3 Top-Ranked Tech Stocks With Big Growth

The Zacks Computer and Technology sector has staged a significant rebound in 2023 so far, up more than 17% and widely outperforming the general market.

The sector faced a challenging environment in 2022 amid a hawkish Fed, resulting in the steep declines we saw. However, market participants have piled back into the volatile sector with the Fed’s tightening cycle nearing an end.

For those interested in the sector, three stocks – ServiceNow NOW, Synopsys SNPS, and CrowdStrike CRWD – all sport improved earnings outlooks paired with solid growth profiles.

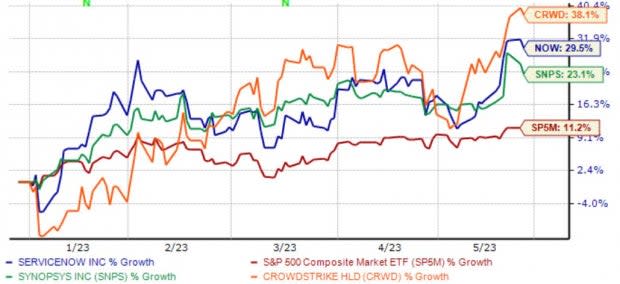

Below is a chart illustrating the year-to-date performance of all three, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three have widely outperformed the general market year-to-date, providing solid returns. Let’s take a closer look at each.

ServiceNow

ServiceNow provides cloud computing services that automate digital workflows to accelerate enterprise IT operations. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with earnings expectations increasing across nearly all timeframes.

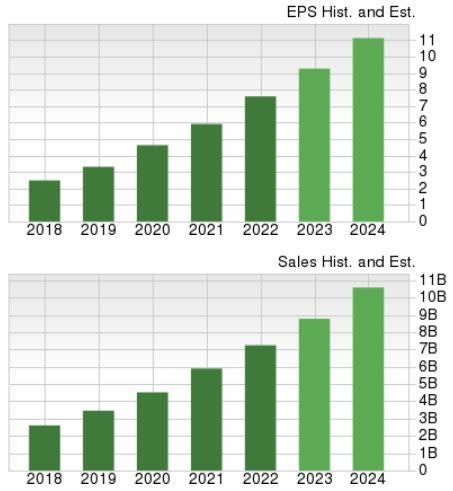

Image Source: Zacks Investment Research

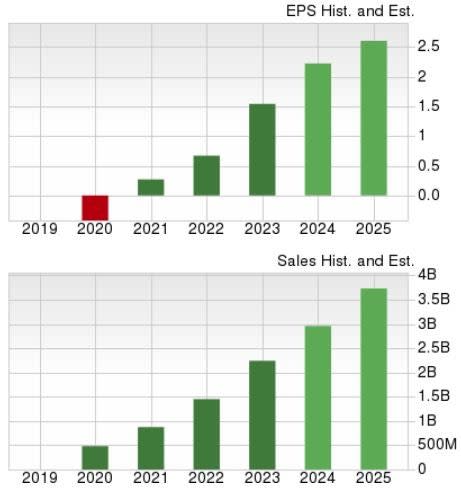

It’s hard to ignore the company’s growth profile, with earnings forecasted to soar 26% in its current fiscal year (FY23) and a further 25% in FY24. The projected earnings growth comes on top of forecasted revenue increases of 22% in FY23 and 21% in FY24.

Image Source: Zacks Investment Research

Synopsys

Synopsys is an electronic design automation (EDA) software vendor for the semiconductor and electronics industries. The stock is currently a Zacks Rank #2 (Buy).

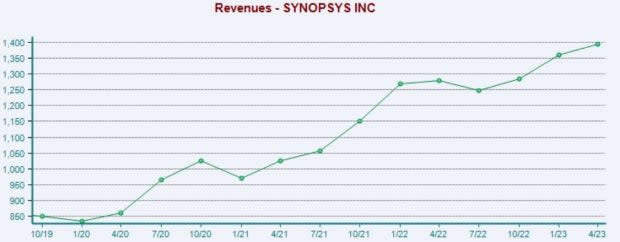

SNPS just reported last on May 17th; results came in modestly above expectations, with SNPS exceeding the Zacks Consensus EPS Estimate by roughly 3%. Quarterly revenue totaled $1.4 billion, a tick above estimates and improving 9% from the year-ago quarter.

The company’s top line growth has been impressive, as seen in the chart below.

Image Source: Zacks Investment Research

In addition, Synopsys is forecasted to grow at a solid pace, with estimates calling for 20% earnings growth in its current fiscal year on 14% higher revenues. And in FY24, earnings and revenue are forecasted to see growth of 14% and 11%, respectively.

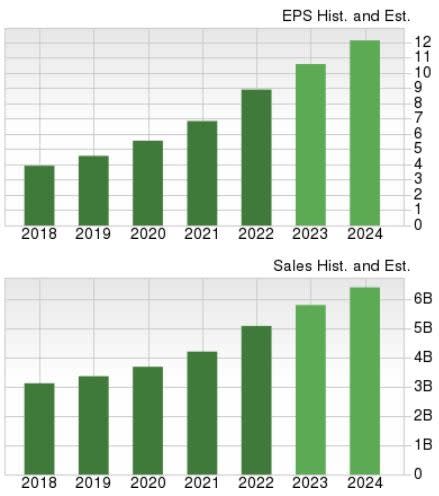

Image Source: Zacks Investment Research

CrowdStrike

CrowdStrike is a leader in next-generation endpoint protection, threat intelligence, and cyberattack response services. Like the stocks above, CRWD sports a favorable Zacks Rank #2 (Buy), with earnings expectations increasing as of late.

CRWD’s growth profile could be considered the most impressive of all, with earnings forecasted to soar 50% in its current fiscal year (FY24) and an additional 27% in FY25. Revenue growth is also apparent, forecasted to see growth of 34% in FY24 and 28% in FY25.

Image Source: Zacks Investment Research

Analysts have become notably bullish on the company’s current fiscal year, with the annual EPS estimate being revised nearly 40% higher since May of 2022.

Image Source: Zacks Investment Research

Bottom Line

Investors love technology stocks, as their growth potential is nearly impossible to ignore.

And in 2022, the music was shut off for tech stocks, with a hawkish Fed spoiling the fun.

However, the story has been entirely different so far in 2023, with the sector crushing the S&P 500’s performance.

For those with an interest in exposure to the sector, all three stocks above – ServiceNow NOW, Synopsys SNPS, and CrowdStrike CRWD – boast improved earnings outlooks and solid growth trajectories.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance