5 Crypto-Centric Stocks to Buy as Bitcoin Reaches Key Milestone

On Feb 14, the largest cryptocurrency Bitcoin (BTC) reached a milestone to close the day with more than $1 trillion in market capital, for the first time since December 2021. In intraday trading, the digital currency rose to $52,079, marking its highest level since December 2021.

The cryptocurrency market started 2024 on a positive note after an impressive rally last year. The much-hyped reformation in the cryptocurrency space took place on Jan 10. The U.S. Securities and Exchange Commission (SEC) approved rule changes to allow the creation of spot bitcoin exchange-traded funds (ETFs). As many as 11 spot Bitcoin ETFs were launched last month.

After soaring 157% in 2023, Bitcoin has railed more than 20% year to date. Bitcoin continues to hold a lot of potential. The SEC’s latest decision is likely to turn out to be a landmark, positioning the entire crypto space as an integral component of mainstream finance. The game-changing decision of the SEC will allow individuals, money managers and other financial institutions to get exposure to the world’s largest cryptocurrency without having to own it.

Moreover, the next Bitcoin halving will occur in the first half of 2024. When a halving occurs, the reward for mining new blocks is halved, making it more challenging for miners to earn net Bitcoins. Historically, this event has led to increased scarcity and has driven up the value of Bitcoin due to reduced supply.

Our Top Picks

We have narrowed our search to five crypto-oriented stocks that have strong potential for 2024. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NVIDIA Corp. NVDA is a semiconductor industry giant and one of the biggest success stories of 2023. As a leading designer of graphic processing units (GPUs), the NVDA stock usually soars on a booming crypto market. This is because GPUs are pivotal to data centers, artificial intelligence, and the creation of crypto assets.

NVIDIA’s expected earnings growth rate for the current year is 63.1% (ending January 2025). The Zacks Consensus Estimate for its current-year earnings has improved 1.8% over the last 30 days.

CME Group Inc.’s CME options give the buyer of the call/put the right to buy/sell cryptocurrency futures contracts at a specific price at some future date. CME offers Bitcoin and ether options based on the exchange's cash-settled standard and micro-Bitcoin and Ethereum futures contracts.

CME Group has an expected earnings growth rate of 2.3% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last 60 days.

Interactive Brokers Group Inc. IBKR is a global automated electronic broker. IBKR executes, processes and trades in cryptocurrencies. IBKR’s commodities futures trading desk also offers customers a chance to trade cryptocurrency futures.

Interactive Brokers Group has an expected earnings growth rate of 5.6% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 60 days.

CleanSpark Inc. CLSK operates as a bitcoin miner in the Americas. CLSK owns and operates data centers that primarily run on low-carbon power. CLSK’s infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion.

CleanSpark has an expected earnings growth rate of 81.4% for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last seven days.

Iris Energy Ltd. IREN is a Bitcoin mining company. IREN builds, owns and operates data center infrastructure with a focus on entry into regions where it can access abundant and/or under-utilized renewable energy to power its operations.

IREN has an expected earnings growth rate of more than 100% for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days.

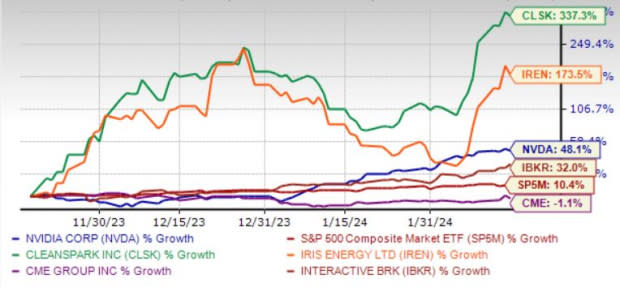

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Cleanspark, Inc. (CLSK) : Free Stock Analysis Report

Iris Energy Limited (IREN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance