5 affordable Aussie suburbs where property prices are set to skyrocket

House prices in Australia has been falling for 17 consecutive months and are set to drop another $60,000 by the end of the year – but not all hope is lost for property investors.

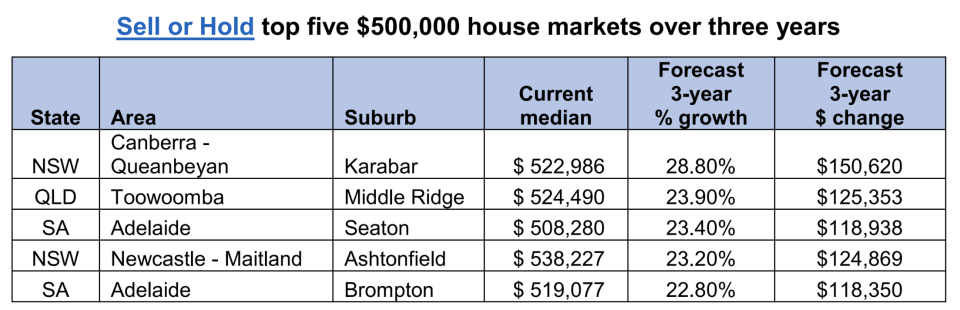

New analysis from Sell Or Hold has revealed the five Aussie suburbs with average house prices of about half a million dollars that are estimated to grow in value by up to $150,000 by 2022.

The suburbs are located in NSW, Queensland, and South Australia – but no Sydney suburb made the cut due to the $500,000 benchmark.

Queanbeyan is the city forecast for the highest growth of 28.8 per cent, or $150,620. While technically located in NSW, it’s just a 20-25 minute drive from Canberra, making suburbs within Queanbeyan such as Karabar attractive for public servants.

Related story: Here’s how long the Aussie property downturn will last

Related article: Australian property downturn is slowing but spreading

Related article: Aussie property prices to drop another $60,000 by the end of the year

Queensland’s Toowoomba claimed second spot on the list and was described by Sell Or Hold head of research Jeremy Sheppard as a “premier suburb”.

“[It’s] located in a region with a strong local economy as well as a number of large infrastructure projects, including the Toowoomba Wellcamp Airport, which was Australia’s first privately funded major airport,” he added.

Here are the five areas where property investors should be looking:

Sell Or Hold analysis also revealed the bottom five markets flagged to stagnate or dip over the next three years.

These areas are primarily located in Western Australia, the Northern Territory and Queensland.

Sheppard warned investors against holding onto properties that could lose value over time.

For example, Karabar in Queanbeyan is tipped to grow by $150,000 in three years, while a similarly-priced house in Darwin’s Rosebery will see a price drop of $3,150 over the same period.

“Comparing the pair shows that holding on to an under-performing asset could potentially cost an investor $153,000 in lost capital growth in a relatively short period of time,” Sheppard noted.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance