3 Stocks to Watch That Recently Announced Dividend Hikes

Wall Street has lately bounced back from the blow it suffered during the first three quarters of the year. On Nov 30, investors’ sentiment got a further boost after Fed Chair Jerome Powell hinted at scaling back the pace of interest rate hikes soon. This sent stocks on a rally.

This might lead the S&P 500 and the Dow to somehow manage ending the year in green. However, the crisis is far from over, as inflation is still at multi-year highs and far from the Fed’s target range of 2%. Although at a slower pace, the Fed will continue to hike interest rates over the next year.

Interest Rate Hikes to Continue

Inflation has lately shown signs of cooling off in the United States, which has been the Fed’s biggest concern since the beginning of the year. The consumer price index (CPI) rose 0.3% month over month in October and 7.7% from a year ago, after increasing 8.2% in the prior month.

Market participants have since been optimistic about the Fed going slow on its aggressive rate-hike stance in the coming months. On Wednesday, they got further assurance after Powell said that the Fed might consider scaling back its interest rate hikes as soon as December.

Although stocks rallied on the news, inflation is still at a multi-year high, and Powell cautioned that the crisis is far from over. So, interest rate hikes will continue, albeit at a slower pace.

Powell warned that fight against inflation is not yet over and that important questions remain unanswered, including how far and how long interest rates will need to be hiked. Market players are worried about the high borrowing costs that could harm the economy and push it into recession as the Fed’s target of 2% is still a far cry.

Undoubtedly, such a situation will affect the business climate and consequently the stock market performance.

Also, COVID-19 cases are again on the rise in China, compelling the government to impose strict restrictions. Businesses are once again being shut down, and citizens have come out on the streets, getting involved in frequent clashes with the regime opposing the restrictions.

In addition to all of these factors, the current geopolitical conflict between Russia and Ukraine poses dangers to the global supply chain and is causing stock market volatility.

Higher interest rates result in higher costs of borrowing. The likelihood of an economic downturn rises as a result of this. Both these are warnings for the markets, which have been volatile all year.

Therefore, it makes sense for an astute investor to keep a watch on dividend-paying equities right now. This is because dividend stocks have a history of success and a solid business plan, which allows them to withstand market volatility.

They not only provide a steady stream of revenues, but also fewer chances of frequent price movements. Moreover, dividend-paying firms have regularly outperformed non-dividend-paying stocks during periods of market turmoil. Three such companies are Merck & Co., Inc. MRK, McCormick & Company, Incorporated MKC and Tsakos Energy Navigation Limited TNP.

Merck & Co., Inc. boasts more than six blockbuster drugs in its portfolio, with PD-L1 inhibitor, Keytruda, approved for several types of cancer. MRK made its biggest acquisition of Schering-Plough and sold off its Consumer Care business to Bayer.

Other key acquisitions of Merck & Co. include Idenix Pharmaceuticals, Cubist Pharmaceuticals, Rigontec, ArQule and Acceleron Pharma. Merck & Co. presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

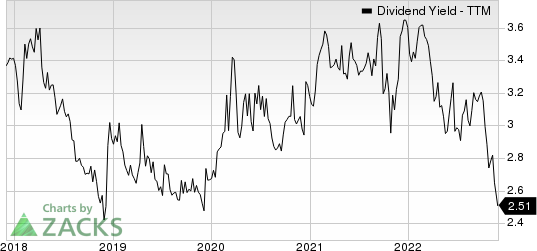

On Nov 30, 2022, Merck & Co announced that its shareholders would receive a dividend of $0.73 per share on Jan 9, 2023. MRK has a dividend yield of 2.54%. Over the past five years, Merck & Co has increased its dividend seven times, and its payout ratio is presently 36% of earnings. Check MRK’s dividend history here.

Merck & Co., Inc. Dividend Yield (TTM)

Merck & Co., Inc. dividend-yield-ttm | Merck & Co., Inc. Quote

McCormick & Company, Incorporated is a leading manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors to the entire food industry across the entire globe. MKC conducts its business through two segments, namely the Consumer unit and the Flavor Solutions unit.

On Nov 29, 2022, McCormick & Company declared that its shareholders would receive a dividend of $0.39 per share on Jan 9, 2023. MKC has a dividend yield of 1.77%. Over the past five years, McCormick & Company has increased its dividend six times, and its payout ratio is presently 56% of earnings. Check MKC’s dividend history here.

McCormick & Company, Incorporated Dividend Yield (TTM)

McCormick & Company, Incorporated dividend-yield-ttm | McCormick & Company, Incorporated Quote

Tsakos Energy Navigation Limited is a leading provider of international seaborne crude oil and petroleum product transportation services. In July 2001, TNP’s name was changed to Tsakos Energy Navigation to enhance its brand recognition in the tanker industry, particularly among charterers.

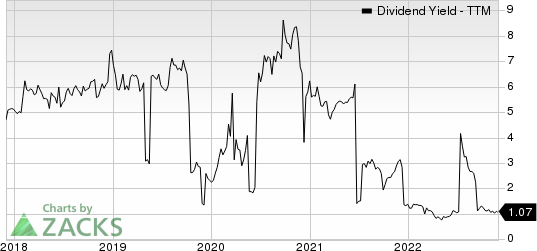

On Nov 22, 2022, Tsakos Energy Navigation Limited declared that its shareholders would receive a dividend of $0.15 per share on Dec 20, 2022. TNP has a dividend yield of 1.05%. Over the past five years, Tsakos Energy Navigation Limited has increased its dividend twice, and its payout ratio is presently 13% of earnings. Check TNP’s dividend history here.

Tsakos Energy Navigation Ltd Dividend Yield (TTM)

Tsakos Energy Navigation Ltd dividend-yield-ttm | Tsakos Energy Navigation Ltd Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Tsakos Energy Navigation Ltd (TNP) : Free Stock Analysis Report

Orange County Bancorp, Inc. (OBT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance