3M Completes Divestiture of Ballistic Protection Business

3M Company MMM has announced, on Jan 2, that it completed the divestiture of its advanced-ballistic protection business in a $91-million transaction. The other party to the transaction was Avon Rubber p.l.c.

The aforementioned transaction was initially announced in August 2019. Notably, 3M’s shares have gained 2.03% yesterday, ending the trading session at $180.

Avon Rubber is primarily engaged in providing respiratory protection systems that include electronics, advanced chemical, nuclear and radiological systems. Prime end markets served are fire, military and law enforcement. This company is headquartered in the U.K.

Discussion on Divestment

3M’s advanced-ballistic protection business (with annual sales of $85 million) formerly was under the Advanced Materials Division, which is part of the company’s Transportation & Electronics segment.

Before discussing further, we would like to mention that the Advanced Materials Division of 3M specializes in providing glass bubbles, fluoropolymers and various highly engineered materials.

As part of the transaction, 3M sold its flat armor, body armor, ballistic helmets and various helmet-attachment products. These products are mainly used by law enforcement and government customers. Also, advanced-ballistic protection business’ 280 employees will now work for Avon Rubber.

The transaction will enable 3M to concentrate on more relevant businesses. Earnings impact of the advanced-ballistic protection business divestiture will be neutral.

Inorganic Activities of 3M

The company's value model comprises four priorities — Portfolio, Innovation, Transformation as well as People and Culture. With respect to its Portfolio priority, 3M divested its communication markets business in 2018 and acquired the technology business of M*Modal in February 2019. Also, the company sold its gas and flame detection business to Teledyne Technologies Incorporated TDY in August 2019. In October 2019, 3M completed the acquisition of Acelity Inc and its KCI subsidiaries.

In the third quarter of 2019, acquired assets and divestments had a net positive impact of 0.6% on sales. The company expects acquisitions (net of impact from divested assets) to boost sales by 1% in 2019.

Zacks Rank, Estimates and Price Performance

With a market capitalization of nearly $101.5 billion, 3M currently carries a Zacks Rank #3 (Hold).

The company is well positioned to benefit from solid product portfolio, restructuring actions, acquired assets and shareholder-friendly policies. However, it faces headwinds from soft China end markets as well as weakness in electronics and automotive markets. Also, forex woes, high debts and restructuring charges are other headwinds.

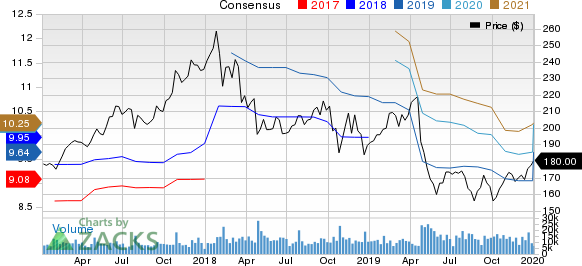

In the past 60 days, earnings estimates for 3M have moved down. The Zacks Consensus Estimate for its earnings is pegged at $9.05 for 2019 (results pending) and $9.64 for 2020, suggesting decline of 0.4% and 0.2% from the respective 60-day-ago figures.

3M Company Price and Consensus

3M Company price-consensus-chart | 3M Company Quote

In the past three months, the company’s shares have increased 15.5% compared with the industry’s growth of 12.9%.

Stocks That Warrant a Look

Two better-ranked stocks in the industry are Honeywell International Inc HON and ITT Inc ITT. Both the stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, bottom-line estimates for Honeywell remained stable for the current year. The same for ITT improved. Further, earnings surprise for the last reported quarter was 3.48% for Honeywell and 7.78% for ITT.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance