3 Highly Ranked Tech Stocks to Buy for Value

Considering the Nasdaq has now climbed +30% over the last year, it can be harder to find tech stocks that are reasonably valued. However, several technology-driven stocks were added to the Zacks Rank #1 (Strong Buy) list today and are starting to stand out in terms of their valuation.

With that being said, here are three of these favorably valued top-rated tech stocks to consider at the moment.

Celestica CLS

Value Score: B

Being one of the largest electronics manufacturing services companies in the world, Celestica offers great value to its shareholders at current levels. Astonishingly, Celestica’s stock has climbed +87% year to date and has skyrocketed more than +300% in the last year.

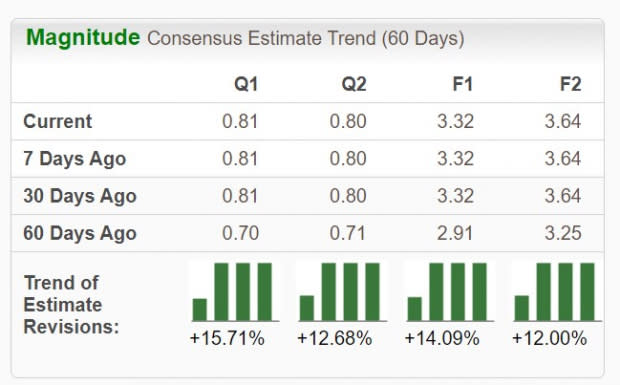

Still, at $54, Celestica’s stock trades at 16X forward earnings and less than 1X sales with double-digit top and bottom-line growth in the forecast for the foreseeable future. Plus, earnings estimate revisions for fiscal 2024 and FY25 are nicely up over the last 60 days which could continue to catapult Celestica’s stock.

Image Source: Zacks Investment Research

Dell Technologies DELL

Value Score: B

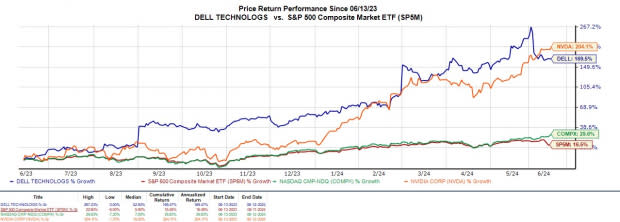

Yes, Dell’s price tag of $131 is not cheap but the company’s underlying fundamentals suggest its stock is still undervalued. This is especially true considering Dell’s artificial intelligence partnership with Nvidia NVDA has fueled its attractive growth trajectory as a leading provider of servers that harvest generative AI.

While Dell’s stock has soared over +70% YTD it still trades at a reasonable 16.8X forward earnings multiple with EPS projected to expand 9% this year and forecasted to climb another 23% in FY25 to $9.66 per share. Furthermore, Dell also trades near the optimum level of less than 1X sales with high single-digit growth expected on its top line in FY24 and FY25 as projections edge to over $100 billion.

Image Source: Zacks Investment Research

Upland Software UPLD

Value Score: A

As a provider of cloud-based Enterprise Work Management software, Upland Software is a penny stock that may certainly catch investors’ attention with a price tag of $2. Notably, Upland Software is already profitable and appears to be extremely undervalued after going public in 2020.

To that point, UPLD trades at just 3.7X forward earnings despite FY24 EPS projected at $0.65 versus $0.97 a share last year. However, FY25 EPS is projected to rebound and rise 6%. This makes the drop from a 52-week high of $5 look like a buying opportunity considering the risk to reward at current levels.

Image Source: Zacks Investment Research

Bottom Line

It’s no secret that promising tech stocks such as Celestica, Dell Technologies, and Upland Software can command high premiums which makes them very attractive right now considering their reasonable valuations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Celestica, Inc. (CLS) : Free Stock Analysis Report

Upland Software, Inc. (UPLD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance