5 Soft Drink Stocks Gearing Up to Grab a Share of Industry Boom

The Zacks Beverages – Soft Drinks industry is showing resilience on the recovery across markets, share gains in at-home and away-from-home channels, improved pricing and continued innovation. Accelerating digital investments also bode well. Companies are expected to gain from expansion into newer categories, including capturing market share in the Ready-to-Drink (RTD) category. Players like The Coca-Cola Company KO, PepsiCo Inc. PEP, Coca-Cola FEMSA, S.A.B. de C.V. KOF, Keurig Dr Pepper Inc. KDP and Monster Beverage Corporation MNST are well-poised on robust innovation efforts.

However, industry players are witnessing continued pressure from higher supply-chain costs, including transportation and commodity costs, particularly steel and aluminum. The companies’ actions, including price increases, reducing reliance on imported cans and moving production closer to markets, are poised to combat these headwinds. Elevated operating expenses related to increased spending on marketing and advertising to capture a share are likely to strain margins in the near term.

About the Industry

The Zacks Beverages - Soft drinks industry comprises companies that manufacture, source, develop, market and sell non-alcoholic beverages. Soft drinks mainly include sparkling drinks, natural juices, enhanced water, sports and energy drinks as well as dairy, RTD tea and coffee beverages. Notably, some industry players like PepsiCo produce and sell handy food with flavored snacks, which complement their beverage portfolio. The companies sell products through a network of wholesalers and retailers that include supermarkets, department stores, mass merchandisers, club stores and other retail outlets. Some also offer products via company-owned or controlled bottling, independent bottling partners and partner brand owners.

What's Shaping the Future of Beverages - Soft Drinks Industry?

Evolving Trends: Companies in the soft drinks space have been gaining from improved demand trends, which are aiding volume growth. Market share gains in at-home and away-from-home channels, owing to recovery across markets, have been boosting sales. Implementing price increases to overcome the ongoing cost pressures has significantly lifted sales in recent quarters. The soft drinks industry has transformed as health consciousness, personal well-being, natural ingredients, varied flavors and better taste experiences are changing consumers’ consumption patterns. Companies in the industry are expected to benefit from the expansion into newer and adjacent categories, including capturing market share in the fast-growing RTD alcoholic beverage category through collaborations. RTD has emerged as the fastest-growing category since 2018. The industry players are also exploring CBD-infused drinks, which have been gaining popularity lately.

Innovation & Digital Growth: The soft drinks industry is poised to gain from innovations and accelerating digital investments. The companies have been optimizing their portfolio, focusing on core brands and investments in innovation to meet the evolving needs of consumers. The players remain committed to product launches and innovation to boost growth. Further, expansion into newer markets has been a key focus for soft drink makers to boost market share. Moreover, the companies are expected to reap the benefits of digital and technology-driven investments based on the shift in consumer preference for online shopping. Companies in the industry have been accelerating investments to build strong digital capabilities by piloting numerous digital-enabled fulfillment options. They have been expanding digital offerings and investing in loyalty programs and fintech platforms to capture online demand. The investments are likely to position soft drink companies for long-term growth.

Raw Material Cost Inflation and Supply Constraints: The beverage industry is plagued with higher supply-chain costs, including higher commodity input costs and transportation expenses. Raw material cost inflation, particularly steel and aluminum, has increased packaging costs. The ongoing supply constraints in the aluminum can industry have been other headwinds. The companies are also witnessing delays in procuring certain ingredients, both domestically and internationally, leading to shortages of some goods. The industry players have been facing freight inefficiencies and significant increases in domestic and international freight costs. Logistic issues, higher input costs and freight inefficiencies have resulted in higher costs of sales and operating expenses, impacting gross and operating margins. Most players expect commodity cost inflation and higher transportation costs to persist in the near term.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Beverages - Soft Drinks industry is housed within the broader Consumer Staples sector. It currently carries a Zacks Industry Rank #61, which places it in the top 24% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. In the past year, the industry’s earnings estimates for 2022 and 2023 have gained 2.6% and 1.2%, respectively.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry vs. Broader Market

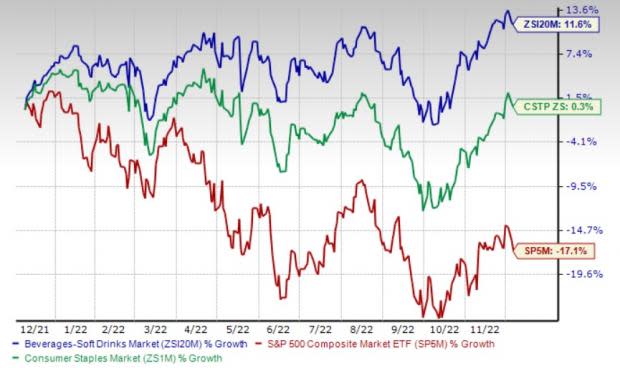

The Zacks Beverages – Soft Drinks industry has outperformed the S&P 500 Index and the Consumer Staples sector in a year.

The stocks in the industry have collectively rallied 11.6% compared with the sector’s gain of 0.3% and the S&P 500’s decline of 17.1%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing soft drink stocks, the industry is currently trading at 22.16X compared with the S&P 500’s 17.53X and the sector’s 19.4X.

Over the last five years, the industry has traded as high as 23.71X and as low as 18.52X, with a median of 21.83X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Soft Drink Stocks to Watch

One stock in the Zacks Beverages – Soft Drinks industry currently sport a Zacks Rank #1 (Strong Buy), whereas another stock has a Zacks Rank #2 (Buy). We have also highlighted three stocks with a Zacks Rank #3 (Hold) from the same industry. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s take a look.

Coca-Cola FEMSA: The largest Coca-Cola franchise bottler is a subsidiary of Fomento Economico Mexicano. The Mexico-based company remains committed to leveraging its revenue management capabilities, working intensively to provide affordability to consumers, and offering the right product at the right price. The company is likely to benefit from the progress on its strategic goals, including the rollout of its digital omni-channel platform. Volume growth, pricing initiatives and favorable price-mix effects have been driving Coca-Cola FEMSA’s revenues.

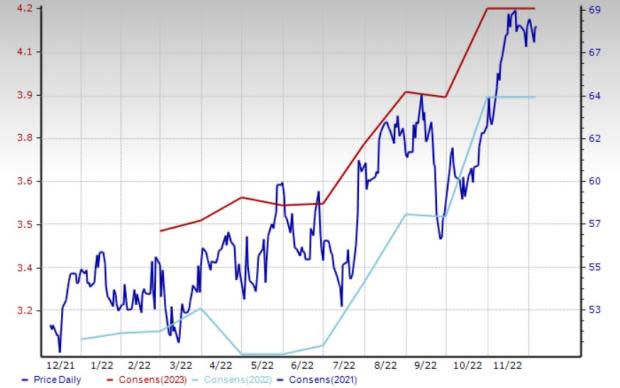

Coca-Cola FEMSA’s shares have rallied 32.7% in the past year. The Zacks Consensus Estimate for KOF’s 2022 sales and earnings indicate a year-over-year rise of 15.6% and 6.2%, respectively. The consensus mark for earnings has been unchanged in the past 30 days. The company currently sports a Zacks Rank #1.

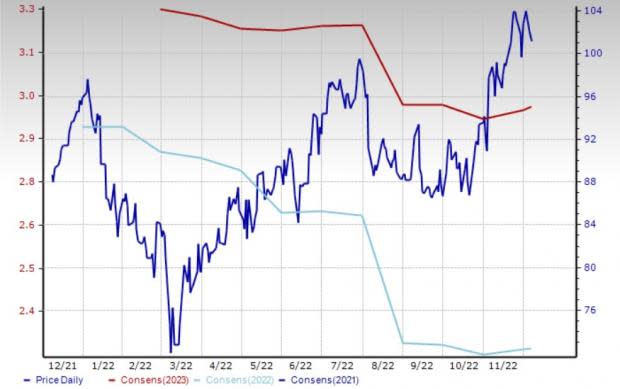

Price and Consensus: KOF

PepsiCo: The stock of this Purchase, NY-based leading soft-drink company has risen 9.2% in the past year. Resilience and strength in the global beverage and convenient food businesses have been aiding the company. It expects to benefit from delivering convenience, variety and value proposition to customers through its brands. PEP is poised to benefit from investments in brands, go-to-market systems, supply chain, manufacturing capacity and digital capabilities to build competitive advantages. Its cost-management and revenue-management initiatives bode well amid the ongoing inflationary pressures.

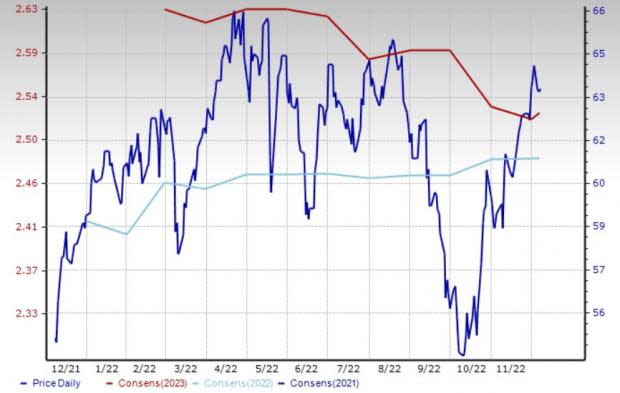

In the beverage business, PepsiCo expects strong growth and market share gains from the liquid refreshment beverage category, with share gains in the carbonated soft drinks, Ready-to-Drink Tea and water categories. The Zacks Consensus Estimate for PEP’s 2022 sales and earnings suggest growth of 7.1% and 8%, respectively. The consensus estimate for the Zacks Rank #2 company’s 2022 EPS has been unchanged in the past 30 days.

Price and Consensus: PEP

Coca-Cola: The soft drink behemoth is poised to gain from strategic transformation and ongoing worldwide recovery. The streamlining of the portfolio and accelerating investments to expand the digital presence position the company for growth in the long term. It has been witnessing a splurge in e-commerce, with the growth rate of the channel doubling in many countries. It is strengthening consumer connections and piloting numerous digital-enabled initiatives through fulfillment methods to capture the online demand for at-home consumption.

Coca-Cola is diversifying its portfolio to tap into the rapidly growing RTD category. The company has been gaining from elasticity in the marketplace, improved price/mix and concentrate sales and underlying share gains in both at-home and away-from-home channels. The Zacks Consensus Estimate for KO’s 2022 sales and earnings suggest growth of 10.7% and 6.9%, respectively. The consensus mark for earnings has been unchanged in the past 30 days. The company’s shares have gained 15.8% in the past year. It currently has a Zacks Rank #3.

Price and Consensus: KO

Keurig Dr Pepper: Strength across most business segments, particularly the Packaged Beverages segment, has been driving sales for the beverage and coffee company with operations in the United States and Canada. Robust market share gains and in-market performances across categories and brands have been the growth drivers. A recovery in the supply chain of coffee and non-carbonated beverages, better pricing to mitigate inflation, and continued portfolio growth have been contributing to the company’s growth.

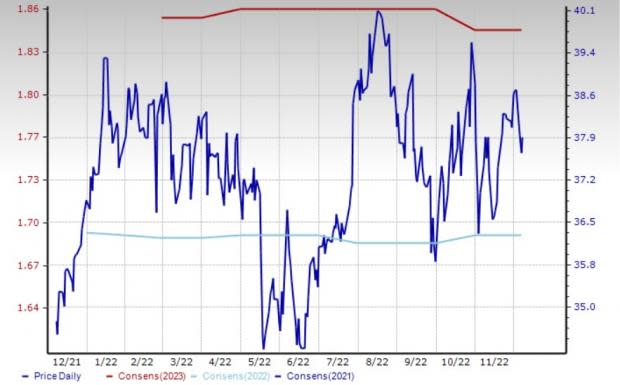

The company expects increased household penetration across hot and cold beverage portfolios to continue. Its market share growth is being supported by efficient marketing and product innovation strategies. The company is also investing in boosting distribution platforms and e-commerce operations. Shares of the Zacks Rank #3 company have gained 9.7% in the past year. The Zacks Consensus Estimate for KDP’s 2022 sales and earnings suggest growth of 10.8% and 5.6%, respectively. The consensus estimate for 2022 EPS has been unchanged in the past 30 days.

Price and Consensus: KDP

Monster Beverage: The Corona, CA-based company markets and distributes energy drinks and alternative beverages. Monster Beverage has been experiencing continued strength in its energy drinks category, which is driving performance. The company offers a wide range of energy drinks brands such as Monster Energy, Java Monster, Cafe Monster, Espresso Monster, Monster Energy Mule, Juice Monster Pipeline Punch, Juice Monster Pacific Punch, Juice Monster Mango Loco, Monster Ultra Paradise and Monster Hydra Sport. Product innovation also plays a significant role in the company's success. Monster Beverage is implementing pricing actions to overcome the ongoing cost pressures.

Despite the ongoing supply-chain challenges, Monster Beverage continues to stand by its strategy to ensure product availability and solidify the continued long-term growth of its brands. Management is optimistic about strength in the global energy drinks category. It remains poised to gain from growth in the Monster Energy family of brands and strength in Strategic and Affordable energy brands. Shares of the Zacks Rank #3 company have risen 14.6% in the past year. The Zacks Consensus Estimate for MNST’s 2022 sales indicates a year-over-year rise of 15.2%. The consensus mark for earnings suggests a decline of 11.3% and has moved up by a penny in the past 30 days.

Price and Consensus: MNST

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company The (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance