5 S&P 500 Bank Stocks With Decent Dividend Yield to Bet On

Amid near-term macroeconomic concerns, the banking industry seems to have regained some momentum after a disastrous start to 2022. As the Federal Reserve has already raised the interest rates four times so far this year (the policy rate is now in the range of 2.25-2.50%) and more such hikes are expected, banks are well poised to capitalize on this.

The recently concluded earnings season for banks also indicated that rising rates have been a great support to the financials. Further, the pent-up demand for loans as economic activities continue at a decent pace has aided banks’ financials. Amid such developments, bank stocks are gaining investors’ interest.

Yet, investors must be judicious while picking bank stocks. The operating environment is gradually turning dismal with recessionary fears taking hold, and banks will not be untouched by the economic headwinds. Thus, we have selected five banks – Citigroup C, Comerica CMA, M&T Bank MTB, Regions Financial RF and Zions Bancorporation ZION – that are part of the S&P 500 Index and have been paying dividends regularly.

To choose these banks, we ran the Zacks Stocks Screener to identify stocks with a dividend yield in excess of 2.5% and a five-year historical dividend growth of more than 5%. Also, these five stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s discuss the above-mentioned bank stocks in detail:

Headquartered in New York, Citigroup is a globally diversified financial services holding company providing a range of financial products and services. The company, which is among the top four U.S. banks, has around 200 million customer accounts across 160 countries and jurisdictions.

A diverse business model, focus on core operations and streamlining of international consumer businesses will continue to drive the company’s growth. C continues to optimize its branch network, with a focus on core urban markets and improving digital channels. It is also making efforts to simplify operations and reduce costs. All these initiatives will likely help augment its profitability and efficiency over the long term.

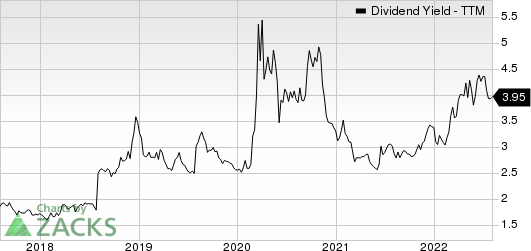

The stock has a dividend yield of 3.95% and a five-year annualized dividend growth of 10.7%. Further, C's payout ratio is 23% of earnings at present. Check Citigroup’s dividend history here.

Citigroup Inc. Dividend Yield (TTM)

Citigroup Inc. dividend-yield-ttm | Citigroup Inc. Quote

Comerica, based in Dallas, TX, is a banking and financial services company. CMA delivers financial services in three primary geographic markets — Texas, California and Michigan — as well as Arizona and Florida. It has operations in numerous other U.S. states as well as in Canada and Mexico.

A decent economic growth, higher interest rates and gradually improving loan commitments will support CMA’s financials. Comerica’s revenues and efficiency improvement initiative – GEAR Up (started in mid-2016) – have been bearing fruits. The company's efforts in product enhancements, improved sales tools and training as well as better customer analytics bode well for robust revenue growth. Given its ample liquidity, it is less likely to default interest and debt repayments, even if the economic situation worsens.

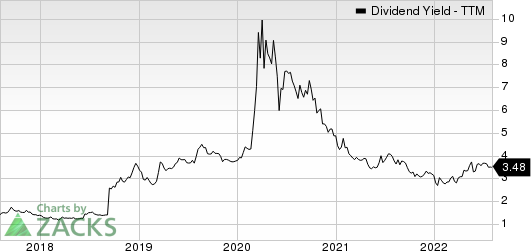

The company has a dividend yield of 3.48% and a five-year annualized dividend growth of 17.45%. Currently, CMA's payout ratio is 40% of earnings. Check Comerica’s dividend history here.

Comerica Incorporated Dividend Yield (TTM)

Comerica Incorporated dividend-yield-ttm | Comerica Incorporated Quote

M&T Bank Corporation, headquartered in Buffalo, NY, is the holding company for M&T Bank and Wilmington Trust, National Association. MTB operates in New York, MD, New Jersey, PA, Delaware, CT, Virginia, WV and the District of Columbia.

Organic growth, driven by higher fee income, rising rates and solid loans and deposits will likely continue leading to revenue growth for MTB. The company is growing inorganically backed by a sound liquidity position. The acquisition of People's United Financial (completed this April) is expected to be accretive to its earnings and will result in substantial cost savings.

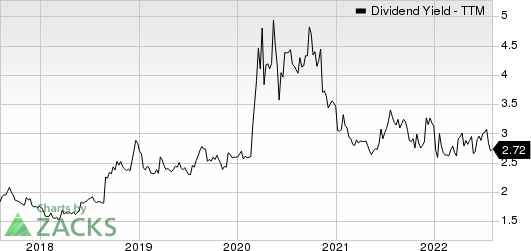

The company has a dividend yield of 2.72% and a five-year annualized dividend growth of 9.9%. Also, MTB's payout ratio is 37% of earnings at present. Check M&T Bank’s dividend history here.

M&T Bank Corporation Dividend Yield (TTM)

M&T Bank Corporation dividend-yield-ttm | M&T Bank Corporation Quote

Regions Financial is a Birmingham, AL-based financial holding company, providing retail and commercial and mortgage banking, and other financial services. RF operates through four business segments – Corporate Bank, Consumer Bank, Wealth Management and Others.

Decent economic growth and a strong lending pipeline are expected to drive loan growth, thereby aiding the company's net interest income. Regions Financial also keeps exploring opportunities for bolt-on buyouts, primarily in mortgage servicing rights, besides adding capabilities in the wealth management unit. As RF is committed to diversifying its revenue streams, such endeavors will likely support growth in the long term.

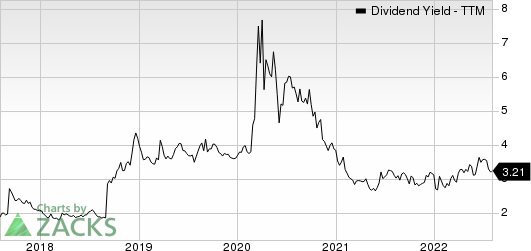

This bank has a dividend yield of 3.21% and a five-year annualized dividend growth of 17.14%. At present, RF's payout ratio is 30% of earnings. Check Regions Financial’s dividend history here.

Regions Financial Corporation Dividend Yield (TTM)

Regions Financial Corporation dividend-yield-ttm | Regions Financial Corporation Quote

Based in Salt Lake City, UT, Zions is a diversified financial service provider. The company operates through a network of more than 400 branches across 11 western states, namely Utah, Idaho, California, Nevada, Arizona, Colorado, Texas, New Mexico, Washington, Oregon and Wyoming.

Robust loans and deposit balances, and higher interest rates will keep aiding revenues. With the rising interest rate environment, Zions’ net interest margin is likely to witness decent improvement. Business simplifying initiatives and a robust balance sheet position are other positives. Further, given the earnings strength, Zions is likely to be able to continue meeting debt obligations, even if the economic situation worsens.

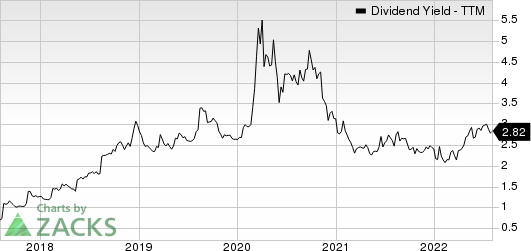

The company has a dividend yield of 2.82% and a five-year annualized dividend growth of 18.42%. Further, ZION's payout ratio is 28% of earnings at present. Check Zions’ dividend history here.

Zions Bancorporation, N.A. Dividend Yield (TTM)

Zions Bancorporation, N.A. dividend-yield-ttm | Zions Bancorporation, N.A. Quote

Parting Thoughts

Investors like dividends (specifically when macroeconomic factors are turning dismal) for a number of reasons. These greatly improve stock investing profits, lower overall portfolio risk and carry tax advantages, among others. But they must be mindful that choosing stocks just based on higher yields is not a good idea. Investors must also take into account company fundamentals to find compelling investment opportunities.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Regions Financial Corporation (RF) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance