5 Must-Buy Technology Giants Defying Recession Threats in 2023

The technology sector is back in form after suffering a massive blow last year. The performance of the technology sector is inversely related to interest rate trajectory. In 2022, the Fed hiked the benchmark lending rate by a massive 4.5% to combat record-high inflation, which led to a stiff decline in technology stocks.

On the other hand, as the central bank reduced the magnitude of interest rate hikes following a sharp decline in the inflation rate from its peak in June 2022. Although inflation is still elevated, a series of weak economic data for the last two months clearly indicated that Fed’s rate hike started delivering desired results. Consequently, tech stocks regained their mojo.

A section of market participants and financial researchers are concerned that the technology sector is not out of the woods as a probable recession will hurt these stocks to a large extent. A sharp drop in consumer spending, especially in retail sales, devastated housing sector, weak manufacturing and services data and recent softness in the resilient labor market may lead to a recession in the near-term.

However, the key to the technology sector will be the interest rate. The Fed has already said that it is approaching the end of the current rate hike cycle. The terminal interest rate is projected at 5.125%, indicating just one 25 basis -points rate hike. Moreover, a recession may compel the central bank to cut the rate in late 2023 rather than wait for early 2024.

Year to date, the tech-heavy Nasdaq Composite has railed 15.8% beating the S&P 500 (7.8%) and the Dow (2.2%). Out of the11 broad sectors of the S&P 500 Index, the Technology Select Sector SPDR (XLK) has gained 19.5%, second only to the Communication Services Select Sector SPDR (XLC), which has surged 23.4%. Notably, the XLC is very closely related to XLK.

Our Top Picks

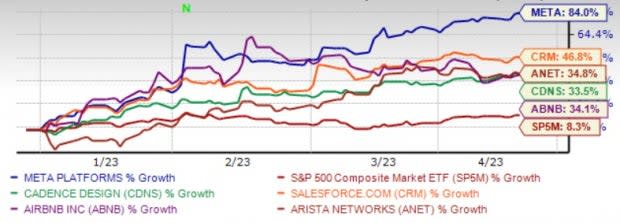

We have narrowed our search to five technology behemoths (market capital >$50 billion) that have rallied more than 30% year to date with solid upside left. These stocks have strong growth potential for the rest of 2023 and have seen positive earnings estimate revisions in the last 60 days. Finally, each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Meta Platforms Inc. META is benefiting from steady user growth across all regions, particularly Asia Pacific. Increased engagement for its products like Instagram, WhatsApp, Messenger and Facebook has been a major growth driver. META is considered to have pioneered the concept of social networking.

However, as developed regions mature, Meta Platforms has taken measures to drive penetration in emerging markets of South East Asia, Latin America and Africa. Of all places, India deserves a-special mention in terms of user growth. The world’s second-largest populated country offers tremendous potential for META. With China off the radar, India can prove to be a terrific growth engine for Meta.

Meta Platform has an expected revenue and earnings growth rate of 4.6% and 4.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last seven days. The stock price of META has soared 84.1% year to date.

salesforce.com inc. CRM is benefiting from a robust demand environment as customers are undergoing a major digital transformation. The rapid adoption of its cloud-based solutions is driving demand for CRM’s products. CRM’s sustained focus on introducing more aligned products as per customer needs is driving its top-line.

Continued deal wins in the international market are the other growth drivers. The acquisition of Slack would position salesforce.com as a leader in the enterprise team collaboration solution space and help it compete better with Microsoft’s Teams product. We expect CRM revenues to witness a CAGR of 12.5% during fiscal 2023-2025.

salesforce.com has an expected revenue and earnings growth rate of 10.4% and 35.7%, respectively, for the current year (January 2024). The Zacks Consensus Estimate for current-year earnings has improved 35.4% over the last 30 days. The stock price of CRM has surged 46.6% year to date.

Arista Networks Inc. ANET develops markets and sells cloud networking solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. ANET benefits from the expanding cloud networking market, driven by strong demand for scalable infrastructure. The company recently joined the Microsoft Intelligent Security Association.

Arista Networks continues to gain from solid momentum and diversification across its top verticals and product lines. It is well-poised for growth in the data-driven cloud networking business, with proactive platforms and predictive operations. ANET introduced an enterprise-grade Software-as-a-Service offering for its flagship CloudVision platform.

Arista Networks has an expected revenue and earnings growth rate of 24.8% and 27.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.4% over the last 60 days. The stock price of ANET has jumped 34.8% year to date.

Airbnb Inc. ABNB is riding on an improvement in the travel industry. Continued recovery in both longer-distance and cross-border travel owing to a reduction in travel restrictions is benefiting ABNB’s Nights & Experience bookings. Additionally, growth in average daily rates and gross booking value is a tailwind.

Growing active listings in Latin America, North America and EMEA are contributing well to the top line. Growing sales and marketing initiatives along with continuous efforts to upgrade various aspects of the Airbnb service are helping the company gain momentum among hosts and guests.

Airbnb has an expected revenue and earnings growth rate of 14.9% and 19.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 16.8% over the last 60 days. The stock price of ABNB has climbed 34.1% year to date.

Cadence Design Systems Inc. CDNS offers products and tools that help customers design electronic products. Through the System Design Enablement strategy, CDNS offers software, hardware, services and reusable IC design blocks to electronic systems and semiconductor customers.

Cadence’s performance is being driven by strength across segments like digital & signoff solutions and functional verification suite. CDNS is also gaining from higher investments in emerging trends like IoT and autonomous vehicle sub-systems along with strength in the semiconductor end-market. Frequent product launches are expected to help CDNS sustain top-line growth.

Cadence Design Systems has an expected revenue and earnings growth rate of 13.4% and 16.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.3% over the last 60 days. The stock price of CDNS has advanced 33.5% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance