3 Railroad Stocks With Solid Dividend Yield You May Count On

Prospects of Zacks Transportation - Rail industry’s participants are being weighed down by challenges like inflation-induced elevated interest rates, supply-chain disruptions and the slowdown of economic growth. Most industry players are looking to drive their bottom line amid the headwinds through cost reduction.

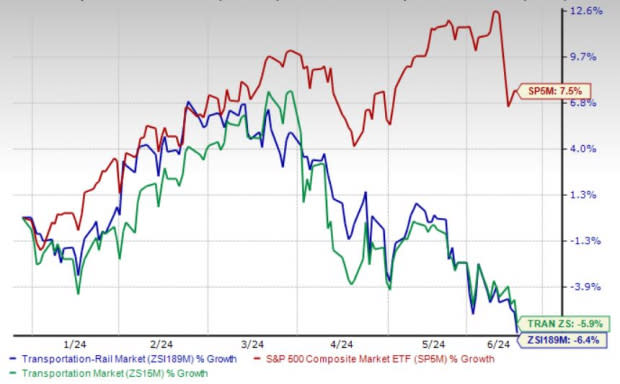

Partly due to these headwinds, the industry has declined 6.4% so far this year, underperforming the S&P 500 Index’s 7.5% appreciation and a 5.9% loss of the broader Zacks Transportation sector.

Image Source: Zacks Investment Research

Despite the challenges surrounding the industry,some railroad companies like Union Pacific Corporation UNP, Canadian National Railway Company CNI and Norfolk Southern Corporation NSC have consistently announced dividend hikes, thus highlighting their pro-shareholder stance.

Stocks that have a strong history of dividend growth belong to mature companies, which are less susceptible to large swings in the market and act as a hedge against economic or political uncertainty as well as stock market volatility. At the same time, they offer downside protection with their consistent increase in payouts.

Additionally, these companies have superior fundamentals like a sustainable business model, a long track of profitability, rising cash flows, good liquidity, a strong balance sheet and some value characteristics.

How to Pick Stocks With Solid Dividend Payouts?

In order to choose some of the best dividend stocks from the aforementioned industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%. Each stock mentioned below presently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Union Pacific: Headquartered in Omaha, NE, Union Pacific, through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States. Currently, the company has a market capitalization of $135.52 billion.

UNP pays out a quarterly dividend of $1.30 ($5.20 annualized) per share, which gives it a 2.34% yield at the current stock price. This company’s payout ratio is 50% of its earnings at present. The five-year dividend growth rate is 9.56%. (Check Union Pacific’s dividend history here).

Union Pacific Corporation Dividend Yield (TTM)

Union Pacific Corporation dividend-yield-ttm | Union Pacific Corporation Quote

Union Pacific’s consistent initiatives to reward its shareholders through dividends and share repurchases look encouraging. In 2022, UNP paid dividends worth $3.159 billion and repurchased shares worth $6.282 billion. In 2023, the company returned $3.9 billion to its shareholders through dividends ($3.2 billion) and buybacks ($0.7 billion). During the first quarter of 2024, UNP paid $795 million in dividends (did not repurchase any shares). Management has decided to restart the share repurchase in the second quarter of 2024.

Canadian National: Based in Montreal, Canada, Canadian National is involved in the rail, intermodal, trucking, and marine transportation and logistics business in Canada and the United States. Currently, CNI has a market capitalization of $77.22 billion.

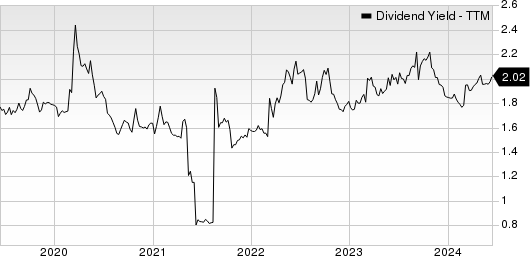

CNI pays out a quarterly dividend of $1.23 ($2.45 annualized) per share, which gives it a 2.02% yield at the current stock price. This company’s payout ratio is 47% of its earnings at present. The five-year dividend growth rate is 10.20%. (Check Canadian National’s dividend history here).

Canadian National Railway Company Dividend Yield (TTM)

Canadian National Railway Company dividend-yield-ttm | Canadian National Railway Company Quote

CNI’s efforts to reward its shareholders via dividends and buybacks are encouraging and highlight the company's financial strength. In January 2024, the company’s board approved a dividend hike of 7%. This marks the company’s 28th annual dividend increase. The company also announced a normal course issuer bid over a 12-month period up to 32 million common shares. The bid has taken effect from Feb 1, 2024, and runs through Jan 31, 2025. Strong cash flow generating-ability supports Canadian National's shareholder-friendly activities.

Norfolk Southern: Headquartered in Atlanta, GA, Norfolk Southern engages in the rail transportation of raw materials, intermediate products and finished goods in the United States. Currently, NSC has a market capitalization of $50.12 billion.

NSC pays out a quarterly dividend of $1.35 ($5.40 annualized) per share, which gives it a 2.43% yield at the current stock price. This company’s payout ratio is 49% of its earnings at present. The five-year dividend growth rate is 11.12%. (Check Norfolk Southern’s dividend history here).

Norfolk Southern Corporation Dividend Yield (TTM)

Norfolk Southern Corporation dividend-yield-ttm | Norfolk Southern Corporation Quote

Norfolk Southern's consistent initiatives to reward its shareholders through dividends and share repurchases look encouraging. During first-quarter 2024, NSC paid dividends worth $305 million (and did not repurchase any shares under its stock repurchase program). In 2023, the company returned $1.847 billion to shareholders through a combination of dividends ($1.225 billion) and share buybacks ($.622 billion). During 2022, Norfolk Southern paid dividends worth $1,167 million and repurchased and retired common stock worth $3,110 million.

Such shareholder-friendly moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business. These initiatives not only instill investors’ confidence but also positively impact earnings per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance