4 Stocks to Watch on Dividend Hikes Amid Inflation Worries

The year started on a high as markets bounced back from their 2022 lows. Despite a blockbuster January, all the major indexes ended in the red in February on concerns of inflation rising once again. The Dow finished 4.2% down in February, while the S&P 500 and the Nasdaq Composite lost 2.6% and 1.1%, respectively, for the month.

Strong economic data and hotter-than-expected inflation have once again raised fears that the Fed might continue with its tight monetary control and interest rate hike policy for a longer period than earlier expected.

Rate Hike Worries Grow Again

Although inflation somewhat eased at the end of 2022, solid economic data in January like retail sales, industrial production, ISM manufacturing index and nonfarm payroll have ignited fears that if the Fed continues with its high-interest rate hikes, it will raise aggregate demand and make inflation stubborn.

The Personal Consumption Expenditures (PCE) price index rose a sharp 0.6% in January, after increasing 0.2% in December. Year over year, the PCE index rose 5.4% in January. Core PCE, which excludes the volatile food and energy costs, also jumped 0.6% in January after rising 0.4% in December. On a year-over-year basis, the January PCE index increased 4.7%.

Also, the consumer price index (CPI) climbed 0.5% in January and 6.4% on a year-over-year basis. Analysts had expected a 0.4% monthly and a 6.2% year-over-year jump.

The core CPI, which excludes the volatile food and energy prices, increased 0.4% in January and 5.6% year over year.

Inflation, which had shown signs of easing at the end of last year had raised hopes of the Fed going slow on its rate-hike policy in 2023 and eventually. In fact, the Fed also hinted at a similar move by increasing interest rates by 25 basis points in December. Market participants too were of the opinion that the Fed would increase rates by 25 basis points by a maximum of three times.

However, several economists and financial professionals have begun to predict since the middle of February that the Fed will increase interest rates by 1% this year, with room for more increases if inflation stays sticky.

Given this situation, an astute investor would prefer to keep an eye on dividend-paying stocks right now. This is because dividend stocks with a proven track record and a solid business plan can weather market turbulence.

Also, in addition to ensuring a constant flow of profits, they reduce the chances of price swings. Also, during times of market turbulence, dividend-paying stocks have consistently outperformed non-dividend-paying companies. Four such companies are Valmont Industries, Inc. VMI, Comerica Incorporated CMA, RCI Hospitality Holdings, Inc. RICK and Steel Dynamics, Inc. STLD.

Valmont Industries, Inc. is primarily engaged in the production of fabricated metal products, metal and concrete pole and tower structures and mechanized irrigation systems in the United States and abroad. VMI has two operating segments — Infrastructure and Agriculture.

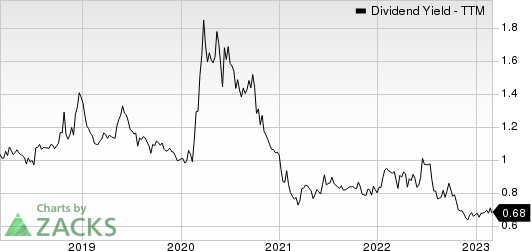

On Feb 28, Valmont Industries declared that its shareholders would receive a dividend of $0.60 a share on Apr 14, 2023. VMI has a dividend yield of 0.69%. Over the past five years, Valmont Industries has increased its dividend four times and its payout ratio at present sits at 16% of earnings. Check Valmont Industries’ dividend history here.

Valmont Industries, Inc. Dividend Yield (TTM)

Valmont Industries, Inc. dividend-yield-ttm | Valmont Industries, Inc. Quote

Comerica Incorporated is a banking and financial services company. CMA delivers financial services in three primary geographic markets — Texas, California and Michigan — as well as Arizona and Florida. Also, Comerica has operations in numerous other U.S. states as well as in Canada and Mexico.

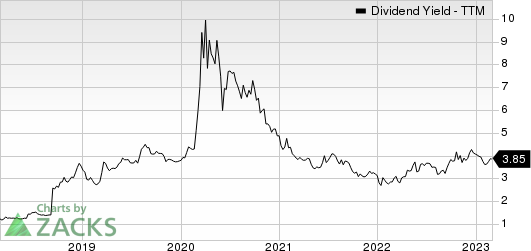

On Feb 28, Comerica Incorporated announced that its shareholders would receive a dividend of $0.71 a share on Apr 1, 2023. CMA has a dividend yield of 3.88%. Over the past five years, Comerica Incorporated has increased its dividend four times and its payout ratio currently sits at 32% of earnings. Check Comerica Incorporated’s dividend history here.

Comerica Incorporated Dividend Yield (TTM)

Comerica Incorporated dividend-yield-ttm | Comerica Incorporated Quote

RCI Hospitality Holdings, Inc. owns and operates adult nightclubs that offer live adult entertainment, restaurant and bar services. RICK operates adult nightclubs under the name Rick's Cabaret, Club Onyx, XTC Cabaret, Tootsie's Cabaret, Cabaret North, Jaguars and Cabaret East. RCI Hospitality Holdings also owns and operates adult Internet Websites. RCI Hospitality Holdings, Inc., formerly known as Rick's Cabaret International, Inc., is based in Houston, TX.

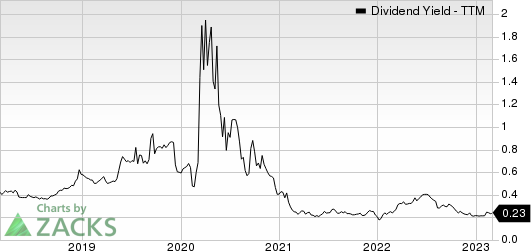

On Feb 28, RCI Hospitality Holdings declared that its shareholders would receive a dividend of $0.06 a share on Mar 29, 2023. RICK has a dividend yield of 0.24%. Over the past five years, RCI Hospitality Holdings has increased its dividend five times and its payout ratio at present sits at 4% of earnings. Check RCI Hospitality Holdings’ dividend history here.

RCI Hospitality Holdings, Inc. Dividend Yield (TTM)

RCI Hospitality Holdings, Inc. dividend-yield-ttm | RCI Hospitality Holdings, Inc. Quote

Steel Dynamics, Inc. is among the leading steel producers and metal recyclers in the United States. STLD currently has steelmaking and coating capacity of around 16 million tons. Steel Dynamics makes and markets steel products, processes and sells recycled ferrous and nonferrous metals, and fabricates and sells steel joist and decking products in the United States and internationally. STLD has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

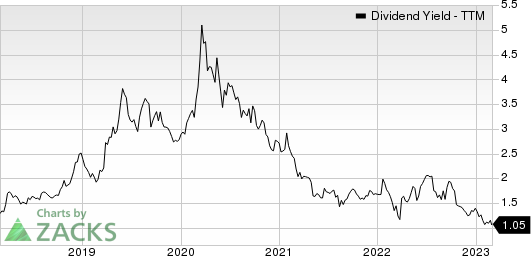

On Feb 27, Steel Dynamics announced that its shareholders would receive a dividend of $0.43 a share on Apr 14, 2023. STLD has a dividend yield of 1.08%. Over the past five years, Steel Dynamics has increased its dividend six times and its payout ratio presently sits at 6% of earnings. Check Steel Dynamics’ dividend history here.

Steel Dynamics, Inc. Dividend Yield (TTM)

Steel Dynamics, Inc. dividend-yield-ttm | Steel Dynamics, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

RCI Hospitality Holdings, Inc. (RICK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance