3 Top Stocks to Buy From a Prospering Electronics Industry

The Zacks Electronics - Semiconductors industry is benefiting from the solid adoption of laptops, notebooks, office equipment and network peripherals worldwide. The growing proliferation of AI, Machine Learning (ML) and industrial revolution 4.0 (which focuses on interconnectivity and automation) has turned out to be a boon for industry players like Broadcom AVGO, Infineon Technologies IFNNY and Lattice Semiconductor LSCC. The growing demand for high-volume consumer electronic devices, including digital media players, smartphones, tablets, efficient packaging, machine vision solutions and robotics, should continue to drive the industry’s growth.

However, widening supply-chain challenges, end-market volatility, inflationary pressures and growing geo-political tensions are persistent concerns for the underlined industry.

Industry Description

The Zacks Electronics – Semiconductors industry comprises companies that provide a wide range of semiconductor technologies. Their offerings include packaging and test services, wafer cleaning, factory automation, face detection and image-recognition capabilities to develop smart and connected products. The industry participants primarily cater to end-markets constituting consumer electronics, communications, computing, industrial and automotive. The companies are increasing their spending on research and development to stay afloat in an era of technological advancements and changing industry standards. The underlined industry is experiencing solid demand for advanced electronic equipment, which is helping its participants increase their investments in cost-effective process technologies.

What's Shaping the Future of the Electronics - Semiconductors Industry?

5G Prospects Are Key Catalysts: The growing deployment of 5G will expose industry players to near-term prospects. An uptick in demand for 5G test solutions required for 5G deployment is another major positive. The growing number of high-speed data centers worldwide, which require ultra-fast internet that 5G promises to deliver, is another tailwind. Increased connectivity and use of technology in consumer electronics through IoT, AI, robotics, AR/VR and others further set the momentum for 5G. Given the upbeat scenario, the industry is anticipated to remain on a growth trajectory, backed by efforts to strengthen 5G infrastructure.

Smart Devices Aiding Computing Demand: Smart devices need computing and learning capabilities to perform functions like face detection, image recognition and video analytics capabilities. These require high levels of processing power, speed and memory and low power consumption as well as better graphic processors and solutions, which bode well for the industry. Graphic solutions help increase the speed of rendering images and improve image resolution and color definition.

Prospects Around Advanced Packaging Robust: The increasing demand for miniaturization, greater functionality, lower power consumption and improved thermal and electrical performance are driving the demand for semiconductor packaging and test technologies. The growing requirement for advanced packaging is gaining traction in the semiconductor industry, which is a key catalyst for the industry participants.

Supply-Chain Disruptions Remain Worrisome: The industry players are reeling under the impacts of the coronavirus-induced macroeconomic woes. Supply chains were disrupted by the pandemic-led shelter-in-place measures and lockdowns, which affected industry participants. Production delays and underutilization of manufacturing capacities are a major concern. The pandemic aggravated the concerns related to the economic downturn, persistently hurting the industry players’ spending patterns and new bookings.

Zacks Industry Rank Indicates Impressive Prospects

The Zacks Electronics - Semiconductors industry is housed within the broader Zacks Computer and Technology sector. It currently carries a Zacks Industry Rank #113, which places it in the top 45% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s look at the industry’s recent stock-market performance and valuation picture.

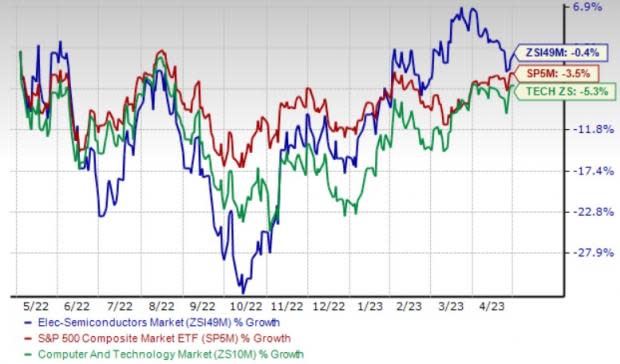

Industry Outperforms S&P 500 & Sector

The Zacks Electronics - Semiconductors industry has outperformed the Zacks S&P 500 composite and surpassed the broader Zacks Computer and Technology sector in the past year.

The companies in the industry have collectively lost 0.4% against the S&P 500 and the broader sector’s decline of 3.5% and 5.3%, respectively.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings ratio, which is a commonly-used multiple for valuing electronics semiconductors stocks, the industry is currently trading at 18.63X versus the S&P 500 and the sector’s 18.49X and 22.86X, respectively.

Over the past five years, the industry has traded as high as 44.45X, as low as 5.58X and recorded a median of 15.24X, as the charts below show.

Price/Earnings Ratio (F12M)

3 Electronics Semiconductor Stocks to Buy

Infineon Technologies: The Munich, Germany-based company is gaining from strength in product and application areas, especially microcontrollers, which are benefiting the Automotive segment. Growing prospects in ADAS and electromobiity are other tailwinds. Industrial drives, and strength in renewable energy, energy infrastructure and transport, along with solid momentum in decarbonization and automation, are aiding its Industrial Power Control segment.

The Zacks Rank #1 (Strong Buy) company is riding on momentum across enterprise power solutions and automotive charging. Rising solar installations by residential customers, and strong demand in the area of servers, industrial applications and silicon microphones are aiding its Power & Sensor Systems segment. Solid demand in the industrial IoT and smart buildings space is another positive for its Connected Secure Systems segment.

You can see the complete list of today’s Zacks #1 Rank stocks here.

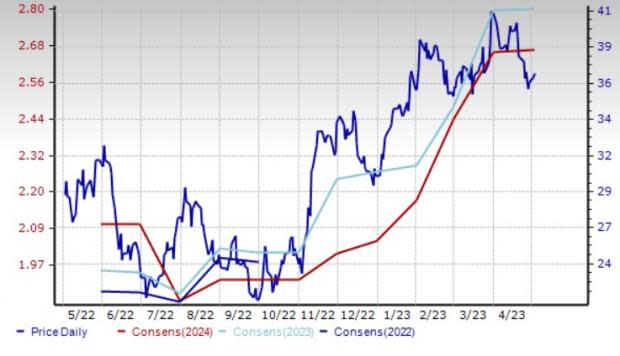

Infineon Technologies has gained 23.8% in the past year. The Zacks Consensus Estimate for the company’s fiscal 2023 earnings has moved 14.7% north to $2.80 per share over the past 60 days.

Price and Consensus: IFNNY

Broadcom: The San Jose, CA-headquartered designer, developer and global supplier of a broad range of semiconductor devices is gaining on the continued strength across both Semiconductor solutions and Infrastructure software verticals. The robust adoption of next-generation PON, with Wi-Fi 6 and 6C access gateways, is a major positive. An acceleration in 5G deployment, production ramp-up and an increase in radio frequency content favor prospects.

This Zacks Rank #2 (Buy) company is well-positioned to capitalize on the increased spending by telecommunication companies in modernizing infrastructure and enhancing Edge and core networks, as well as higher cloud spending by data centers. The solid demand for broadband, networking and wireless products remains another tailwind.

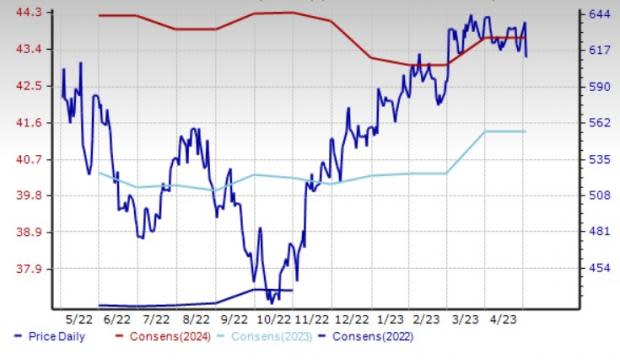

Broadcom’s shares have returned 1.5% in the past year. The Zacks Consensus Estimate for the company’s fiscal 2023 earnings moved north by 1.8% to $41.38 per share in the past 60 days.

Price and Consensus: AVGO

Lattice Semiconductor: This Hillsboro, OR-based player is gaining traction from the strong momentum across a number of different OEM server platforms. Strength in data center servers, 5G wireless infrastructure and data center networking is a tailwind. Moreover, advancement in its products that are widely utilized on server and client-computing platforms, remains a major positive.

The currently Zacks Rank #2 entity is well-poised to gain solid traction across the industrial and automotive markets on the back of its solid momentum in multiple applications such as industrial, automation and robotics, ADAS and infotainment systems.

LSCC has gained 57.6% in the past year. The Zacks Consensus Estimate for the stock’s 2023 earnings has moved 1.9% north to $2.10 per share in the past 60 days.

Price and Consensus: LSCC

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Infineon Technologies AG (IFNNY) : Free Stock Analysis Report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance