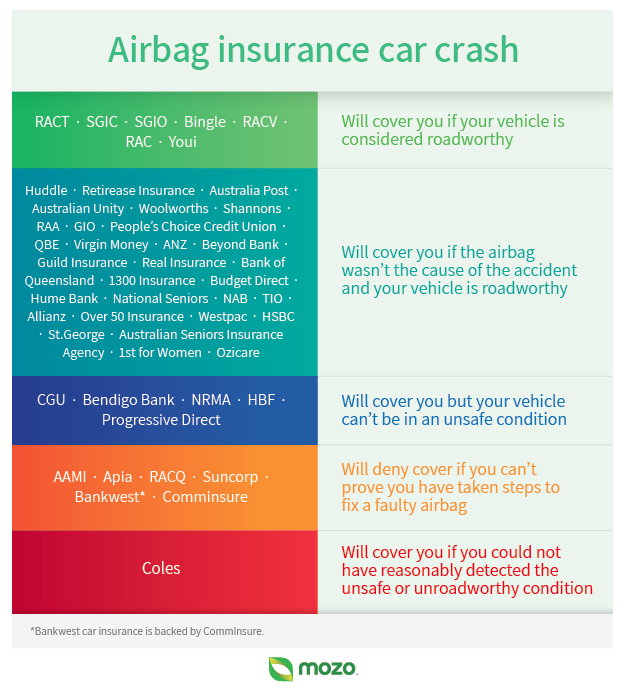

Mozo analysis of 49 insurers’ product disclosure statements found not all insurers will cover drivers in the event of an accident if they have not replaced faulty airbags.

“Worryingly, we found seven insurers will not pay out if you can’t prove you have taken steps to

fix a faulty airbag, so it pays to keep a record of the efforts you’ve made and to act quickly to get

your faulty airbag fixed,” Godfrey said.

“With hundreds of thousands of vehicles in Australia yet to be repaired, even if you have car

insurance, the message is clear – it’s time to act to get your airbag fixed.”

Another 29 insurers will pay if the airbag wasn’t the cause of the accident and the car was otherwise roadworthy, while five insurers will provide cover provided the car wasn’t in an unsafe condition.

“We have already seen 24 people killed and 300 injured around the world by dodgy Takata airbags, so with some insurers refusing coverage and regulators in some states likely to deem vehicles unroadworthy, it pays to double check to see if your vehicle is caught up in the recall.”

These were the main clauses identified by Mozo:

The Australian Competition and Consumer Commission again raised the alarm over the dangerous airbags this month, urging motorists to not be complacent.

“If you receive a letter or call from your car’s manufacturer, don’t delay or ignore it,” said ACCC deputy chair Delia Rickard.

She added that state and territory authorities have also begun imposing registration sanctions on consumers who have not replaced the airbags.

Australians can check if their car has been affected by the Takata airbag recall by heading to IsMyAirbagSafe.com.au.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: IBM apologises after asking applicants their skin colour

Now read: What happens to a funeral company when less people die?

Now read: ‘Landmark’ $3.5m deal will bring more Fiji kava to Aussie shelves

Yahoo Finance

Yahoo Finance