4 Business Services Stocks Set to Top Q4 Earnings Estimates

The Zacks Business Services sector is one of the nine (out of the total 16) Zacks sectors expected to register earnings growth in fourth-quarter 2019, per the latest Earnings Outlook report. The sector is anticipated to record earnings growth of 15.1% on 12.2% higher revenues in the current reporting cycle.

The sector has performed well compared with the benchmark index over the past year. It has gained 26.7% compared with the Zacks S&P 500 composite’s rise of 25.5% in the said time frame. It currently carries a Zacks Sector Rank in the top 38% (6 out of 16 sectors).

Factors Driving the Sector’s Q4 Results

The sector is expected to have benefited from economic strength and stability, and robust service activities in the fourth quarter. It remained buoyed by a strong labor market, soaring job growth, low unemployment and inflation.

Notably, U.S. GDP grew at an annualized rate of 2.1% in fourth-quarter 2019, in line with the growth in the third quarter, per estimates released by the Bureau of Economic Analysis.

Further, January was the 120th month of consecutive growth in non-manufacturing activities with ISM-measured Non-Manufacturing Index, touching 55.5%. Notably, a reading above 50 indicates growth.

Further, the sector remained less affected by severe trade tensions in the quarter as business services firms have lower foreign exposure compared with goods companies and incur lower foreign input costs.

Zeroing in on Winners

Earnings ESP is our proprietary methodology for determining the stocks that have the best chance to deliver a positive earnings surprise in their next earnings announcement. Earnings ESP shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. The selection can be done with the help of the Zacks Stock Screener. Our research shows that for stocks with this combination, the chance of a positive earnings surprise is as high as 70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

4 Business Services Stocks That Match the Criteria

Waste management company Advanced Disposal Services, Inc. ADSW has an Earnings ESP of +35.85% and a Zacks Rank #2. The company is slated to release fourth-quarter 2019 results on Feb 20. You can see the complete list of today’s Zacks #1 Rank stocks here.

Advanced Disposal Services Inc. Price and EPS Surprise

Advanced Disposal Services Inc. price-eps-surprise | Advanced Disposal Services Inc. Quote

Waste management, comprehensive waste, and environmental services company Waste Management WM has an Earnings ESP of +2.90% and carries a Zacks Rank #2. The company is scheduled to release fourth-quarter 2019 results on Feb 13.

Waste Management, Inc. Price and EPS Surprise

Waste Management, Inc. price-eps-surprise | Waste Management, Inc. Quote

Non-hazardous solid waste collection, transfer, recycling, disposal, and energy services provider company Republic Services, Inc. RSG has an Earnings ESP of +2.96% and carries a Zacks Rank #2. The company is scheduled to release fourth-quarter 2019 results on Feb 13.

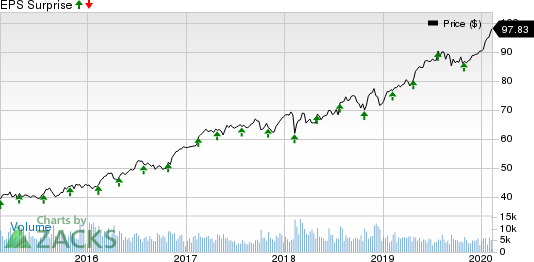

Republic Services, Inc. Price and EPS Surprise

Republic Services, Inc. price-eps-surprise | Republic Services, Inc. Quote

Financial services and technology company Fidelity National Information Services FIS has an Earnings ESP of +0.30% and carries a Zacks Rank #3. The company will release fourth-quarter 2019 results on Feb 13.

Fidelity National Information Services, Inc. Price and EPS Surprise

Fidelity National Information Services, Inc. price-eps-surprise | Fidelity National Information Services, Inc. Quote

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Advanced Disposal Services Inc. (ADSW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance