3 US Growth Companies With High Insider Ownership And A Minimum 21% Earnings Growth

As the S&P 500 approaches its 30th record high of the year, reflecting a mix of optimism and strategic caution among investors, the U.S. market landscape continues to evolve with significant movements in tech and shifts in interest rates. In this context, growth companies with high insider ownership can be particularly compelling, as they often indicate confidence from those who know the company best amidst changing economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.6% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

We'll examine a selection from our screener results.

GigaCloud Technology

Simply Wall St Growth Rating: ★★★★★★

Overview: GigaCloud Technology Inc. operates as a provider of end-to-end B2B ecommerce solutions for large parcel merchandise, both in the United States and internationally, with a market capitalization of approximately $1.28 billion.

Operations: The company generates revenue primarily through its online retail segment, totaling approximately $827.11 million.

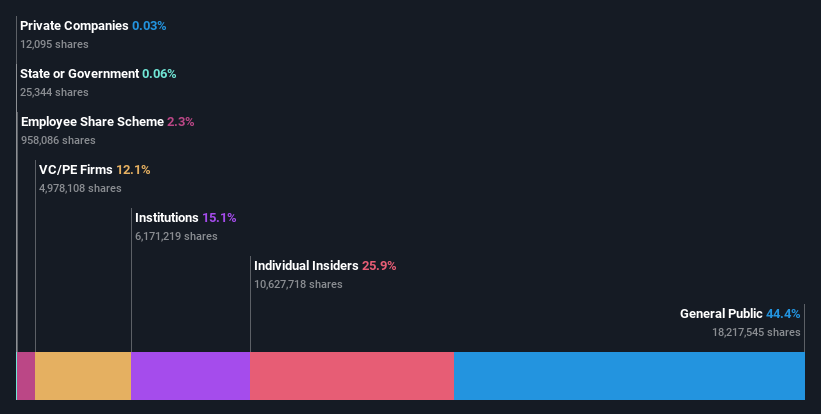

Insider Ownership: 25.9%

Earnings Growth Forecast: 21.3% p.a.

GigaCloud Technology has demonstrated robust growth with its first quarter revenue doubling year-over-year to US$251.08 million and net income increasing to US$27.2 million. The company anticipates further growth, projecting Q2 revenues between US$265 million and US$280 million. Expansion efforts include a significant increase in global fulfillment capabilities, now exceeding 10 million square feet, supporting its B2B marketplace. Despite high volatility in share price, insider activities show more buying than selling recently, underscoring confidence from those closest to the company.

Unlock comprehensive insights into our analysis of GigaCloud Technology stock in this growth report.

Fiverr International

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace for freelance services, with a market capitalization of approximately $878.54 million.

Operations: The company's primary revenue of $366.94 million is generated from its internet software and services segment.

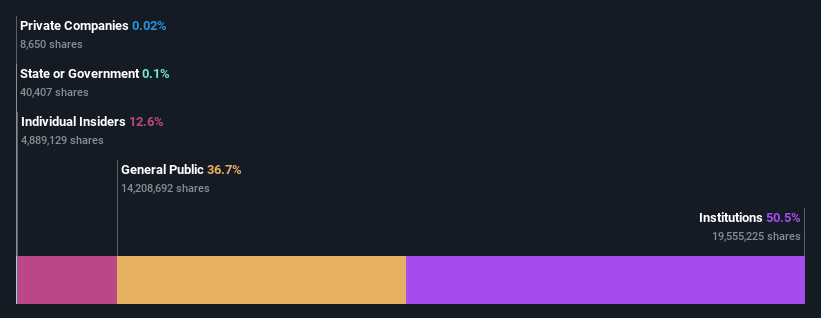

Insider Ownership: 12.6%

Earnings Growth Forecast: 53.7% p.a.

Fiverr International has recently transitioned to profitability, reporting a net income of US$0.788 million for Q1 2024, contrasting sharply with a loss in the previous year. The company forecasts revenue growth of 5%-7% year-over-year for both the upcoming quarter and the full fiscal year, indicating steady progress. Despite shareholder dilution last year, Fiverr's earnings are expected to surge by 53.68% annually over the next three years, significantly outpacing market averages. Additionally, a new US$100 million share buyback program reflects strong confidence from management in its financial health and future prospects.

ZKH Group

Simply Wall St Growth Rating: ★★★★★★

Overview: ZKH Group Limited operates a trading and service platform in China, providing a range of products from spare parts to office supplies, with a market capitalization of approximately $642.67 million.

Operations: The company generates CN¥8.64 billion primarily through its business-to-business trading and services of industrial products.

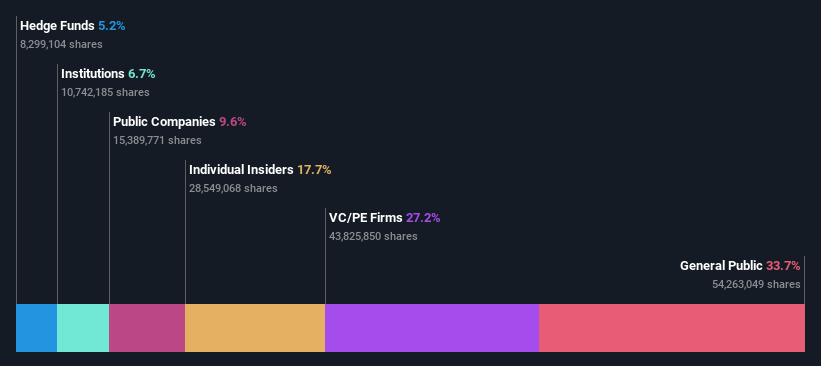

Insider Ownership: 17.7%

Earnings Growth Forecast: 104% p.a.

ZKH Group, despite its recent financial challenges, is showing promising signs of growth with an expected revenue increase of 21.8% per year and a forecast to become profitable within three years. The company's recent US$50 million share repurchase program underscores management's confidence in its financial trajectory. However, the resignation of a board director and fluctuating quarterly results indicate some operational uncertainties. ZKH's strategic focus on profitability and market outperformance highlights its potential as a growth-oriented company with significant insider commitment.

Click here and access our complete growth analysis report to understand the dynamics of ZKH Group.

Upon reviewing our latest valuation report, ZKH Group's share price might be too pessimistic.

Seize The Opportunity

Unlock our comprehensive list of 181 Fast Growing US Companies With High Insider Ownership by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:GCT NYSE:FVRR and NYSE:ZKH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance