6 Banks Trading With Low Price-Sales Ratios

According to the GuruFocus All-In-One Screener, a Premium feature, the following banks were trading with low price-sales ratios as of July 13.

The Toronto-Dominion Bank

Shares of The Toronto-Dominion Bank (TD) were trading around $44.10 with a price-sales ratio of 2.61 and a price-earnings ratio of 10.53.

The Canadian bank has an $80 billion market cap. The stock price has risen at an annualized rate of 5.91% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $71.32, suggesting it is undervalued with a 38.17% margin of safety, while the Peter Lynch earnings line gives the stock a fair price of $64.50.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.05% of outstanding shares, followed by Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.03%.

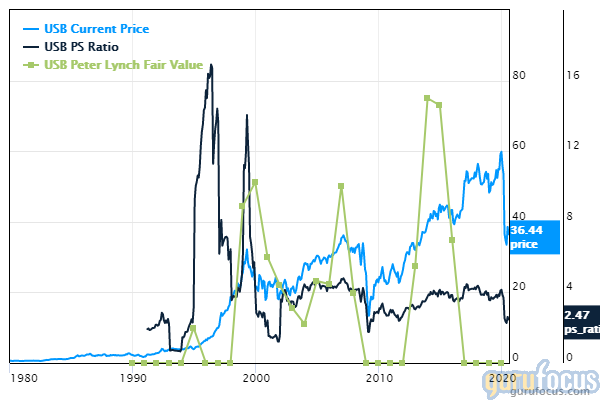

U.S. Bancorp

On Monday, U.S. Bancorp (USB) was trading around $36.44 per share with a price-sales ratio of 2.46 and a price-earnings ratio of 9.44.

The diversified financial-services provider has a market cap of $54.8 billion. The stock has risen at an annualized rate of 6.92% over the past 10 years.

The discounted cash flow calculator gives the stock a fair value of $63.61, suggesting it is undervalued with a 42.71% margin of safety, while the Peter Lynch earnings line gives the stock a fair price of $57.90.

With 8.79% of outstanding shares, Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway is the company's largest guru shareholder, followed by Chris Davis (Trades, Portfolio) with 0.87% and First Eagle Investment (Trades, Portfolio) with 0.78%.

PNC

PNC Financial Services Group Inc. (PNC) was trading around $101.60 on Monday with a price-sales ratio of 2.48 and a price-earnings ratio of 9.46.

The diversified financial services company has a market cap of $43 billion. The stock has risen at an annualized rate of 7.26% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $157.40, suggesting it is trading with a margin of safety of 35.45%, while the Peter Lynch earnings line gives the stock a fair price of $161.10.

With 2.17% of outstanding shares, Buffett's firm is the company's largest guru shareholder, followed by the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.30% and Pioneer Investments (Trades, Portfolio) with 0.15%.

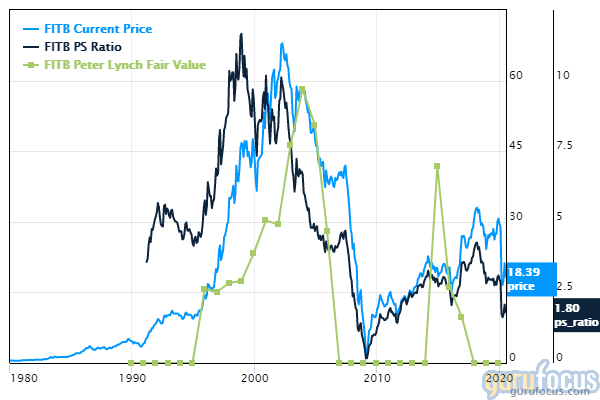

Fifth Third Bancorp

Fifth Third Bancorp (FITB) was trading around $18.39 with a price-sales ratio of 1.80 and a price-earnings ratio of 8.07.

The Cincinnati-based bank has a market cap of $13 billion. The stock has climbed at an annualized rate of 5.89% over the past 10 years.

The discounted cash flow calculator gives the stock a fair value of $52.88, suggesting it is undervalued with a 65.22% margin of safety. The Peter Lynch earnings line gives the stock a fair price of $34.20.

Some notable guru shareholders are the T Rowe Price Equity Income Fund (Trades, Portfolio) with 1.64% of outstanding shares and Richard Pzena (Trades, Portfolio) with 0.74%.

KeyCorp

KeyCorp (KEY) was trading around $11.55 per share with a price-sales ratio of 1.82 and a price-earnings ratio of 8.49.

The Ohio-based bank has a market cap of $10.9 billion. The stock has risen at an annualized rate of 6% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $14.45, suggesting it is undervalued with a margin of safety of 20.07%, while the Peter Lynch fair value is $20.25.

The company's largest guru shareholder is Pzena with 0.82%, followed by Pioneer Investments (Trades, Portfolio) with 0.06%.

SVB Financial

SVB Financial Group (SIVB) was trading around $212 with a price-sales ratio of 3.35 and a price-earnings ratio of 11.25.

The company has a market cap of $10.9 billion. The stock has risen at an annualized rate of 17.55% over the past decade.

The discounted cash flow calculator gives the stock a fair value of $536.34, suggesting it is undervalued with a margin of safety of 60.47%, while the Peter Lynch fair value is $282.

The company's largest guru shareholder is Ken Fisher (Trades, Portfolio) with 1.52% of outstanding shares, followed by Diamond Hill Capital (Trades, Portfolio) with 0.86% and Pioneer Investments (Trades, Portfolio) with 0.56%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Utilities Outperforming the Market

Insiders Roundup: Mastercard, Eli Lilly

5 Retailers Popular Among Gurus

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance