4 Metal Fabrication Stocks to Watch in a Promising Industry

The Zacks Metal Products - Procurement and Fabrication industry is poised well to gain from growth in end-use sectors, such as manufacturing, aerospace and automotive. Recent indications of easing supply-chain disruptions instill optimism.

Companies like Norsk Hydro ASA NHYDY, ESAB Corporation ESAB, Worthington Industries WOR and CIRCOR International CIR have witnessed order growth and delivered improved results despite the inflationary scenario and supply-chain woes. Solid end-market demand, efforts to gain market share and investment in automation should aid growth. Their focus on cost management and improving efficiency will boost margins.

Industry Description

The Zacks Metal Products - Procurement and Fabrication industry primarily comprises metal processing and fabrication services providers that transform metal into metal parts, machinery or components used across various other industries. Their processes include forging, stamping, bending, forming and machining, which are used in shaping individual pieces of metal, and welding and assembling to join parts. The companies either use one of these processes or a combination of all. The most common raw materials utilized by metal fabrication companies include plate metal, formed or expanded metal, tube stock, welding wire or rod and casting. The industry players serve an array of markets, including construction, mining, aerospace and defense, automotive, agriculture, oil and gas, electronics/electrical components, industrial equipment, and general consumer.

What's Shaping the Future of the Metal Products - Procurement and Fabrication Industry

Easing Supply-Chain Snarls to Bring Relief: Per the Fed’s latest industrial production report, the aggregate production of fabricated metal products in the United States dipped 0.9% in March 2023. Over the 12 months ended March 2023, production of fabricated metal products was down 1.3%. Overall, industrial production gained 0.5% over the same period. In December, the Institute for Supply Management’s manufacturing index touched 46.3%, contracting for the fifth month in a row. Nevertheless, the average for the 12 months ended December 2022 was 50.9%. Amid the ongoing uncertainty in the global economy and persisting inflationary trends, customers have been curbing spending. The industry has also been bearing the brunt of supply-chain issues. On a positive note, some of the industry players recently noted that supply-chain issues are easing. The delivery performance of suppliers to manufacturing organizations was reported to be faster for the sixth straight month in March. March’s reading of 44.8% indicates the fastest supplier delivery performance since March 2009, when the index registered 43.2%. Once the situation normalizes, strong demand in the metal Products - Procurement and Fabrication industry’s diverse end markets will drive its growth.

Pricing Actions to Combat High Costs: The industry has been experiencing significant levels of inflation, including higher prices for labor, freight and fuel. The companies are currently witnessing labor shortages for some positions and incurring steep labor costs to meet demand. The industry players are focusing on pricing actions, cost-cutting measures, efforts to improve productivity and efficiency, and diversification of the supplier base to mitigate some of these headwinds.

Automation & End-Market Growth to Act as a Catalyst: The industry’s customer-focused approach to providing cost-effective technical solutions and automation to increase efficiency and lowering labor costs, as well as the development of the latest and innovative products, should drive growth in the days ahead. Growth in the end-use sectors, such as manufacturing, aerospace and automotive, is anticipated to benefit the metal fabrication market over the next few years. Developing countries hold promise due to rapid industrialization. This, in turn, is likely to create demand.

Zacks Industry Rank Indicates Bright Prospects

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates upbeat prospects in the near term. The Zacks Metal Products - Procurement and Fabrication industry, which is a 10-stock group within the broader Industrial Products sector, currently carries a Zacks Industry Rank #13, which places it in the top 5% of the 251 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s look at the industry’s recent stock-market performance and the valuation picture.

Industry Versus Broader Market

The Zacks Metal Products - Procurement and Fabrication industry has outperformed its sector and the Zacks S&P 500 composite over the past year.

Over this period, the industry has gained 14.4% compared with the sector’s growth of 7.6% and the Zacks S&P 500 composite’s gain of 8.0%.

One-Year Price Performance

Industry's Current Valuation

Based on the trailing 12-month EV/EBITDA ratio, a commonly used multiple for valuing the Metal Products - Procurement and Fabrication companies, the industry is currently trading at 14.67 compared with the S&P 500’s 11.00 and the Industrial Products sector’s trailing 12-month EV/EBITDA of 14.52. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Over the last five years, the industry traded as high as 17.38 and as low as 5.01, with the median at 7.73.

4 Metal Products - Procurement and Fabrication Stocks to Keep Tabs on

CIRCOR International: In 2022, the company’s total order levels grew 12% organically, with Aerospace and Defense rising 24% and Industrial orders gaining 7%. This has been instrumental in the stock’s 43% price gain over the past six months. The company witnessed a strong backlog of $543 million at the end of 2022, which marked a 22% year-over-year increase, driven by strong demand in the Aerospace & Defense, and Industrial segments. This will support its top-line performance in the forthcoming quarters. New products for missile fusing devices and space applications, growth in medical products, and the sustained momentum in commercial aerospace, aided by the ongoing recovery in the market, bode well for the Aerospace & Defense segment. In the Industrial segment, higher pricing has helped the company counter inflationary pressures and deliver solid margin expansion. Power generation, midstream O&G, new business activities for lithium battery manufacturing, are expected to drive growth for the segment.

The Zacks Consensus Estimate for CIRCOR International earnings for 2023 has moved up 32% over the past 60 days. The company has a trailing four-quarter earnings surprise of 57.7%, on average. Burlington, MA-based CIRCOR is one of the world’s leading providers of mission-critical flow control products and services for the Industrial, and Aerospace & Defense markets. The company currently flaunts a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

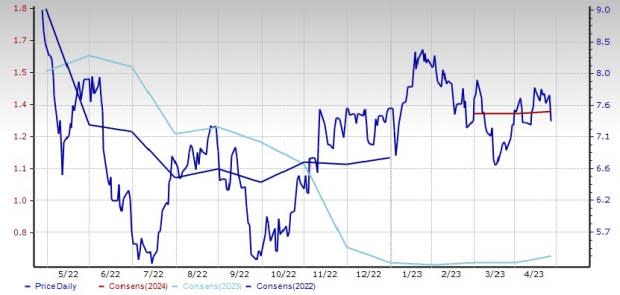

Price and Consensus: CIR

ESAB Corp: In 2022, the company furthered its M&A strategy with the buyouts of Ohio, Therapy Equipment and Swift-Cut acquisitions, strengthening its gas control and fabrication technology businesses. In 2022, the company was successfully launched as a public company. It continues its track of innovation and product introductions with the upcoming global launch of the game-changing Renegade VOLT battery-powered welder in partnership with DEWALT. This offering strengthens ESAB’s equipment portfolio and fills a key customer need for improved transportability and is expected to improve ESAB’s margins. The company is progressing toward its goal of creating a faster-growing, higher-margin and less-cyclical business. The company’s shares have surged 61% over the past six months.

North Bethesda, MD-based ESAB Corp engages in the formulation, development, manufacture, and supply of consumable products and equipment for use in cutting, joining, and automated welding, as well as gas-control equipment. The Zacks Consensus Estimate for ESAB’s current-year earnings has moved north by 3.4% over the past 60 days. The Zacks Ranked #1 stock has a trailing four-quarter earnings surprise of 11.8%.

Price and Consensus: ESAB

Worthington: In September 2022, the company announced that its board of directors approved a plan to pursue a separation of the company’s Steel Processing business, which is expected to be completed by early 2024. This plan, referred to as “Worthington 2024,” will result in two independent, publicly traded companies that are more specialized, and with enhanced prospects for growth and value creation. The healthy demand in its key end markets bodes well for the company. It is building on its capabilities in automation, analytics and advanced technologies, which, in turn, will help it stay ahead of the curve. Its proactive steps to cut costs and strong end-market demand will aid results. Focus on core businesses and efforts to grow in new markets will aid growth. The company’s shares have gained 32% over the past six months.

The Zacks Consensus Estimate for Worthington’s current-year earnings has moved up 19% over the past 60 days. The company has a trailing four-quarter earnings surprise of 27.3%, on average. WOR currently flaunts a Zacks Rank #1.

Price and Consensus: WOR

Norsk Hydro: The company delivered record results in 2022, with adjusted EBITDA improving 42% year over year, driven by higher realized all-in metal and alumina prices, as well as record results in both Extrusions and Energy. Shares of NHYDY have gained 19% over the past six months. The company has been adjusting capacity to meet market demand, and continues to focus on reducing costs and improving operational excellence, which will help drive margins. It has been making progress on the Hydro 2025 strategy, both strengthening its position in low-carbon aluminum and growing in the new energy areas. Greener aluminum, with a lower carbon footprint, is a key lever for the green transition. Hydro announced a strategic partnership with Mercedes-Benz in the fourth quarter of 2022. In 2023, Hydro will deliver REDUXA 3.0 to a range of Mercedes-Benz models, ultimately reducing the material carbon footprint. Recently, Hydro, became the first aluminum producer in the world to deliver aluminum made with a near-zero carbon footprint to a building project in Europe. The company recently acquired a 12% stake in Lithium de France, marking a strategic expansion in sustainable battery materials for Hydro Batteries.

Headquartered in Oslo, Norway, NHYDY engages in power production, bauxite extraction, alumina refining, aluminum smelting, remelting, and recycling activities, and the provision of extruded solutions worldwide. The Zacks Consensus Estimate for Norsk Hydro’s current-year earnings has moved 4.4% north over the past 60 days. The company has a trailing four-quarter earnings surprise of 41.3%, on average. NHYDY has an estimated long-term earnings growth rate of 12.8% and a Zacks Rank #2 (Buy), currently.

Price and Consensus: NHYDY

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Norsk Hydro ASA (NHYDY) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

CIRCOR International, Inc. (CIR) : Free Stock Analysis Report

ESAB Corporation (ESAB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance