3 UK Stocks Estimated To Be Trading At Up To 41.4% Discount

The UK stock market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China and falling commodity prices impacting key sectors. Despite these headwinds, there are opportunities for discerning investors to find undervalued stocks that may be trading at significant discounts. Identifying such stocks requires careful analysis of their fundamentals and potential for recovery in the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Integrated Diagnostics Holdings (LSE:IDHC) | US$0.368 | US$0.73 | 49.7% |

GlobalData (AIM:DATA) | £2.09 | £4.10 | 49.1% |

Topps Tiles (LSE:TPT) | £0.47 | £0.91 | 48.4% |

AstraZeneca (LSE:AZN) | £127.12 | £246.96 | 48.5% |

Mercia Asset Management (AIM:MERC) | £0.353 | £0.69 | 48.6% |

Redcentric (AIM:RCN) | £1.29 | £2.46 | 47.6% |

Ricardo (LSE:RCDO) | £5.16 | £10.19 | 49.4% |

Velocity Composites (AIM:VEL) | £0.43 | £0.83 | 48.2% |

Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

Foxtons Group (LSE:FOXT) | £0.63 | £1.22 | 48.2% |

Let's dive into some prime choices out of the screener.

JD Sports Fashion

Overview: JD Sports Fashion Plc is a retailer of branded sports fashion and outdoor clothing, footwear, accessories, and equipment for all ages across the UK, Ireland, Europe, North America, and internationally with a market cap of £7.04 billion.

Operations: The company's revenue segments include £9.98 billion from Sports Fashion and £559.90 million from Outdoor products.

Estimated Discount To Fair Value: 41.4%

JD Sports Fashion is trading at £1.36, significantly below its estimated fair value of £2.32, indicating it may be undervalued based on cash flows. Despite recent guidance suggesting revenue will be in the lower half of the expected range for 2024 due to currency headwinds, JD's earnings are forecast to grow at 15.87% per year, outpacing the UK market average. The company also boasts a high return on equity forecast of 23.2% in three years’ time.

Smith & Nephew

Overview: Smith & Nephew plc, with a market cap of £10.54 billion, develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally.

Operations: The company's revenue segments include Orthopaedics ($2.26 billion), Sports Medicine & ENT ($1.77 billion), and Advanced Wound Management (AWM) ($1.61 billion).

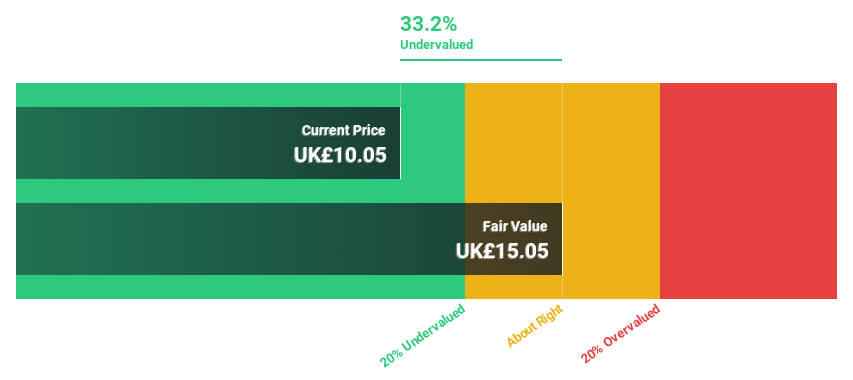

Estimated Discount To Fair Value: 33.9%

Smith & Nephew is trading at £12.09, well below its estimated fair value of £18.29, highlighting its potential undervaluation based on cash flows. Despite a high level of debt and a dividend not fully covered by earnings or free cash flows, the company’s earnings are forecast to grow significantly at 22.68% per year over the next three years. Recent strategic partnerships and product approvals further bolster its growth prospects in structurally growing markets.

W.A.G payment solutions

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform for the commercial road transportation industry primarily in Europe, with a market cap of £554.34 million.

Operations: The company's revenue segments include Payment Solutions, generating €2.10 billion, and Mobility Solutions, contributing €124.13 million.

Estimated Discount To Fair Value: 14.4%

W.A.G payment solutions is trading at £0.80, below its estimated fair value of £0.94, indicating it may be undervalued based on cash flows. The company’s revenue is forecast to grow 8.9% annually, outpacing the UK market's 3.7%. Despite recent earnings showing a decline in net income to EUR 2.43 million from EUR 5.25 million a year ago, analysts expect the stock price to rise by nearly 49%.

Make It Happen

Unlock our comprehensive list of 58 Undervalued UK Stocks Based On Cash Flows by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:JD. LSE:SN. and LSE:WPS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance