$90 billion needed to save Australia’s economy: report

The federal government urgently needs to come up with a plan to lift the economy out of the “biggest social and economic shock since World War II”, and this will call for $70 to $90 billion in extra stimulus across two years.

That’s according to the Grattan Institute’s ‘Recovery Book’ on what the Australian government should do to recover from the economic crisis.

“Australia faces a globally synchronised deep recession,” wrote authors John Daley, Danielle Wood, Brendan Coates, Stephen Duckett, Julie Sonnemann, Marion Terrill and Tony Wood.

Also read: All the laws ending and changing 1 July: Here's what it means for you

Also read: What Australia’s jobs market will look like after Covid-19

Also read: ‘Too soon’: Expert warns against reopening offices

The government has thus far spent more than $160 billion to support businesses and households – but this will run out in mere months.

“Many of these programs are due to roll off together at the end of September,” the authors said.

“To avoid a severe economic crunch, they should be wound down more gradually in a package that will cost about $30 billion in 2020-21.”

What should the government do?

Without more stimulus measures, unemployment will remain too high, and economic growth will flounder for several years, the Institute said.

“Governments should start planning for a sizeable fiscal stimulus to support the economy beyond October and into next year. The recovery would be aided by ongoing reforms such as increases to JobSeeker, Rent Assistance, and childcare that would cost at least $21 billion over the next two years.”

Payments such as JobSeeker should be permanently increased by at least $100 a week for singles.

“An increase of about $180 per week would be needed to lift the JobSeeker payment above the poverty line.”

Rent Assistance and childcare, which is slated to dry up on 12 July, should also be boosted.

Meanwhile, JobKeeper should be extended by another three months for businesses still doing it tough but ended early for those that don’t need it anymore, and extended to include temporary migrants, short-term casuals, and universities.

The $550 Coronavirus Supplement should also be gradually phased down.

And if the government wants to get unemployment down to 5 per cent by mid-2022, they’ll have to spend another $20-$40 billion on services, infrastructure, and social housing, according to the report.

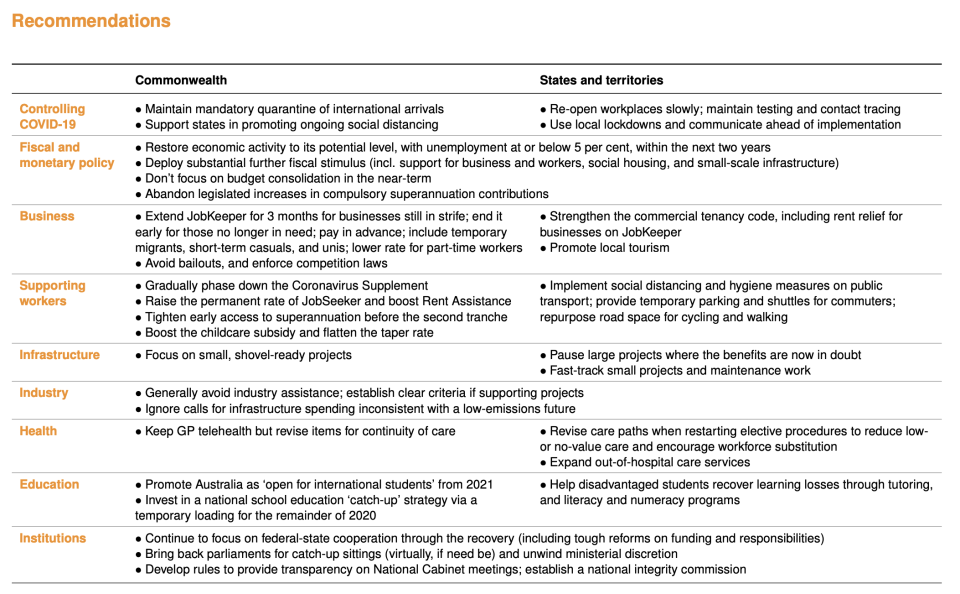

Here’s a snapshot of everything the Grattan Institute is proposing the government should do:

The challenge of reopening

After some industries shut down virtually overnight as the coronavirus pandemic hit its peak, reopening these sectors won’t be as easy as ‘snapping back’, given the health risks of new outbreaks.

“A globally synchronised recession, continuing consumer and business uncertainty, debt overhang for businesses and households, and a significant hit to population growth will all drag on economic activity in the next year and possibly beyond,” the Institute said.

In the short-term, we’ll see a burst of economic activity – but the “abrupt withdrawal” of government support payments will create a “substantial hole” in incomes and heighten economic risks again.

While federal and state governments will accrue significant amounts of debt, but given that interest rates are at record lows, government debt can be contained, the Institute argued.

“Based on current economic forecasts, returning the economy to full employment will require sizeable fiscal support: in the order of $70-to-$90 billion in additional stimulus over the next two years, equivalent to around 3-to-4 per cent of GDP.

“Such stimulus should be deployed with an aim to reduce the unemployment rate by about 1.5 percentage points below current forecasts by June 2022. This could mean between 430,000 and 510,000 extra Australians back in work by mid-2022.”

The Institute also flagged the National Cabinet should consider overhauling the tax system.

“Some of the biggest economic gains to be made are in tax reform, including replacing stamp duties with a broad-based property tax, and broadening and raising the GST.

“The council and National Cabinet should not shy away from these tough but necessary reforms.”

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance