3 Top-Ranked Beverage Stocks to Buy Now

The Soft-Drink and Beverage industry can be an incredibly lucrative one to invest in. Many millionaires have been minted from beverage giants such as Coca-Cola KO, and Monster Beverage MNST, which both have incredibly robust business models, and tremendous stock returns.

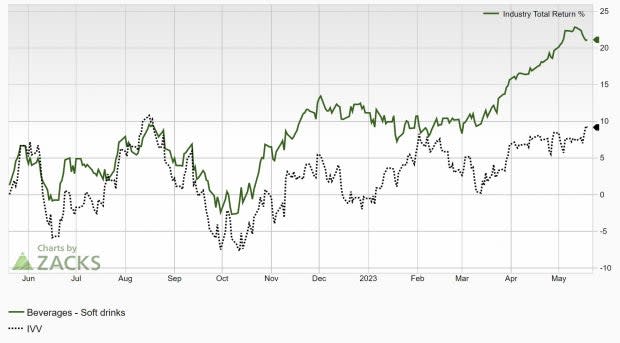

The Beverages-Soft drink industry currently sits in the top 10% of the Zacks industry rank, boosting near term expectations for the group. Additionally, over the last year, the soft drink industry has significantly outperformed the broad market, an impressive feat considering how challenging this period has been.

Notably, Vita Coco Company COCO, National Beverage FIZZ, and PepsiCo PEP all boast high Zacks Ranks, further increasing the likelihood of near-term strength in the stock.

Image Source: Zacks Investment Research

National Beverage

National Beverage is best known for its flavored sparkling water drink La Croix, which has exploded in popularity over the last few years. Some of FIZZ’s lesser-known brands include Shasta, Faygo, Clear Fruit, and Big Shot Beverages. Its portfolio of products ranges from health-conscious options to more traditional carbonated soft drinks.

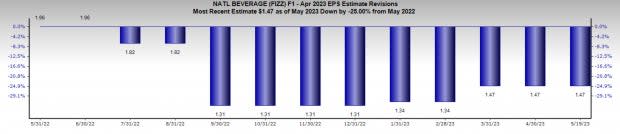

Earnings estimates for FIZZ are being upgraded after experiencing significant revisions lower in the second half of last year. Q1 estimates have been revised 17% higher over the last two months, and FY23 earnings have been revised 9.7% higher. These strong positive revisions earn FIZZ a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

FIZZ stock has had a very strong 10-year performance, compounding at an annual rate of 22.8%, and outperforming the industry and broad market. However, over the last five years the stock has mostly stalled out and traded sideways.

But, now with improving earnings expectations, and a large base to break out from, FIZZ’s next bull run could be starting imminently.

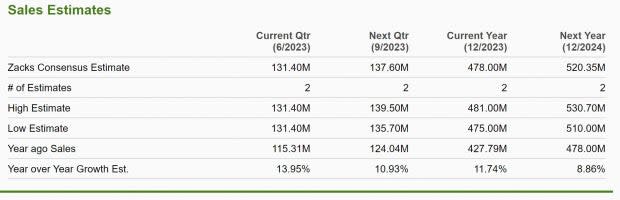

Image Source: Zacks Investment Research

Vita Coco Company

Vita Coco Company is a prominent beverage manufacturer known for its innovative and refreshing coconut water products. With a focus on health-conscious consumers, Vita Coco offers a range of natural and hydrating beverages that have gained widespread popularity in the market.

COCO currently enjoys a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Analysts are in near unanimous agreement in upgrading COCO earnings estimates, with FY23 earnings being revised 4.7% higher, which would reflect a 191% YoY increase.

Image Source: Zacks Investment Research

COCO also expects strong and consistent sales growth over the coming years. Current quarter sales are expected to climb 14% YoY and FY23 sales are project to expand 11.7% YoY.

Image Source: Zacks Investment Research

Vita Coco Company is a recent IPO, going public just 18 months ago. After getting caught up in the broad market weakness of 2022, COCO has surged higher in the last year. COCO stock has more than doubled since IPO, considerably outperforming the industry and market.

Image Source: Zacks Investment Research

PepsiCo

PepsiCo has been unshakeable over the last 25 years, continually grinding higher unabated over that time.

PEP has also outperformed its well-known rival Coca-Cola by a huge margin over the last two decades. So, while there is an ongoing debate with no clear winner regarding flavor, PEP is clearly the superior stock investment.

Image Source: Zacks Investment Research

Besides the current quarter, which was downgraded by -4%, earnings estimates for PEP have been unanimously upgraded. Next quarter earnings are expected to show an 8.1% YoY increase, and FY23 earnings are projected to climb 7.5% YoY. PEP has a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

PepsiCo is also a well-known dividend king, having raised its dividend for 50 years consecutively. Today, PEP provides a dividend yield of 2.4%, which has been increased by an average of 5.4% annually over the last 5 years.

Image Source: Zacks Investment Research

Conclusion

Beverage companies can offer investors a range of different opportunities, from innovative new growth companies to historical dividend payers. As cheap indulgences, which consumers regularly buy during good times and bad, along wide margins, soft drink companies can make for exceptional investments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

National Beverage Corp. (FIZZ) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance