4 Media Stocks Set to Beat Estimates This Earnings Season

Media companies’ third-quarter results are likely to reflect the negative impacts from persistent cord-cutting, lack of spending on political advertising in the United States, and stiff competition from SVOD and vMVPD services.

These factors significantly affected Comcast CMCSA and Charter Communications CHTR as they continued to lose voice and video subscribers.

While Comcast lost 224K video customers and 65K voice customers in the third quarter of 2019, Charter lost 75K video customers.

Moreover, Netflix’s NFLX third-quarter results reflected intensifying competition in the streaming space. The company missed its subscriber addition target for the second consecutive quarter primarily due to the price hike it announced in January.

Furthermore, the bottom line of industry participants is expected to reflect the impact of increasing programming costs and retransmission fees.

Industry Trends to Drive Growth

Nevertheless, media companies are expected to gain from several favorable industry trends. The industry is witnessing rapid evolution in alternative distribution channels for broadcast and cable programming.

Growing preference for digital and subscription services over linear pay television and rental or outright purchase has compelled media companies to alter their business models.

Additionally, the growing demand for high-speed Internet is expected to have benefited the top line of industry participants. Improving Internet speed is driving demand for high-quality video and the trend of binge viewing.

Furthermore, media companies are investing heavily in developing original and fresh content to remain competitive. Additionally, increasing availability of a variety of alternative packages at a lower cost than traditional offerings is expected to have aided subscriber growth.

How to Make the Right Pick?

With the existence of a number of industry players, finding the media stocks that have the potential to beat earnings estimates can be daunting. Our proprietary methodology, however, makes it fairly simple.

You could narrow down the list of choices by looking at stocks that have the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP is our proprietary methodology for determining stocks, which have the best chances to surprise with their next earnings announcement. It is the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

Our research shows that for stocks with this combination, the chance of a positive earnings surprise is as high as 70%.

Our Choices

Given below are four media stocks that have the right combination of elements to post an earnings beat this reporting cycle:

Englewood, CO-based Liberty Broadband LBRDK has an Earnings ESP of +5.75% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is set to report third-quarter 2019 results on Nov 11. The consensus mark for earnings has increased 12.8% to 44 cents over the past 30 days.

Liberty Broadband Corporation Price and EPS Surprise

Liberty Broadband Corporation price-eps-surprise | Liberty Broadband Corporation Quote

Phoenix, AZ-based Cable One CABO is set to report third-quarter 2019 results on Nov 7. The company has an Earnings ESP of +4.35% and a Zacks Rank #3.

The Zacks Consensus Estimate for earnings has increased by a penny to $8.25 over the past 30 days.

Cable One, Inc. Price and EPS Surprise

Cable One, Inc. price-eps-surprise | Cable One, Inc. Quote

New York-based Fox Corporation FOXA has a Zacks Rank #3 and an Earnings ESP of +2.97%. The company is scheduled to report first-quarter fiscal 2019 results on Nov 6.

The consensus mark for earnings has increased a penny to 70 cents over the past 30 days.

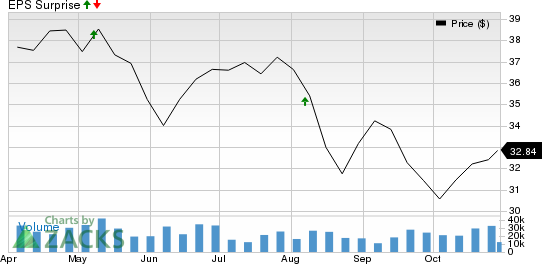

Fox Corporation Price and EPS Surprise

Fox Corporation price-eps-surprise | Fox Corporation Quote

Another New York-based company, Viacom VIAB, has a Zacks Rank #3 and an Earnings ESP of +0.22%.

The company is scheduled to report fourth-quarter fiscal 2019 results on Nov 14. The consensus mark for earnings has stayed at 76 cents over the past 30 days.

Viacom Inc. Price and EPS Surprise

Viacom Inc. price-eps-surprise | Viacom Inc. Quote

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Viacom Inc. (VIAB) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Cable One, Inc. (CABO) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Liberty Broadband Corporation (LBRDK) : Free Stock Analysis Report

Charter Communications, Inc. (CHTR) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance