4 Gold Stocks to Watch as Gold ETFs Return to Inflows in May

After three straight months of net outflows, gold exchange-traded funds (ETFs) witnessed net monthly inflows in May and were at the highest levels since September 2020. This improvement can be attributed to ongoing inflation concerns, a weaker dollar and lower real yields, which made investors return to gold-backed ETFs.

Per the latest report by the World Gold Council, gold ETFs saw inflows of 61.3 tons or $3.4 billion in May. This was the highest since the September 2020 inflows of 68.1 tons or $4.6 billion. Globally, gold-backed ETF assets under management stood at 3,628 tons ($222 billion) — falling 7% behind the October 2020 high of 3,908 tons.

Larger funds in the United States, the U.K. and Germany were primarily instrumental in driving the net inflows during May. North American funds boosted holdings by 34.5 tons or $2.1 billion and European-listed funds added 31.2 tons (equivalent to $1.6 billion). However, Asian-listed fund witnessed net outflows of 3.3 tons ($210 million) and funds listed in other regions lost 1.0 tons or $69 million.

It is worth mentioning that despite the outflows in May, Asia has added 13.8 tons in the first five months of the year, or 11.4% to holdings — making it the strongest region in terms of percentage growth this year.

Gold Prices Gain, Recoups Q1 Loss

Gold has rallied 11% rally in April and May, ending above $1,900 per ounce driven by persistent apprehensions over inflation, a weaker dollar and lower real rates. Increased central bank demand, and holiday and wedding related purchases in China also supported consumer demand. With this performance, gold seems to have erased its 11% loss in the first quarter due to vaccine rollouts and optimism over economic recovery.

Demand in India has taken a beating lately as several states went into lockdowns due to the second wave of COVID-19. As the vaccination drive gathers steam and daily cases drop, lockdowns will eventually be lifted and gold demand will pick up in the country. Historically gold demand in India has been high in the later part of the year thanks to the wedding and festive seasons as buying the yellow metal is considered auspicious. India and China (that roughly account for around 50% of consumer gold demand) will continue to sustain demand for the yellow metal. Also, central banks worldwide are anticipated to increase their gold reserves in the next 12 months. Fears over inflation, continue to cast a pall over markets and should support gold prices in the near term.

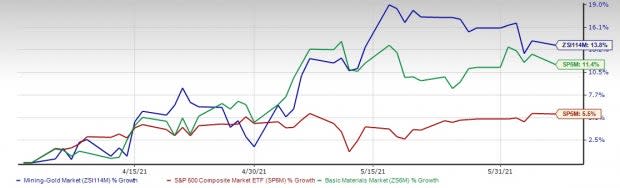

Image Source: Zacks Investment Research

The Zacks Gold Mining industry has rallied 13.8% in the past two months, outperforming the S&P 500’s growth of 5.5%. The industry falls under the broader Basic Materials sector, which gained 11.4%.

Using the Zacks Screener we have picked four gold stocks, which have a Zacks Rank #3 (Hold) and a VGM Score of A. Our research shows that stocks with a Zacks Rank #1 (Strong Buy), or 2 (Buy) or 3, when combined with a VGM Score of A or B, offer solid investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

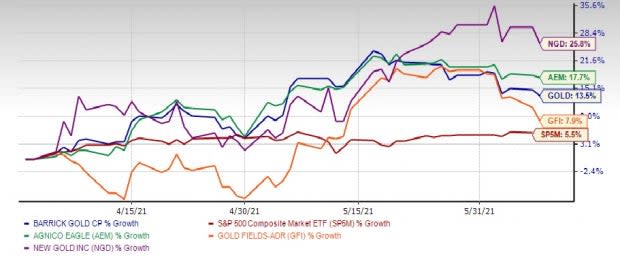

These stocks have also outperformed the S&P 500, year to date, which has been depicted in the chart below.

Image Source: Zacks Investment Research

Barrick Gold Corp GOLD: Headquartered in Toronto, Canada, Barrick Gold engages in the exploration, mine development, production, and sale of gold and copper properties.

Its strong liquidity position and healthy cash flows position it well to take advantage of attractive development, exploration and acquisition opportunities. The company is expected to gain from progress of its key growth projects that are likely to contribute to its production. Barrick Gold should gain from its merger with Randgold, which formed an industry-leading gold company and fortified its position among senior gold peers. Further, it recently announced an agreement with the Papua New Guinea government to restart the Porgera gold mine. Porgera churned out about 600,000 ounces of gold in 2019 before being put on care and maintenance.

The company has a long-term estimated earnings growth rate of 2%. The Zacks Consensus Estimate for the company’s fiscal 2021 earnings suggests year-over-year growth of 2.6%. The estimate has moved north 2.7% over the past 30 days. The company has a trailing four-quarter earnings surprise of 18.4%, on average. The stock has gained 13.5% in the past two months.

Agnico Eagle Mines AEM: Headquartered in Toronto, Canada, Agnico Eagle Mines engages in exploration, development, and production of mineral properties in Canada, Sweden, and Finland.

The company has increased its exploration budget and is reinvesting in assets to expand output. It is expected to gain from the Kittila mine in Finland — the largest primary gold producer in Europe. The Kittila expansion is expected to enhance mine efficiency and lower current operating costs. Further, it is anticipated to gain from the Hope Bay acquisition and the Hammond Reef project. Agnico Eagle Mines also has access to Meliadine and Canadian Malartic, major contributors to its quarterly production. Moreover, it is committed to boosting shareholder's return, while maintaining healthy cash flows and lowering debt levels.

The Zacks Consensus Estimate for fiscal 2021 earnings indicates year-over-year improvement of 40.3%. The estimate has moved up 1% over the past 30 days. Shares of the company have gained 17.7% over the past two months. The company has long-term estimated earnings growth rate of 1%. The company has a trailing four-quarter earnings surprise of 10.1%, on average.

Gold Fields Limited GFI: Based in Sandton, South Africa, Gold Fields operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Australia, and Peru.

The Gruyere mine hit its targets in 2020 and is expected to deliver a 9% increase in production in 2021. The Damang mine is anticipated to have a good couple years ahead. The South Deep mine is projected to record a strong increase this year and the company expects to increase production by 20-30% over the next three to four years. The Salares Norte project remains on schedule and production is expected in first-quarter of 2023. At Tarkwa, the company’s exploration activities are starting to yield results and future prospects look alluring. Backed by its strong cash generation, the company continues to lower its debt levels, which is commendable.

The Zacks Consensus Estimate for the company’s current year earnings has moved up 2% over the past 30 days and indicates year-over-year growth of 14%. The company has an estimated long-term earnings growth of 17.6%. Shares of the company have gained 7.9% over the past two months.

New Gold Inc. NGD: Headquartered in Toronto, Canada, New Gold is an intermediate gold mining company, which engages in development and operation of mineral properties.

New Gold will benefit from higher production levels at Rainy River Mine, at lower costs, as deferred capital projects have been completed and the mine transitions to generating free cash flow. The New Afton mine continues to ramp- up production. Moreover, the company remains committed to operational and cost optimizations at both Rainy River and New Afton, launching B3 production, advancing C-Zone development at New Afton, and following up on key targets from the exploration drilling programs.

The company has a long-term estimated earnings growth rate of 5%. The Zacks Consensus Estimate for the company’s fiscal 2021 earnings indicates year-over-year growth of 542%. The estimate has moved north 7.8% over the past 30 days. The company has a trailing four-quarter earnings surprise of 50%, on average. Shares of the company have gained 25.8% over the past two months.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

New Gold Inc. (NGD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance